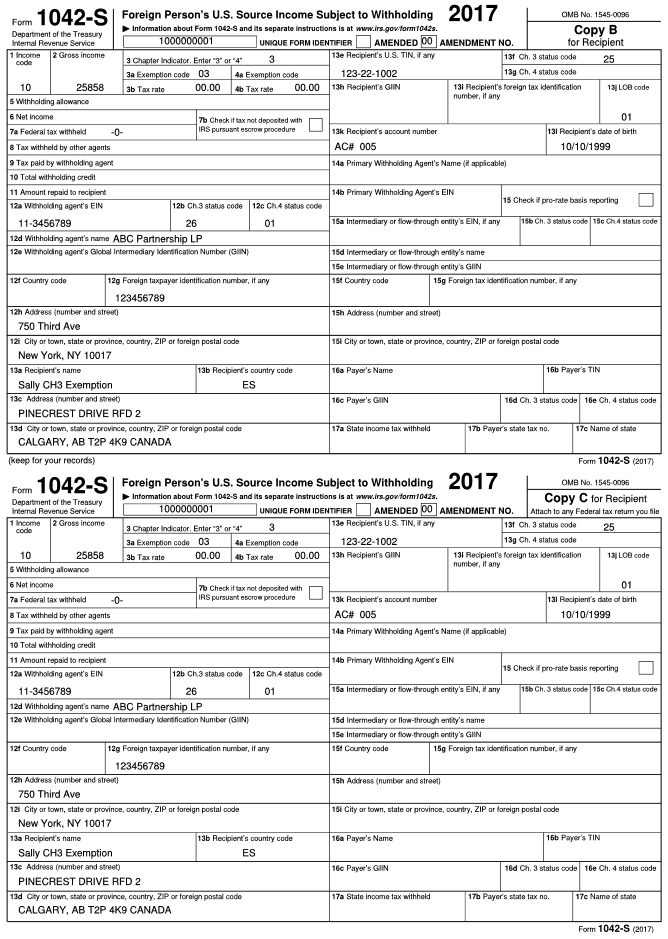

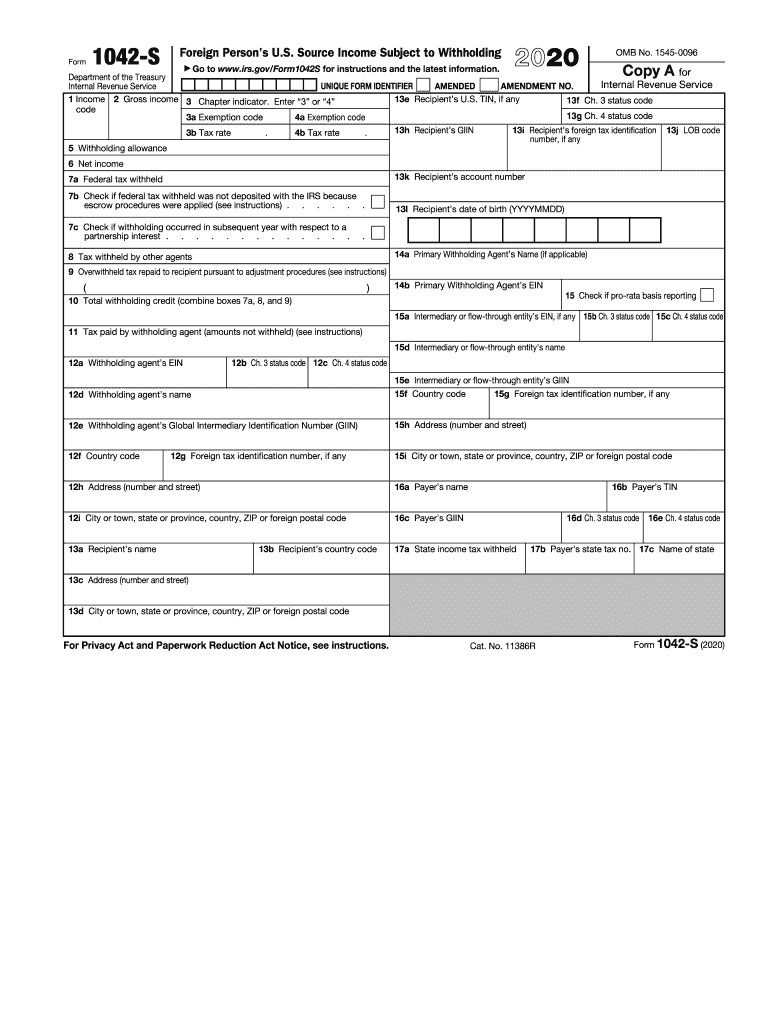

2022 Form 1042-S Instructions

2022 Form 1042-S Instructions - If this is an amended return, check here. Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. The unique form identifier must: The tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign corporations, foreign estates, and foreign trusts. Source income subject to withholding. Source income subject to withholding. Specified federal procurement payments paid to foreign persons that are subject to withholding under section 5000c. Be numeric (for example, 1234567891), be exactly 10 digits, and not be the recipient's u.s. Citizens from certain accounts, including iras. Income, including income that is effectively connected with the conduct of a trade or business in the united states, must file a u.s.

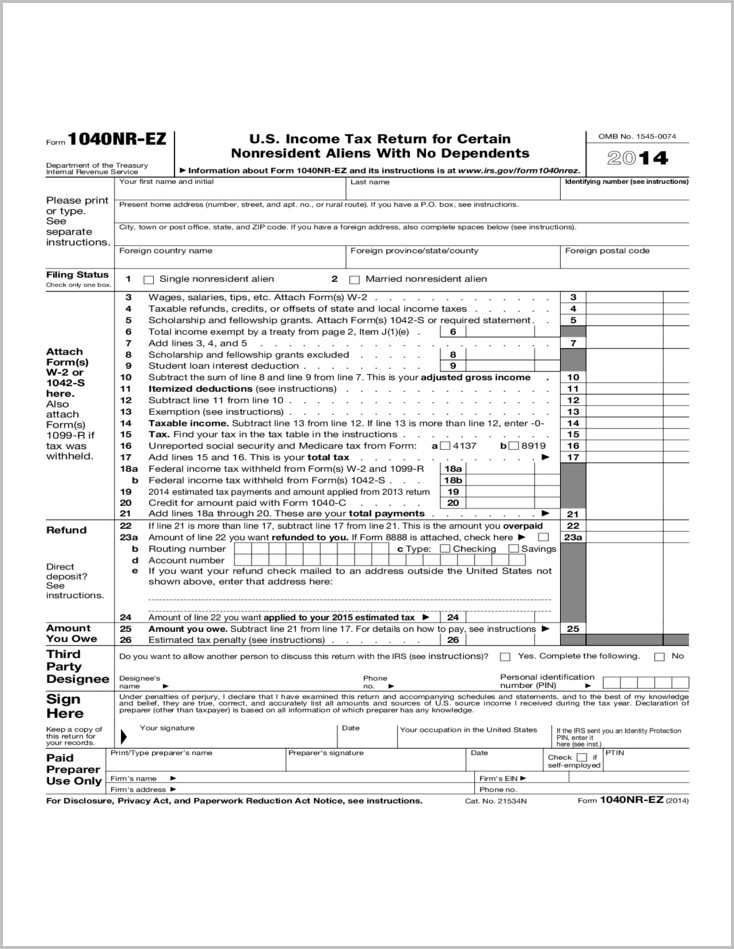

Source income of foreign persons go to www.irs.gov/form1042 for instructions and the latest information. The tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign corporations, foreign estates, and foreign trusts. The unique form identifier must: Web use form 1042 to report the following: Specified federal procurement payments paid to foreign persons that are subject to withholding under section 5000c. Source income subject to withholding. Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. Home office reflected on the form. Income tax filing requirements generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s. Source income subject to withholding.

Web use form 1042 to report the following: The unique form identifier must: Income tax filing requirements generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s. Income, including income that is effectively connected with the conduct of a trade or business in the united states, must file a u.s. Be numeric (for example, 1234567891), be exactly 10 digits, and not be the recipient's u.s. The tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign corporations, foreign estates, and foreign trusts. Specified federal procurement payments paid to foreign persons that are subject to withholding under section 5000c. Source income subject to withholding. Financial institution should continue to use its own withholding agent chapter 4 status code (code 01) for purposes of completing form 1042 if there are any payments made by the u.s. Citizens from certain accounts, including iras.

Form Instruction 1042S The Basics

Home office reflected on the form. Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. The tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign corporations, foreign estates, and foreign trusts. The unique form identifier must: Citizens from certain accounts, including iras.

Form 1042S USEReady

The unique form identifier must: Home office reflected on the form. Source income subject to withholding. The tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign corporations, foreign estates, and foreign trusts. Citizens from certain accounts, including iras.

1042S Software, 1042S eFile Software & 1042S Reporting

Income, including income that is effectively connected with the conduct of a trade or business in the united states, must file a u.s. Income tax filing requirements generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s. Home office reflected on the form. Source income subject to withholding. Specified federal procurement payments paid to foreign persons that.

Form 1042s 2022 instructions Fill online, Printable, Fillable Blank

The tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign corporations, foreign estates, and foreign trusts. Income tax filing requirements generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s. Citizens from certain accounts, including iras. Source income of foreign persons go to www.irs.gov/form1042 for instructions and the latest.

1042 Fill out & sign online DocHub

Income tax filing requirements generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s. Citizens from certain accounts, including iras. Source income subject to withholding. Web use form 1042 to report the following: Income, including income that is effectively connected with the conduct of a trade or business in the united states, must file a u.s.

IRS Form 1042s What It is & 1042s Instructions Tipalti

Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. Source income subject to withholding. If this is an amended return, check here. Web use form 1042 to report the following: Source income of foreign persons go to www.irs.gov/form1042 for instructions and the latest information.

1042S INSTRUCTIONS 2014 PDF

Specified federal procurement payments paid to foreign persons that are subject to withholding under section 5000c. Source income subject to withholding. Financial institution should continue to use its own withholding agent chapter 4 status code (code 01) for purposes of completing form 1042 if there are any payments made by the u.s. Income tax filing requirements generally, every nonresident alien.

1042 S Form slideshare

Income tax filing requirements generally, every nonresident alien individual, nonresident alien fiduciary, and foreign corporation with u.s. Specified federal procurement payments paid to foreign persons that are subject to withholding under section 5000c. The unique form identifier must: Be numeric (for example, 1234567891), be exactly 10 digits, and not be the recipient's u.s. Web use form 1042 to report the.

Supplemental Instructions Issued for 2019 Form 1042S

The unique form identifier must: The tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign corporations, foreign estates, and foreign trusts. Citizens from certain accounts, including iras. If this is an amended return, check here. Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s.

2016 Instructions for Form 1042S Fill out & sign online DocHub

Source income of foreign persons go to www.irs.gov/form1042 for instructions and the latest information. Citizens from certain accounts, including iras. Web use form 1042 to report the following: The tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign corporations, foreign estates, and foreign trusts. Home office reflected on the form.

Income Tax Filing Requirements Generally, Every Nonresident Alien Individual, Nonresident Alien Fiduciary, And Foreign Corporation With U.s.

Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. Home office reflected on the form. Source income subject to withholding. Web use form 1042 to report the following:

Citizens From Certain Accounts, Including Iras.

Specified federal procurement payments paid to foreign persons that are subject to withholding under section 5000c. Be numeric (for example, 1234567891), be exactly 10 digits, and not be the recipient's u.s. Financial institution should continue to use its own withholding agent chapter 4 status code (code 01) for purposes of completing form 1042 if there are any payments made by the u.s. If this is an amended return, check here.

Source Income Subject To Withholding.

Source income of foreign persons go to www.irs.gov/form1042 for instructions and the latest information. Income, including income that is effectively connected with the conduct of a trade or business in the united states, must file a u.s. The unique form identifier must: The tax withheld under chapter 3 on certain income of foreign persons, including nonresident aliens, foreign partnerships, foreign corporations, foreign estates, and foreign trusts.