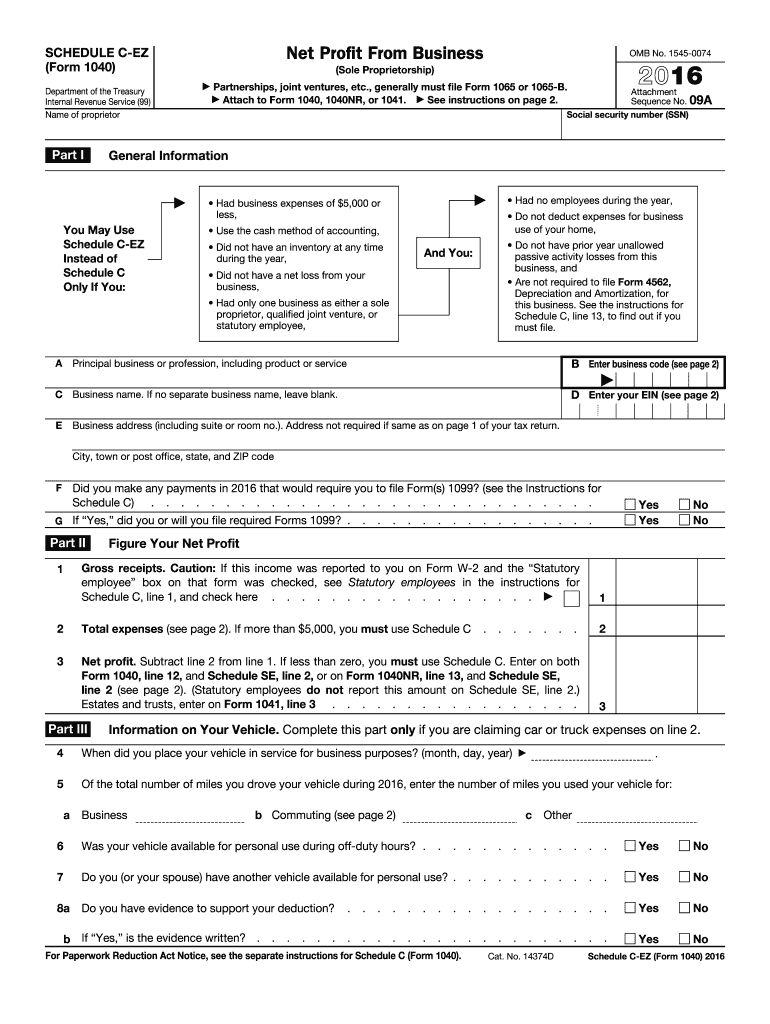

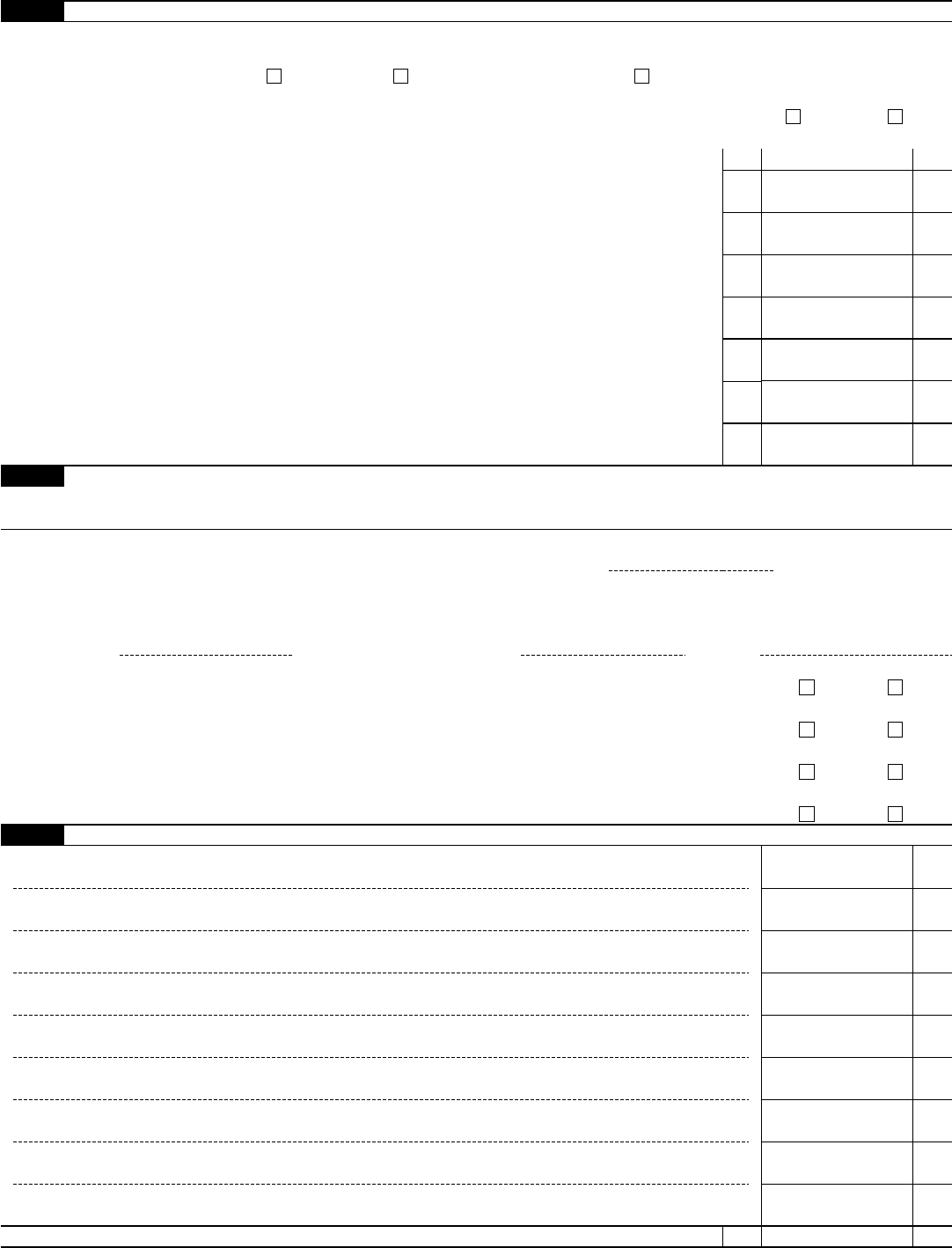

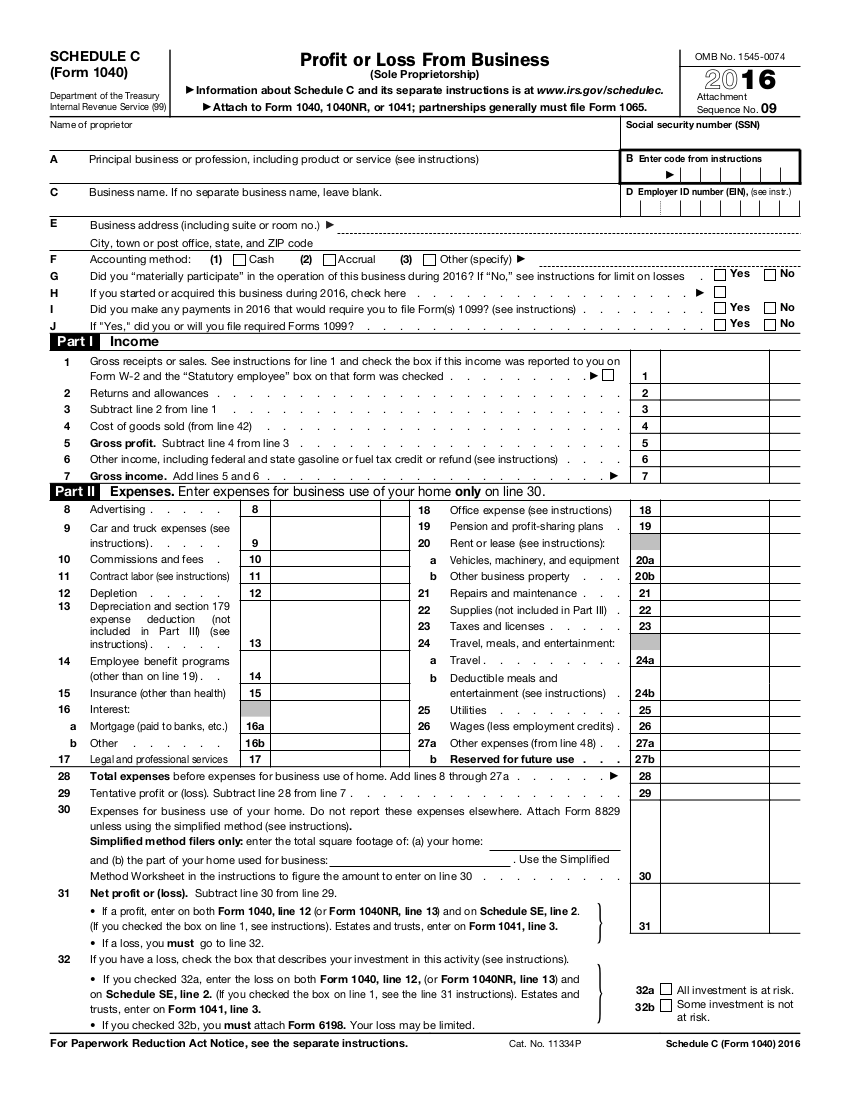

2016 Schedule C Form

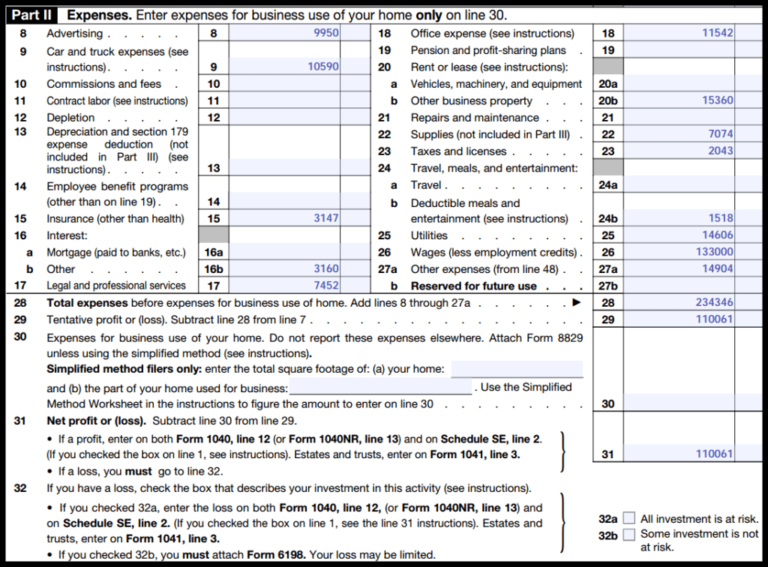

2016 Schedule C Form - Edit your form online type text, add images, blackout confidential details, add comments, highlights and more. Income tax return for cooperative associations for calendar year 2016 or tax year beginning, 2016, ending,. July 29, 2023 5:00 a.m. If more than $5,000, you must use schedule c net profit. Ad access irs tax forms. Complete, edit or print tax forms instantly. Web schedule c, line 1, and check here total expenses (see instructions). Ad edit, sign or email irs 1040 sc & more fillable forms, register and subscribe now! Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today.

This home was built in 1969 and last. Web schedule c, line 1, and check here total expenses (see instructions). Complete, edit or print tax forms instantly. Complete, sign, print and send your tax documents easily with us legal forms. Except for those persons for whom. August social security checks are getting disbursed this week for recipients who've. Web schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) information about schedule c and its. Web 1406 highway 160 e, fort mill, sc 29715 is currently not for sale. If less than zero, you. Select the right 2016 instructions for schedule c 2016 irsgov form version from the list and.

If more than $5,000, you must use schedule c net profit. Get ready for tax season deadlines by completing any required tax forms today. July 29, 2023 5:00 a.m. Fox sv 6.0″ front and rear coilovers. Ad access irs tax forms. Web editable irs instructions 1040 schedule c 2016. Edit your form online type text, add images, blackout confidential details, add comments, highlights and more. Ad edit, sign or email irs 1040 sc & more fillable forms, register and subscribe now! Web schedule c (form 5500) 2016 v.160205 2. Web go to www.irs.gov/schedulec for instructions and the latest information.

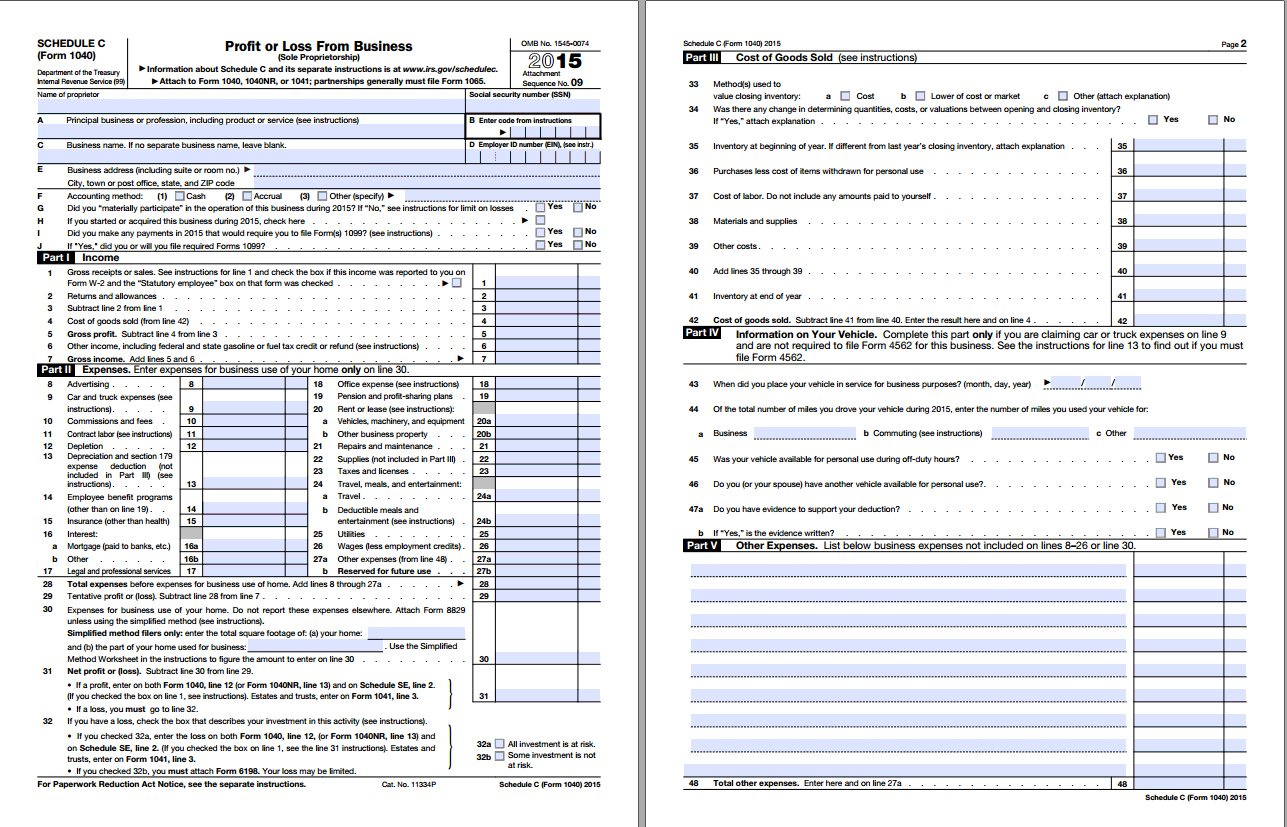

FREE 9+ Sample Schedule C Forms in PDF MS Word

July 29, 2023 5:00 a.m. Web schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) information about schedule c and its. August social security checks are getting disbursed this week for recipients who've. Web we've got more versions of the 2016 instructions for schedule c 2016 irsgov form form. Information.

2016 Schedule C Tax Form Lovely Qualified Dividends And —

If less than zero, you. Web schedule c, line 1, and check here total expenses (see instructions). Web we've got more versions of the 2016 instructions for schedule c 2016 irsgov form form. Web go to www.irs.gov/schedulec for instructions and the latest information. Complete, edit or print tax forms instantly.

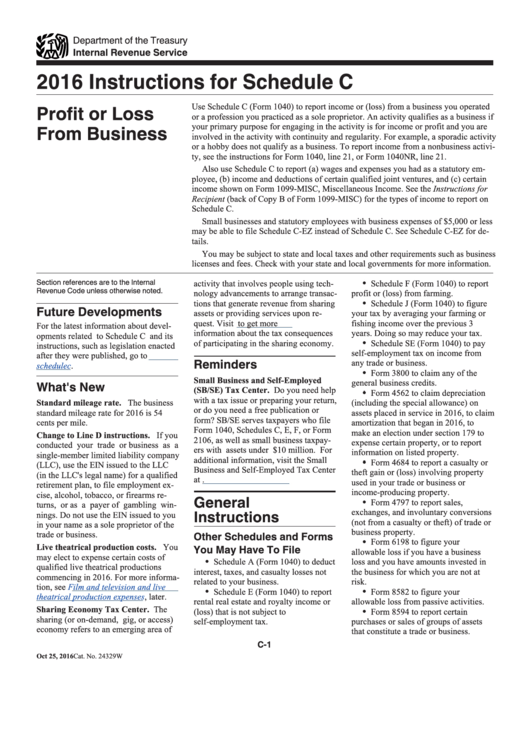

Instructions For Schedule C 1040 2016 printable pdf download

Web general instructions reminders use your 2015 tax return as a guide in figuring your 2016 tax, but be sure to consider the following. Web we've got more versions of the 2016 instructions for schedule c 2016 irsgov form form. Web 1406 highway 160 e, fort mill, sc 29715 is currently not for sale. Web editable irs instructions 1040 schedule.

schedule c form Schedule c instructions anacollege

If more than $5,000, you must use schedule c net profit. Information on other service providers receiving direct or indirect compensation. Web we've got more versions of the 2016 instructions for schedule c 2016 irsgov form form. Sign it in a few clicks draw your signature, type it,. Complete, edit or print tax forms instantly.

Schedule CEZ Form 1040 Net Profit from Business for Sole Proprietors

Edit your form online type text, add images, blackout confidential details, add comments, highlights and more. 1972 chevrolet c10 pickup truck in all black. July 29, 2023 5:00 a.m. Web c60, formerly known as cobalt 60, was a hard rock band from boston, massachusetts. Subtract line 2 from line 1.

IRS Schedule C Instructions Step By Step Including C EZ 1040 Form

Ad access irs tax forms. Web go to www.irs.gov/schedulec for instructions and the latest information. Partnerships must generally file form 1065. Find the best deals for used chevrolet c10 1960 with pictures. Web general instructions reminders use your 2015 tax return as a guide in figuring your 2016 tax, but be sure to consider the following.

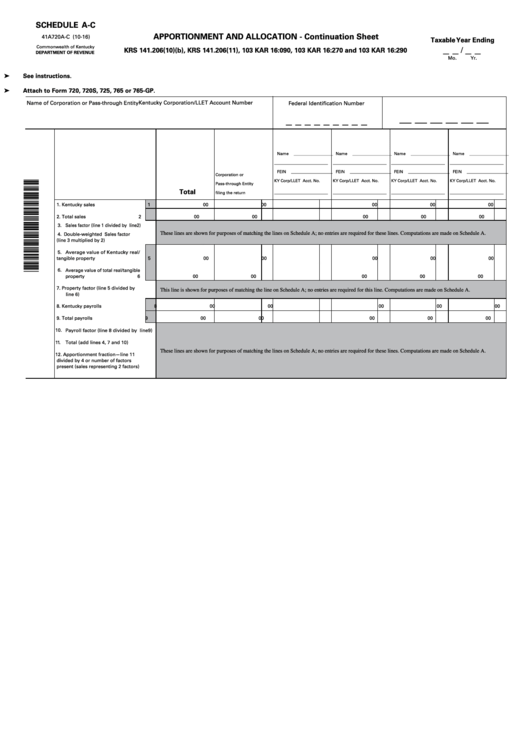

Fillable Schedule AC (Form 41a720aC) Apportionment And Allocation

Sign it in a few clicks draw your signature, type it,. Web 1406 highway 160 e, fort mill, sc 29715 is currently not for sale. Web general instructions reminders use your 2015 tax return as a guide in figuring your 2016 tax, but be sure to consider the following. Web schedule c (form 1040) department of the treasury internal revenue.

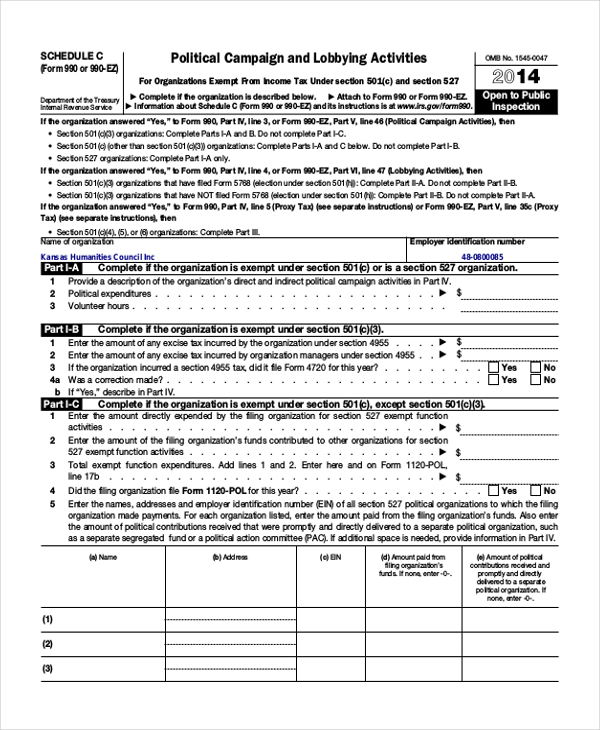

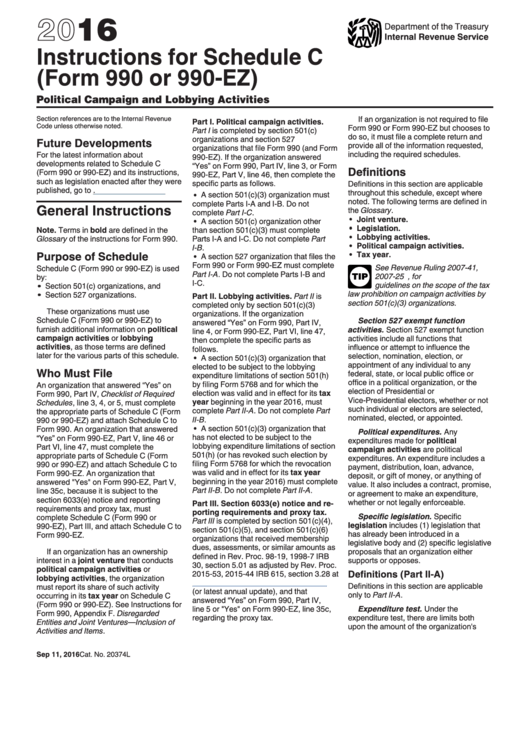

Instructions For Schedule C (Form 990 Or 990Ez) 2016 printable pdf

Ad access irs tax forms. Web schedule c (form 5500) 2016 v.160205 2. Web editable irs instructions 1040 schedule c 2016. Web general instructions reminders use your 2015 tax return as a guide in figuring your 2016 tax, but be sure to consider the following. July 29, 2023 5:00 a.m.

Form 1040 Schedule C Edit, Fill, Sign Online Handypdf

Get ready for tax season deadlines by completing any required tax forms today. Income tax return for cooperative associations for calendar year 2016 or tax year beginning, 2016, ending,. 1972 chevrolet c10 pickup truck in all black. Web schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) information about schedule.

1040schedulec (2016) Edit Forms Online PDFFormPro

Download blank or fill out online in pdf format. Information on other service providers receiving direct or indirect compensation. This home was built in 1969 and last. Complete, edit or print tax forms instantly. Web editable irs instructions 1040 schedule c 2016.

Select The Right 2016 Instructions For Schedule C 2016 Irsgov Form Version From The List And.

Web general instructions reminders use your 2015 tax return as a guide in figuring your 2016 tax, but be sure to consider the following. Complete, edit or print tax forms instantly. Income tax return for cooperative associations for calendar year 2016 or tax year beginning, 2016, ending,. Web 81 chevrolet from $8,500.

Ad Edit, Sign Or Email Irs 1040 Sc & More Fillable Forms, Register And Subscribe Now!

Web editable irs instructions 1040 schedule c 2016. Fox sv 6.0″ front and rear coilovers. If more than $5,000, you must use schedule c net profit. Web schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole proprietorship) information about schedule c and its.

Edit Your Form Online Type Text, Add Images, Blackout Confidential Details, Add Comments, Highlights And More.

Three of the band's songs were featured on the dawson's creek soundtrack, including. Complete, sign, print and send your tax documents easily with us legal forms. August social security checks are getting disbursed this week for recipients who've. Ad access irs tax forms.

Subtract Line 2 From Line 1.

Web oem sealed control arm bushings for reduced nvh. Find the best deals for used chevrolet c10 1960 with pictures. Web we've got more versions of the 2016 instructions for schedule c 2016 irsgov form form. Complete, edit or print tax forms instantly.