15H Form For Senior Citizens

15H Form For Senior Citizens - Form 15h is for senior citizens who are 60 years or elder and form 15g. This is a request to reduce the tds burden on interest earned on recurring. Web form 15h is a declaration form that can be submitted to the income tax department of india by a resident who is a senior citizen (60 years of age or older) or a. Web he/ she is a senior citizen who is more than 60 years of age at the time of filing form 15h. Web form no 15h for senior citizens download preview description: Web some of the banks provide the facility to upload forms online through their website as well. However, you need to meet certain eligibility conditions. Web calendar year taxpayers having no household employees in 2015 do not have to complete this form for 2015. Web form 15h is solely for senior citizens, that is, individuals who are at least 60 years of age. He should be a senior.

You can submit the forms online as well via the bank’s. Form no 15h for senior citizens who needs to receive interest without deduction of tax #pdf submitted. Web form 15h is solely for senior citizens, that is, individuals who are at least 60 years of age. Web if you are a senior citizen, you should file form 15h; Household employee cash wages of $1,900. Tax return for seniors rather than the standard form 1040 when you file your taxes. Web form 15g is a declaration filed by individuals below the age of 60 years, while form 15h is for senior citizens, i.e., individuals above 60. Irs use only—do not write or staple in this. Web some of the banks provide the facility to upload forms online through their website as well. However, you need to meet certain eligibility conditions.

Since these forms are valid for only one financial year, eligible individuals wanting to. Web calendar year taxpayers having no household employees in 2015 do not have to complete this form for 2015. Irs use only—do not write or staple in this. Household employee cash wages of $1,900. Tax return for seniors 2022 department of the treasury—internal revenue service. Web form 15h is solely for senior citizens, that is, individuals who are at least 60 years of age. Web form no 15h for senior citizens download preview description: However, you need to meet certain eligibility conditions. This is a request to reduce the tds burden on interest earned on recurring. Web form 15h is a declaration form that can be submitted to the income tax department of india by a resident who is a senior citizen (60 years of age or older) or a.

Form 15h Download Form 20152022 Fill Out and Sign Printable PDF

Web form 15h for senior citizen fy 2020 21 | how to save tds | senior citizen form 15h fill up form 15h helps to avoid tds deduction from income. Tax return for seniors rather than the standard form 1040 when you file your taxes. The total income tax liability of the taxpayer must be nil for the financial. Web.

Form 15H for senior citizen FY 2020 21 How to Save TDS Senior

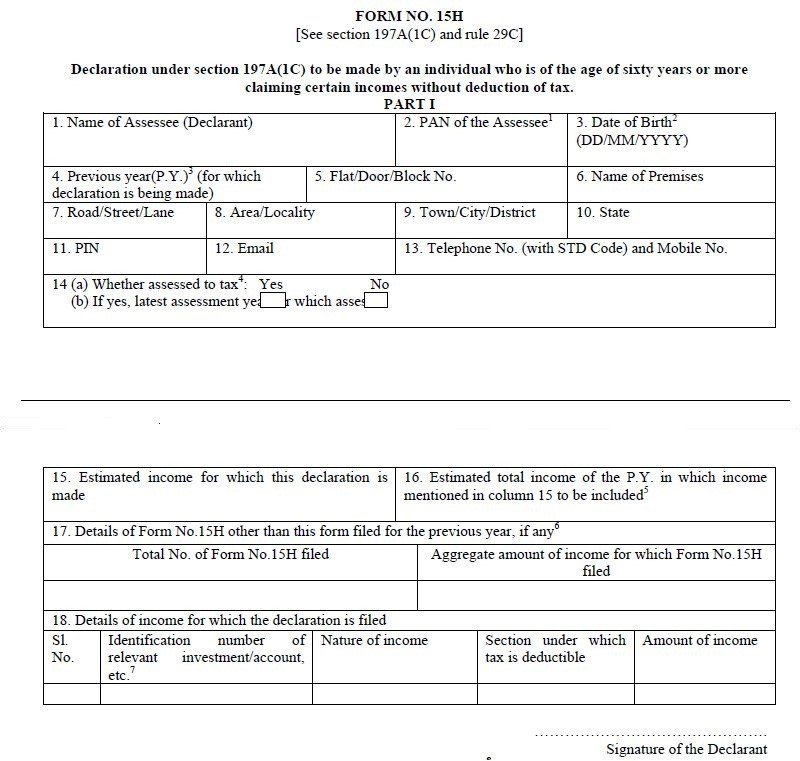

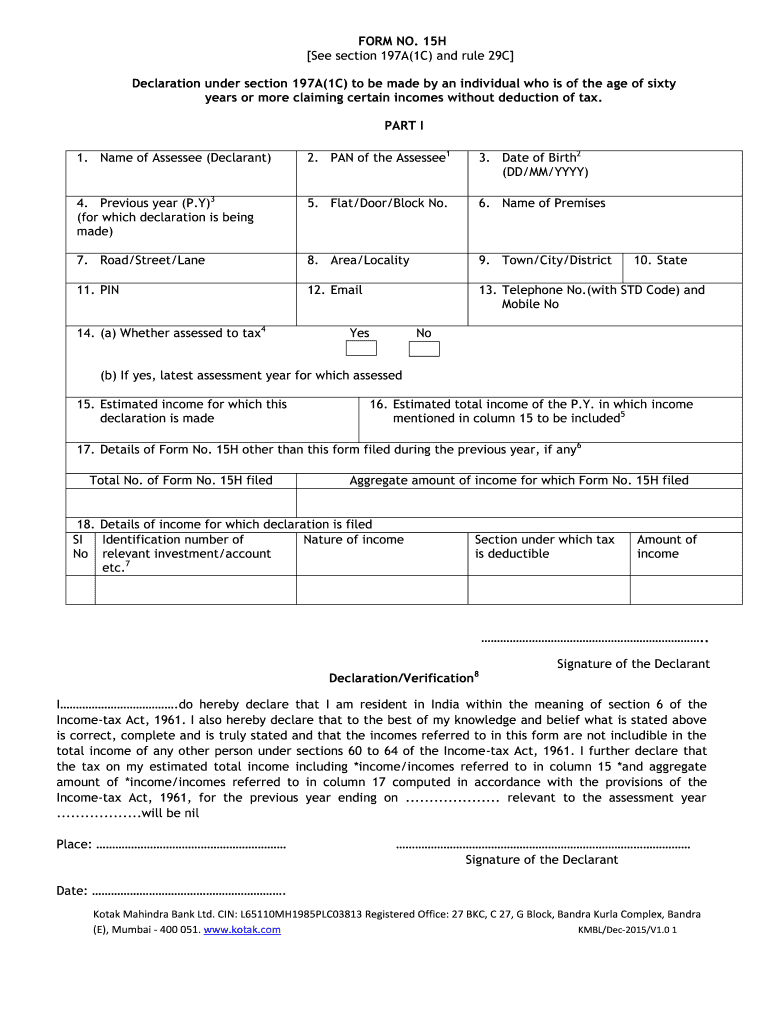

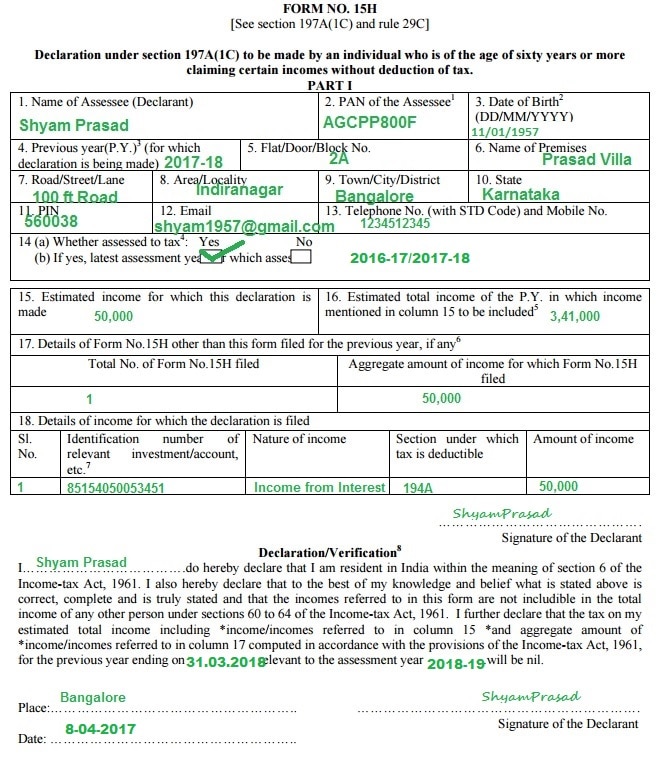

Form 15h is for senior citizens who are 60 years or elder and form 15g. 15h [see section 197a(1c) and rule 29c] declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or more claiming certain. This is a request to reduce the tds burden on interest earned on recurring. Web the.

[PDF] Form 15H For PF Withdrawal PDF Download PDFfile

Web form 15g is a declaration filed by individuals below the age of 60 years, while form 15h is for senior citizens, i.e., individuals above 60. Web form 15h is a declaration form that can be submitted to the income tax department of india by a resident who is a senior citizen (60 years of age or older) or a..

Form 15g In Word Format professionalslasopa

Web form 15g is a declaration filed by individuals below the age of 60 years, while form 15h is for senior citizens, i.e., individuals above 60. He should be a senior. Web the bipartisan budget act of 2018 required the irs to create a tax form for seniors. Since these forms are valid for only one financial year, eligible individuals.

How to fill Form 15H (English) Save TDS on FDs Senior Citizens

Web form 15h is a declaration form that can be submitted to the income tax department of india by a resident who is a senior citizen (60 years of age or older) or a. Topic covered in this video: Web if you are a senior citizen, you should file form 15h; Form no 15h for senior citizens who needs to.

Tax declaration form download pdf Australian guidelines Cognitive Guide

Web form 15h for senior citizen fy 2020 21 | how to save tds | senior citizen form 15h fill up form 15h helps to avoid tds deduction from income. Web form 15g is a declaration filed by individuals below the age of 60 years, while form 15h is for senior citizens, i.e., individuals above 60. Household employee cash wages.

Form 15H (Save TDS on Interest How to Fill & Download

The total income tax liability of the taxpayer must be nil for the financial. Tax return for seniors rather than the standard form 1040 when you file your taxes. Web form no 15h for senior citizens download preview description: Web form 15g is a declaration filed by individuals below the age of 60 years, while form 15h is for senior.

New FORM 15H Applicable PY 201617 Government Finances Public Law

Web form no 15h for senior citizens download preview description: Web form 15h for senior citizen fy 2020 21 | how to save tds | senior citizen form 15h fill up form 15h helps to avoid tds deduction from income. Web he/ she is a senior citizen who is more than 60 years of age at the time of filing.

[PDF] Form 15 H For Senior Citizen PDF Download in English InstaPDF

Web form no 15h for senior citizens download preview description: Web calendar year taxpayers having no household employees in 2015 do not have to complete this form for 2015. Web some of the banks provide the facility to upload forms online through their website as well. Web if you are a senior citizen, you should file form 15h; Household employee.

How To Fill New Form 15G / Form 15H roy's Finance

Web some of the banks provide the facility to upload forms online through their website as well. However, you need to meet certain eligibility conditions. The total income tax liability of the taxpayer must be nil for the financial. This is a request to reduce the tds burden on interest earned on recurring. Web if you are a senior citizen,.

15H [See Section 197A(1C) And Rule 29C] Declaration Under Section 197A(1C) To Be Made By An Individual Who Is Of The Age Of Sixty Years Or More Claiming Certain.

Form no 15h for senior citizens who needs to receive interest without deduction of tax #pdf submitted. Web if you are a senior citizen, you should file form 15h; Web form no 15h for senior citizens download preview description: Form 15h is for senior citizens who are 60 years or elder and form 15g.

The Total Income Tax Liability Of The Taxpayer Must Be Nil For The Financial.

Tax return for seniors 2022 department of the treasury—internal revenue service. This is a request to reduce the tds burden on interest earned on recurring. Topic covered in this video: Web he/ she is a senior citizen who is more than 60 years of age at the time of filing form 15h.

Web Some Of The Banks Provide The Facility To Upload Forms Online Through Their Website As Well.

Web calendar year taxpayers having no household employees in 2015 do not have to complete this form for 2015. He should be a senior. Web form 15h is solely for senior citizens, that is, individuals who are at least 60 years of age. Irs use only—do not write or staple in this.

Since These Forms Are Valid For Only One Financial Year, Eligible Individuals Wanting To.

Household employee cash wages of $1,900. You can submit the forms online as well via the bank’s. Web form 15h for senior citizen fy 2020 21 | how to save tds | senior citizen form 15h fill up form 15h helps to avoid tds deduction from income. Web form 15g is a declaration filed by individuals below the age of 60 years, while form 15h is for senior citizens, i.e., individuals above 60.

![[PDF] Form 15H For PF Withdrawal PDF Download PDFfile](https://pdffile.co.in/wp-content/uploads/pdf-thumbnails/2021/07/small/form-15h-for-pf-withdrawal-847.jpg)

![[PDF] Form 15 H For Senior Citizen PDF Download in English InstaPDF](https://instapdf.in/wp-content/uploads/pdf-thumbnails/form-15h-pdf-179.jpg)