15G Form Pf

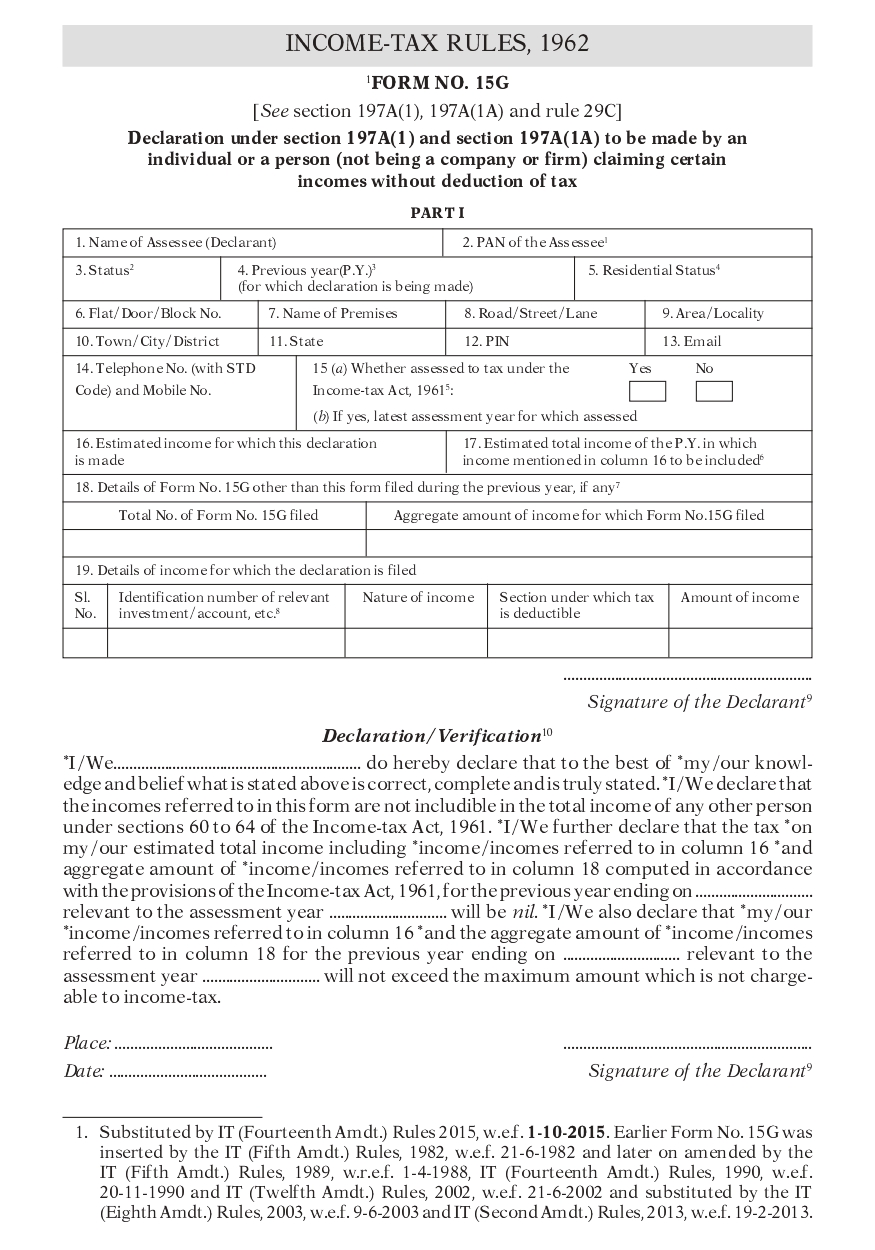

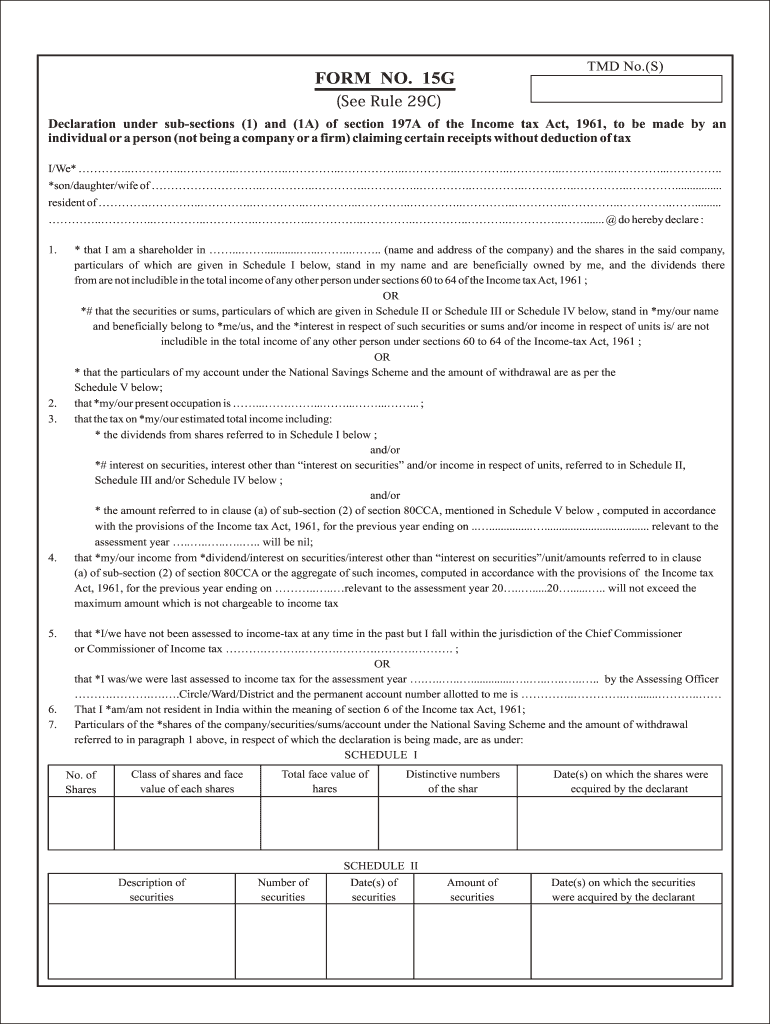

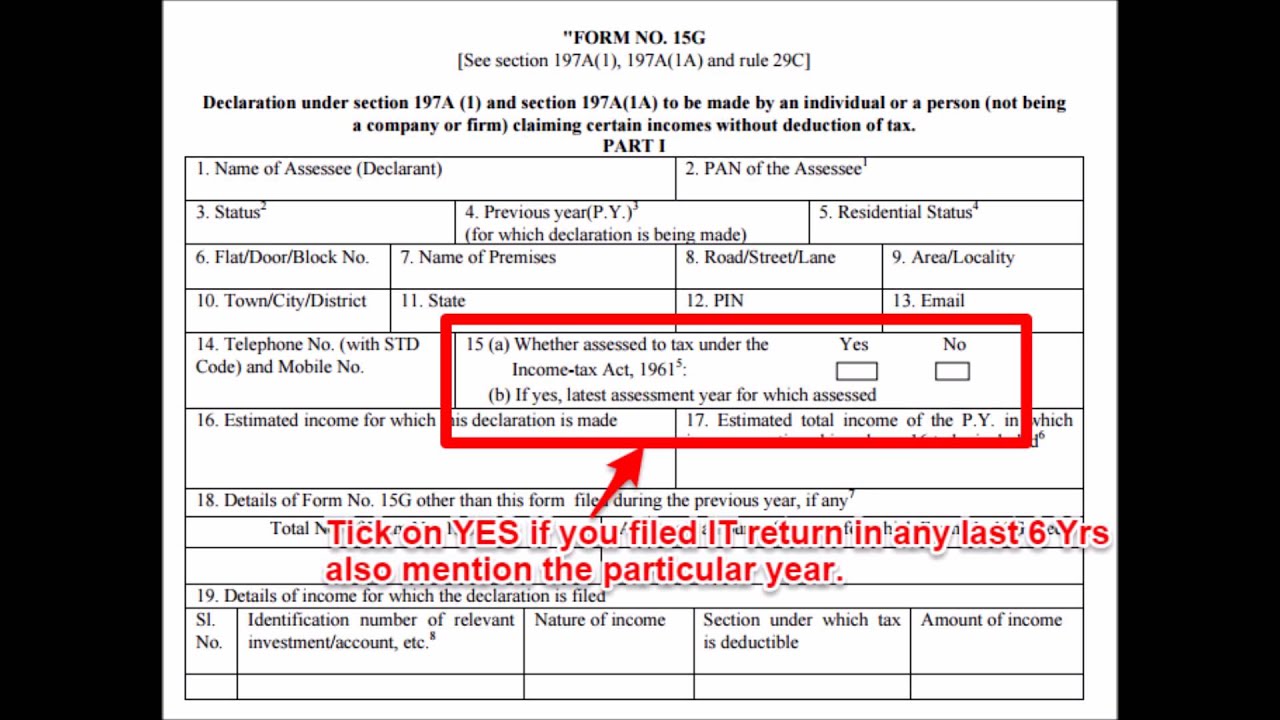

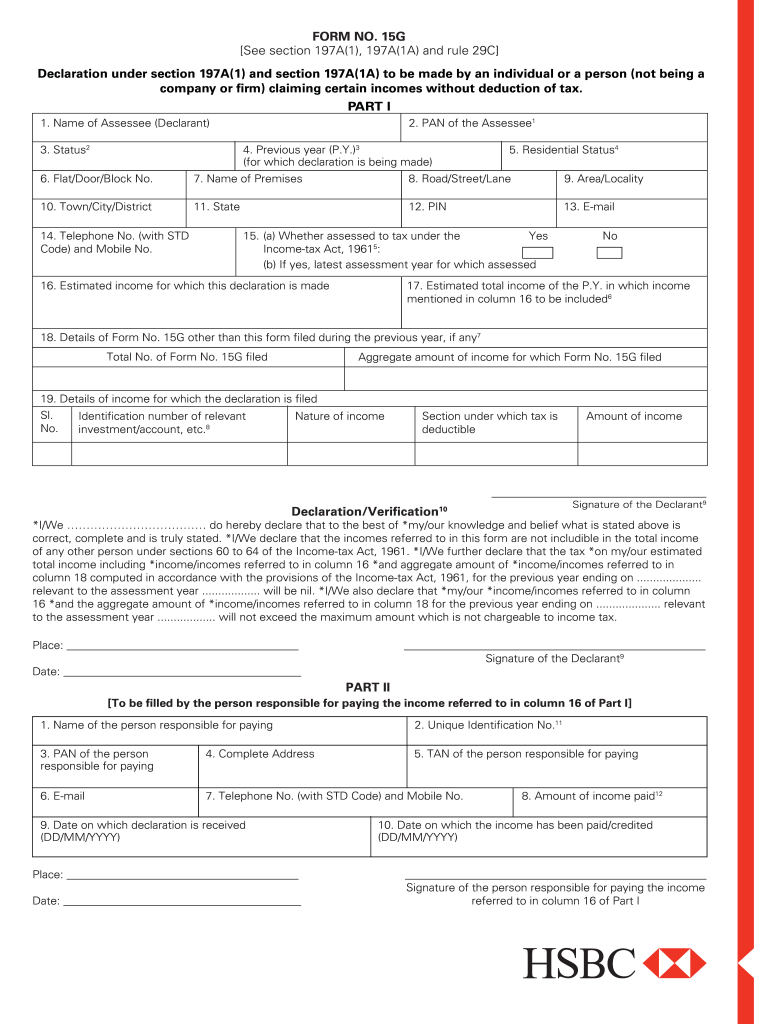

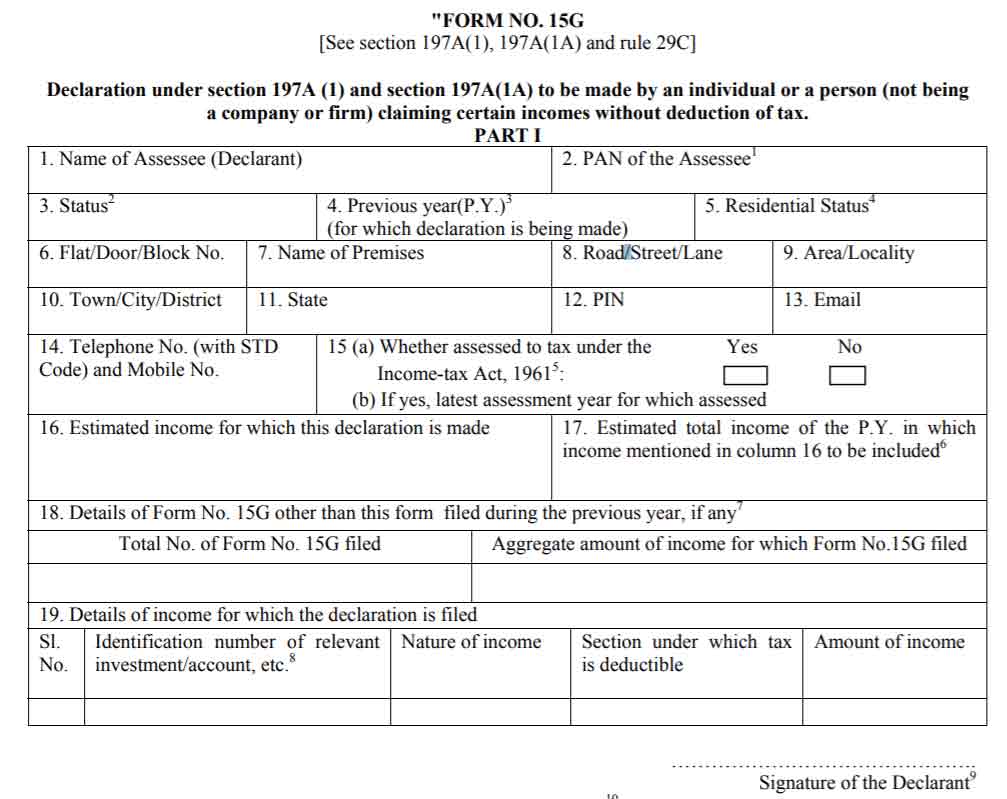

15G Form Pf - 15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a(1a) of the income‐tax act, 1961 to be made by an individual or. Web criteria your age should be less then 60 years. Web 4.7 satisfied 431 votes what makes the form 15g download legally binding? Web up to $40 cash back form 15g for pf withdrawal form no. Start completing the fillable fields and. Web form 15g, a declaration form, is for the people who are holders of a fixed deposit account to fill out. These individuals must be 60 years or less or hufs. The tax on total income. Web form 15g download pdfone or ipad, easily create electronic signatures for signing a form 15g for pf withdrawal in pdf format. Web form 15g/form 15h are forms submitted to the concern authority for not deducting tds for the specified income.

15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a(1a) of the income‐tax act, 1961 to be made by an individual or. Web 4.7 satisfied 431 votes what makes the form 15g download legally binding? It should be filled by the citizens of india. Because the world takes a step away from office working conditions, the completion of documents. Web criteria your age should be less then 60 years. Web the employee provident fund (epf) form 15g is a special variation of form 15g that is used for withdrawals from the epf. The tax on total income. Epf members can declare that. Epf form 15g must be. These individuals must be 60 years or less or hufs.

Epf form 15g must be. Web form 15g download pdfone or ipad, easily create electronic signatures for signing a form 15g for pf withdrawal in pdf format. 15g see section 197a(1), 197a(1a) and rule 29c declaration under section 197a(1) and section 197a(1a) to be made by. 15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a(1a) of the income‐tax act, 1961 to be made by an individual or. Start completing the fillable fields and. If your total work experience is less then 5 year and pf amount more then 50,000. These forms can be used for receipt of any. Because the world takes a step away from office working conditions, the completion of documents. These individuals must be 60 years or less or hufs. Web form 15g, a declaration form, is for the people who are holders of a fixed deposit account to fill out.

EPF Form 15G Download Sample Filled Form 15G For PF Withdrawal GST

Epf form 15g must be. Start completing the fillable fields and. Web epf form 15g is basically a declaration that ensures that tds (tax deducted at source) is not deducted from the employee’s interest income in a year. Then you can fill form 15g epfo. Web form 15g download pdfone or ipad, easily create electronic signatures for signing a form.

What is Form 15G & How to Fill Form 15G for PF Withdrawal

Epf form 15g must be. Web criteria your age should be less then 60 years. 15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a(1a) of the income‐tax act, 1961 to be made by an individual or. These forms can be used for receipt of any. Signnow has paid close attention to ios users and.

Download Form 15G for PF Withdrawal 2022

15g [see section 197a(1), 197a(1a) and rule 29c] declaration under section 197a(1) and section 197a(1a) of the income‐tax act, 1961 to be made by an individual or. Epf members can declare that. 15g see section 197a(1), 197a(1a) and rule 29c declaration under section 197a(1) and section 197a(1a) to be made by. Web up to $40 cash back form 15g for.

Sample Filled Form 15G for PF Withdrawal in 2021

It should be filled by the citizens of india. 15g see section 197a(1), 197a(1a) and rule 29c declaration under section 197a(1) and section 197a(1a) to be made by. If your total work experience is less then 5 year and pf amount more then 50,000. Web criteria your age should be less then 60 years. Web what is form 15g?

15g Form For Pf Withdrawal Rules abilitylasopa

Web criteria your age should be less then 60 years. Start completing the fillable fields and. Signnow has paid close attention to ios users and. Web what is form 15g? Web epf form 15g is basically a declaration that ensures that tds (tax deducted at source) is not deducted from the employee’s interest income in a year.

Pf Form 15g Filled Sample Download Fill Out and Sign Printable PDF

Epf members can declare that. Web form 15g/form 15h are forms submitted to the concern authority for not deducting tds for the specified income. 15g see section 197a(1), 197a(1a) and rule 29c declaration under section 197a(1) and section 197a(1a) to be made by. If your total work experience is less then 5 year and pf amount more then 50,000. Web.

How to fill newly launched Form 15G and Form 15H? YouTube

Web quick steps to complete and design form 15g for pf online: Web 4.7 satisfied 431 votes what makes the form 15g download legally binding? Use get form or simply click on the template preview to open it in the editor. Start completing the fillable fields and. Web form 15g, a declaration form, is for the people who are holders.

Form 15g For Pf Withdrawal Pdf Fill Online, Printable, Fillable

Epf form 15g must be. Web form 15g download pdfone or ipad, easily create electronic signatures for signing a form 15g for pf withdrawal in pdf format. 15g see section 197a(1), 197a(1a) and rule 29c declaration under section 197a(1) and section 197a(1a) to be made by. If your total work experience is less then 5 year and pf amount more.

Form 15G How to Fill Form 15G for PF Withdrawal MoneyPiP

Epf members can declare that. Because the world takes a step away from office working conditions, the completion of documents. These individuals must be 60 years or less or hufs. Web form 15g download pdfone or ipad, easily create electronic signatures for signing a form 15g for pf withdrawal in pdf format. 15g [see section 197a(1), 197a(1a) and rule 29c].

How To Fill Form 15G For PF Withdrawal YouTube

Web epf form 15g is basically a declaration that ensures that tds (tax deducted at source) is not deducted from the employee's interest income in a year. These individuals must be 60 years or less or hufs. Use get form or simply click on the template preview to open it in the editor. If your total work experience is less.

Epf Form 15G Must Be.

The tax on total income. Because the world takes a step away from office working conditions, the completion of documents. Web quick steps to complete and design form 15g for pf online: Use get form or simply click on the template preview to open it in the editor.

15G [See Section 197A(1), 197A(1A) And Rule 29C] Declaration Under Section 197A(1) And Section 197A(1A) Of The Income‐Tax Act, 1961 To Be Made By An Individual Or.

Web epf form 15g is basically a declaration that ensures that tds (tax deducted at source) is not deducted from the employee’s interest income in a year. Web form 15g, a declaration form, is for the people who are holders of a fixed deposit account to fill out. It should be filled by the citizens of india. Web epf form 15g is basically a declaration that ensures that tds (tax deducted at source) is not deducted from the employee's interest income in a year.

These Individuals Must Be 60 Years Or Less Or Hufs.

Web form 15g/form 15h are forms submitted to the concern authority for not deducting tds for the specified income. Then you can fill form 15g epfo. Web up to $40 cash back form 15g for pf withdrawal form no. If your total work experience is less then 5 year and pf amount more then 50,000.

These Forms Can Be Used For Receipt Of Any.

Web what is form 15g? Web the employee provident fund (epf) form 15g is a special variation of form 15g that is used for withdrawals from the epf. Epf members can declare that. 15g see section 197a(1), 197a(1a) and rule 29c declaration under section 197a(1) and section 197a(1a) to be made by.