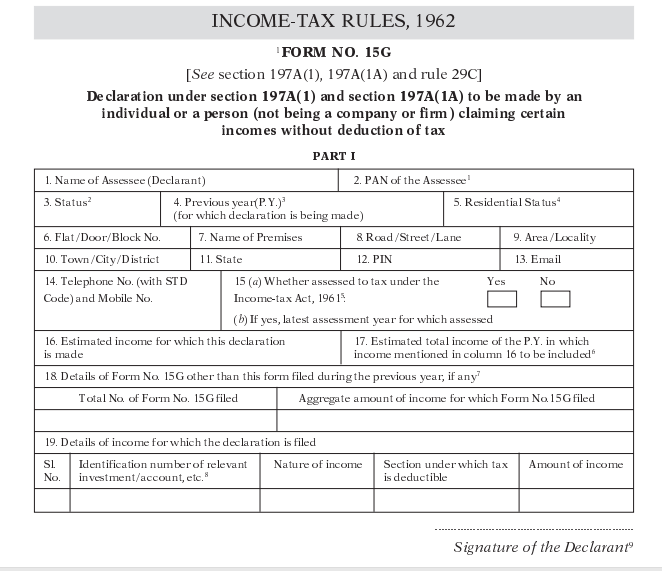

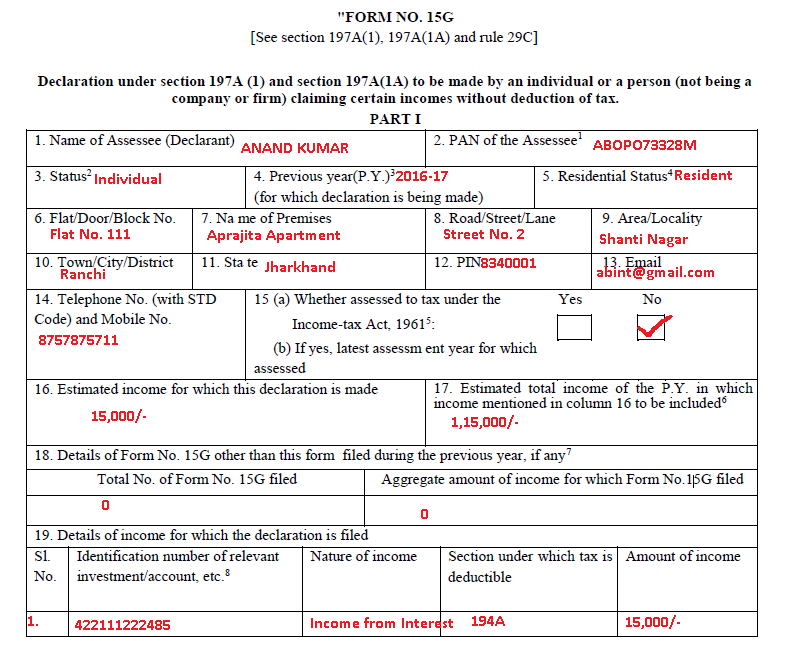

15 H Form

15 H Form - You can submit the forms online as well via the bank’s. However, you need to meet certain eligibility conditions. This is a request to reduce the tds burden on interest earned on recurring deposits or. Web calendar year taxpayers having no household employees in 2015 do not have to complete this form for 2015. To avoid deduction of tds from your interest income you can surely opt for this route. The form must be submitted to financial. Last update august 2, 2020. Include the amounts, if any, from line 8e on schedule 3 (form 1040), line 13b, and line 8f on. Web what is form 15h? 15h [see section 197a(1c) and rule 29c] declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or more claiming certain.

15h [see section 197a(1c) and nile 29c] declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or more claiming certain. Web calendar year taxpayers having no household employees in 2015 do not have to complete this form for 2015. It is an ideal tool for individuals well versed. The form must be submitted to financial. To avoid deduction of tds from your interest income you can surely opt for this route. Web what is form 15h? Form 15h aims to enable individuals claim relief from tds deductions on income generated from interest on fixed deposits in banks made during a specific. 15h [see section 197a(1c) and rule 29c(1a)]declaration under section 197a(1c) of the income‐tax act, 1961 to be made by an individual who is of the age of. 15g and 15h is applicable to all tax payees who do not. Last update august 2, 2020.

Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them. Web include the amount from line 8d above on schedule 2 (form 1040), line 9. This is a request to reduce the tds burden on interest earned on recurring deposits or. Web if you are a senior citizen, you should file form 15h; 15g and 15h is applicable to all tax payees who do not. Web calendar year taxpayers having no household employees in 2015 do not have to complete this form for 2015. However, you need to meet certain eligibility conditions. Include the amounts, if any, from line 8e on schedule 3 (form 1040), line 13b, and line 8f on. Web form 15h is a very popular form among investors and taxpayers.

Form 15H (Save TDS on Interest How to Fill & Download

Web if you are a senior citizen, you should file form 15h; However, you need to meet certain eligibility conditions. Easily fill out pdf blank, edit, and sign them. It is an ideal tool for individuals well versed. Web calendar year taxpayers having no household employees in 2015 do not have to complete this form for 2015.

Form 15G H Download moplafreak

15h [see section 197a(1c) and rule 29c] declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or more claiming certain. Easily fill out pdf blank, edit, and sign them. Web calendar year taxpayers having no household employees in 2015 do not have to complete this form for 2015. Web what is.

bank of india 15h form pdf You can download to on site

The form must be submitted to financial. To avoid deduction of tds from your interest income you can surely opt for this route. Save or instantly send your ready documents. Form 15h aims to enable individuals claim relief from tds deductions on income generated from interest on fixed deposits in banks made during a specific. It is an ideal tool.

[PDF] Form 15 H For Senior Citizen PDF Download in English InstaPDF

15g and 15h is applicable to all tax payees who do not. Web calendar year taxpayers having no household employees in 2015 do not have to complete this form for 2015. This is a request to reduce the tds burden on interest earned on recurring deposits or. 15h [see section 197a(1c) and rule 29c(1a)]declaration under section 197a(1c) of the income‐tax.

[PDF] Jammu CoOperative Bank Form 15H PDF Download InstaPDF

This is a request to reduce the tds burden on interest earned on recurring deposits or. It is an ideal tool for individuals well versed. Save or instantly send your ready documents. Web what is form 15h? Form 15h aims to enable individuals claim relief from tds deductions on income generated from interest on fixed deposits in banks made during.

Form 15g Fillable Format Printable Forms Free Online

This is a request to reduce the tds burden on interest earned on recurring deposits or. Household employee cash wages of $1,900. Web calendar year taxpayers having no household employees in 2015 do not have to complete this form for 2015. Web form 15h is a very popular form among investors and taxpayers. Web if you are a senior citizen,.

Form 15G & 15H What is Form 15G? How to Fill Form 15G for PF Withdrawal

You can submit the forms online as well via the bank’s. Web form 15h is a very popular form among investors and taxpayers. This is a request to reduce the tds burden on interest earned on recurring deposits or. Web include the amount from line 8d above on schedule 2 (form 1040), line 9. Web calendar year taxpayers having no.

15h Form Fill Online, Printable, Fillable, Blank pdfFiller

15h [see section 197a(1c) and nile 29c] declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or more claiming certain. Include the amounts, if any, from line 8e on schedule 3 (form 1040), line 13b, and line 8f on. You can submit the forms online as well via the bank’s. This.

EVERYTHING BANKING NEWS 15G 15H Form Fill Up Step wise Guideline with

Web form 15h is a very popular form among investors and taxpayers. 15g and 15h is applicable to all tax payees who do not. Web if you are a senior citizen, you should file form 15h; Web what is form 15h? Web include the amount from line 8d above on schedule 2 (form 1040), line 9.

How To Fill Form 15G And 15H ★ Filled Form 15G Sample ★ Form 15H Sample

Web form 15h is a declaration form that can be submitted to the income tax department of india by a resident who is a senior citizen (60 years of age or older) or a. Include the amounts, if any, from line 8e on schedule 3 (form 1040), line 13b, and line 8f on. Household employee cash wages of $1,900. Web.

You Can Submit The Forms Online As Well Via The Bank’s.

To avoid deduction of tds from your interest income you can surely opt for this route. Web include the amount from line 8d above on schedule 2 (form 1040), line 9. Last update august 2, 2020. Form 15h aims to enable individuals claim relief from tds deductions on income generated from interest on fixed deposits in banks made during a specific.

15G And 15H Is Applicable To All Tax Payees Who Do Not.

Include the amounts, if any, from line 8e on schedule 3 (form 1040), line 13b, and line 8f on. 15h [see section 197a(1c) and rule 29c(1a)]declaration under section 197a(1c) of the income‐tax act, 1961 to be made by an individual who is of the age of. 15h [see section 197a(1c) and nile 29c] declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or more claiming certain. Web calendar year taxpayers having no household employees in 2015 do not have to complete this form for 2015.

Save Or Instantly Send Your Ready Documents.

15h [see section 197a(1c) and rule 29c] declaration under section 197a(1c) to be made by an individual who is of the age of sixty years or more claiming certain. It is an ideal tool for individuals well versed. This is a request to reduce the tds burden on interest earned on recurring deposits or. Web what is form 15h?

Household Employee Cash Wages Of $1,900.

Web what is form 15h? Web form 15h is a declaration form that can be submitted to the income tax department of india by a resident who is a senior citizen (60 years of age or older) or a. Web form 15h is a very popular form among investors and taxpayers. The form must be submitted to financial.

![[PDF] Form 15 H For Senior Citizen PDF Download in English InstaPDF](https://instapdf.in/wp-content/uploads/pdf-thumbnails/form-15h-pdf-179.jpg)

![[PDF] Jammu CoOperative Bank Form 15H PDF Download InstaPDF](https://instapdf.in/wp-content/uploads/pdf-thumbnails/the-citizen-co-operative-bank-form-15h-732.jpg)