147C Tax Form

147C Tax Form - Web read your notice carefully. Your previously filed return should. This number reaches the irs business & specialty tax department,. Web there is a solution if you don’t have possession of the ein confirmation letter. Web an ein verification letter ( commonly known as a form 147c) is an official document from the internal revenue service that lists your employer identification number and confirms. Web advance child tax credit letters. Web how to obtain a confirmation letter (147c letter) of the employer identification number (ein) if your clergy and/or employees are unable to e‐file their income tax returns because of. The business can contact the irs directly and request a replacement confirmation letter called a 147c. Web edit, sign, and share irs form 147c pdf online. Get details on letters about the 2021 advance child tax credit payments:

The letter requests information about the business’s ein or employer identification number. Your previously filed return should. Web here’s how you request an ein verification letter (147c) the easiest way to get a copy of an ein verification letter is to call the irs. Web advance child tax credit letters. Get details on letters about the 2021 advance child tax credit payments: Individual tax return form 1040 instructions; It will also list the payments we've credited to your account for that tax. The business can contact the irs directly and request a replacement confirmation letter called a 147c. Web employer information to become an employer for the or fmas program you need an employer identification number (ein) from the internal revenue service (irs). Web edit, sign, and share irs form 147c pdf online.

Follow the below process to. Web how to obtain a confirmation letter (147c letter) of the employer identification number (ein) if your clergy and/or employees are unable to e‐file their income tax returns because of. Web read your notice carefully. Your previously filed return should. Web popular forms & instructions; Web employer information to become an employer for the or fmas program you need an employer identification number (ein) from the internal revenue service (irs). The business can contact the irs directly and request a replacement confirmation letter called a 147c. Get details on letters about the 2021 advance child tax credit payments: Web find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced ein. Web the 147c letter is a document that is sent to businesses by the irs.

What Is Form CP575? Gusto

Follow the below process to. The business can contact the irs directly and request a replacement confirmation letter called a 147c. It will show the amount we applied to the following year's taxes. Web there is a solution if you don’t have possession of the ein confirmation letter. The letter requests information about the business’s ein or employer identification number.

IRS FORM 147C PDF

It will show the amount we applied to the following year's taxes. Web find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced ein. Get details on letters about the 2021 advance child tax credit payments: This number reaches the irs business & specialty tax department,..

Irs Form 147c Letter Letter Resume Examples QBD3EAp2OX

Your previously filed return should. Individual tax return form 1040 instructions; Web an ein verification letter ( commonly known as a form 147c) is an official document from the internal revenue service that lists your employer identification number and confirms. The letter requests information about the business’s ein or employer identification number. It will also list the payments we've credited.

Irs Letter 147c Sample Letter Resume Template Collections NLzn2jOz2Q

Web an ein verification letter ( commonly known as a form 147c) is an official document from the internal revenue service that lists your employer identification number and confirms. Your previously filed return should. Web how to obtain a confirmation letter (147c letter) of the employer identification number (ein) if your clergy and/or employees are unable to e‐file their income.

Irs Letter 147c Sample

The business can contact the irs directly and request a replacement confirmation letter called a 147c. Web how to obtain a confirmation letter (147c letter) of the employer identification number (ein) if your clergy and/or employees are unable to e‐file their income tax returns because of. Web here’s how you request an ein verification letter (147c) the easiest way to.

18 [pdf] 147C TAX IDENTIFICATION LETTER PRINTABLE DOCX ZIP DOWNLOAD

Web employer information to become an employer for the or fmas program you need an employer identification number (ein) from the internal revenue service (irs). Web popular forms & instructions; Web the 147c letter is a document that is sent to businesses by the irs. Get details on letters about the 2021 advance child tax credit payments: Web there is.

How can I get a copy of my EIN Verification Letter (147C) from the IRS

Individual tax return form 1040 instructions; Get details on letters about the 2021 advance child tax credit payments: Web popular forms & instructions; Web find a previously filed tax return for your existing entity (if you have filed a return) for which you have your lost or misplaced ein. The letter requests information about the business’s ein or employer identification.

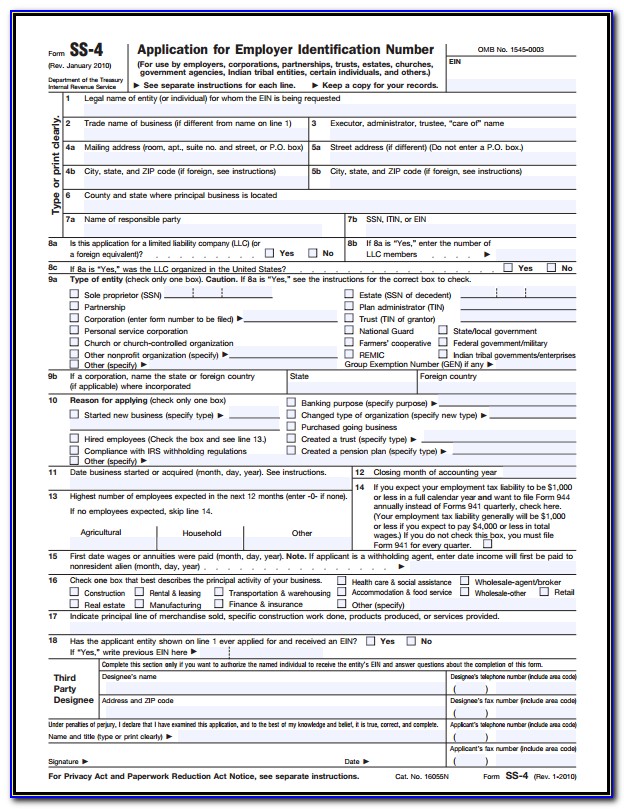

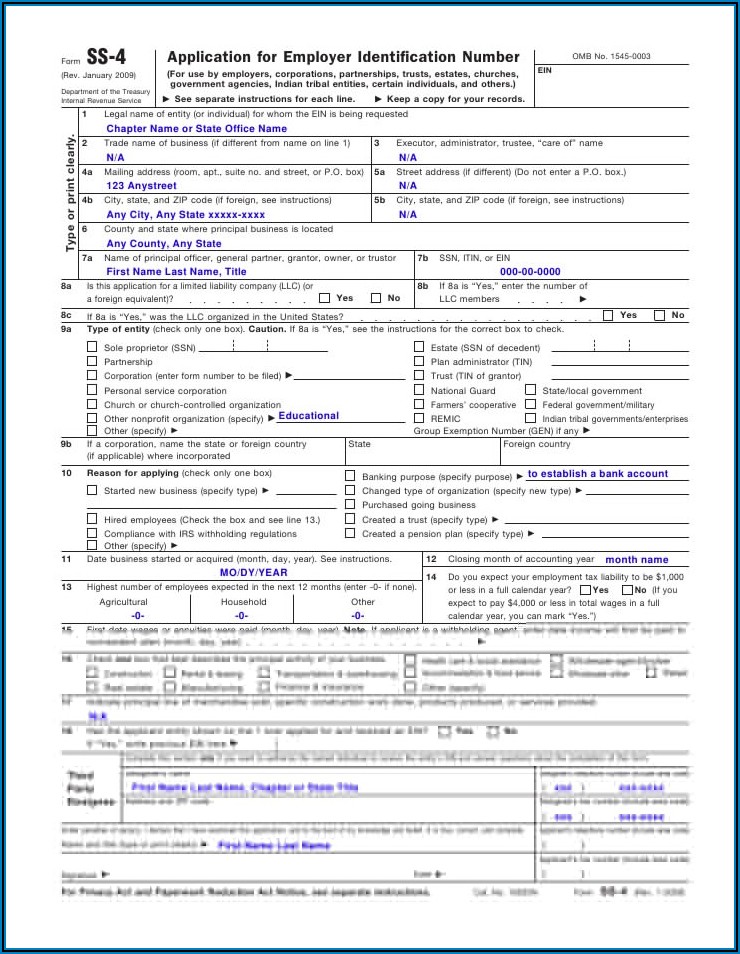

Application Form 0809 Irs Tax Forms Business

Web employer information to become an employer for the or fmas program you need an employer identification number (ein) from the internal revenue service (irs). The letter requests information about the business’s ein or employer identification number. No need to install software, just go to dochub, and sign up instantly and for free. Web the 147c letter is a document.

PPACAHEALTH REFORM UPDATES PPACAW2 REPORTINGIRS GUIDANCE CHART

Web the 147c letter is a document that is sent to businesses by the irs. Web an ein verification letter ( commonly known as a form 147c) is an official document from the internal revenue service that lists your employer identification number and confirms. Web popular forms & instructions; Web read your notice carefully. Web edit, sign, and share irs.

irs letter 147c

Your previously filed return should. Get details on letters about the 2021 advance child tax credit payments: Web how to obtain a confirmation letter (147c letter) of the employer identification number (ein) if your clergy and/or employees are unable to e‐file their income tax returns because of. Web advance child tax credit letters. It will show the amount we applied.

Follow The Below Process To.

Web advance child tax credit letters. Web here’s how you request an ein verification letter (147c) the easiest way to get a copy of an ein verification letter is to call the irs. Web employer information to become an employer for the or fmas program you need an employer identification number (ein) from the internal revenue service (irs). Get details on letters about the 2021 advance child tax credit payments:

Web Popular Forms & Instructions;

The business can contact the irs directly and request a replacement confirmation letter called a 147c. No need to install software, just go to dochub, and sign up instantly and for free. This number reaches the irs business & specialty tax department,. Individual tax return form 1040 instructions;

Web How To Obtain A Confirmation Letter (147C Letter) Of The Employer Identification Number (Ein) If Your Clergy And/Or Employees Are Unable To E‐File Their Income Tax Returns Because Of.

Use this address if you are not enclosing a payment use this. Web an ein verification letter ( commonly known as a form 147c) is an official document from the internal revenue service that lists your employer identification number and confirms. Your previously filed return should. The letter requests information about the business’s ein or employer identification number.

Web Read Your Notice Carefully.

Web edit, sign, and share irs form 147c pdf online. It will also list the payments we've credited to your account for that tax. Web there is a solution if you don’t have possession of the ein confirmation letter. It will show the amount we applied to the following year's taxes.