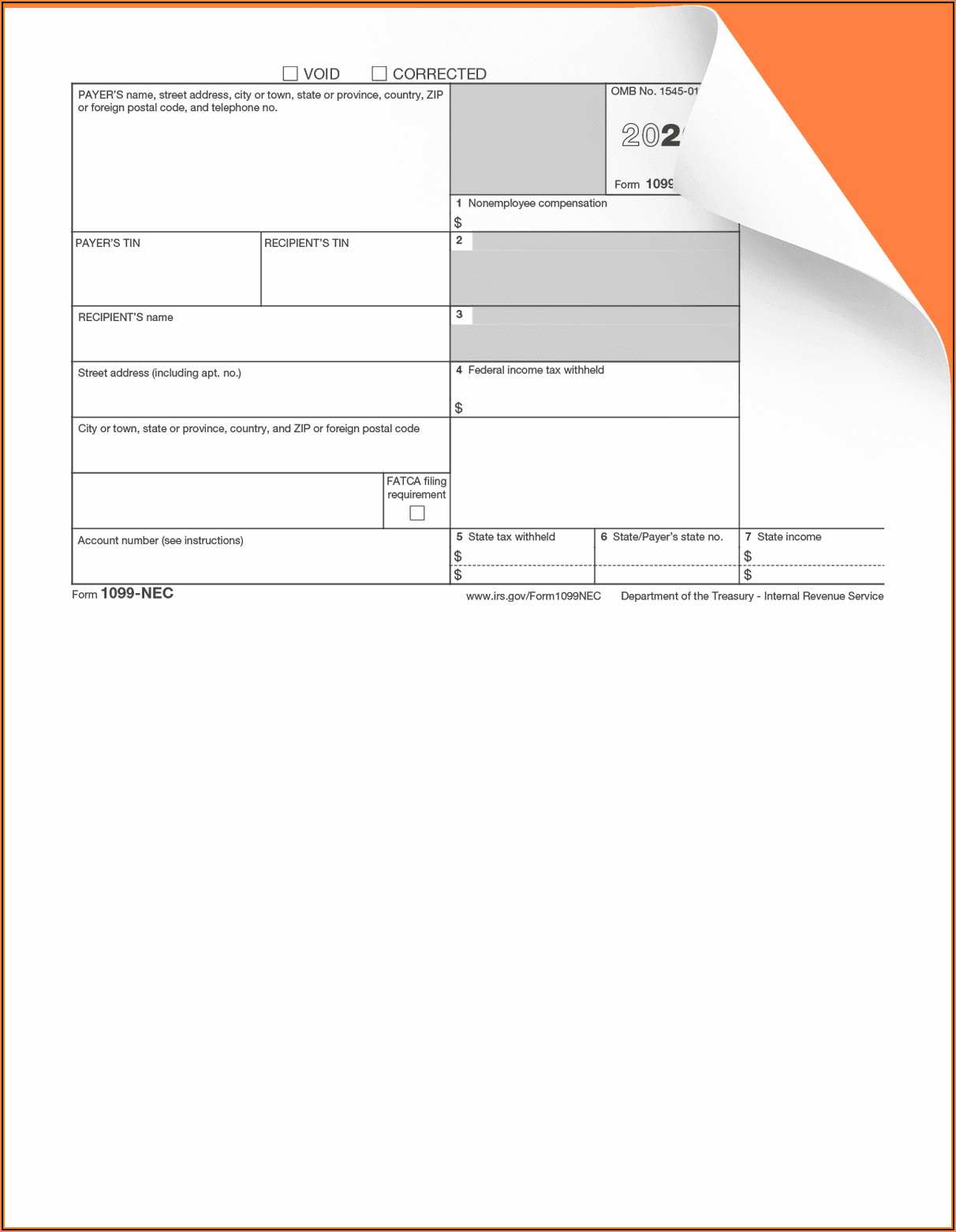

1099 Nec Free Fillable Form

1099 Nec Free Fillable Form - Web a version of the form is downloadable and a fillable online pdf format is available on the irs website. For federal income tax purposes, payments made to people who aren’t directly employed by the company must be reported to the internal revenue service (irs). You can complete the form using irs free file or a tax filing software. Examples of this include freelance work or driving for doordash or uber. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). If you have made a payment of $600 or more to an independent contractor or if you have withheld any taxes, you must. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. Simple, and easy to use no software downloads or installation required. Web www.irs.gov/form1099nec (if checked) federal income tax withheld copy b for recipient this is important tax information and is being furnished to the irs. Web how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save 1099 nec 2021 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 28 votes how to fill out and sign 1099 nec form 2021 online?

You can complete the form using irs free file or a tax filing software. For federal income tax purposes, payments made to people who aren’t directly employed by the company must be reported to the internal revenue service (irs). Click the fill out form button. Specify your information in the first field. Use fill to complete blank online irs pdf forms for free. Get your online template and fill it in using progressive features. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. Write your and the recipient's tin. Web how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save 1099 nec 2021 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 28 votes how to fill out and sign 1099 nec form 2021 online? Examples of this include freelance work or driving for doordash or uber.

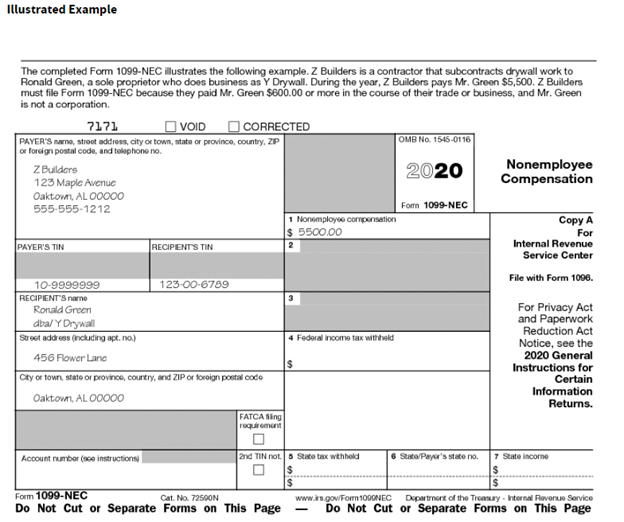

Web instructions for recipient recipient’s taxpayer identification number (tin). Examples of this include freelance work or driving for doordash or uber. Copy b and copy 2: Irs form 1099 nec is due to the irs and to the contractor annually on “ january 31st of the following calendar year”. If you have made a payment of $600 or more to an independent contractor or if you have withheld any taxes, you must. For privacy act and paperwork reduction act notice, see the 2020 general instructions for certain information returns. 72590n do not cut or separate forms on this page — do not cut or separate forms on this page If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. Once completed you can sign your fillable form or send for signing. For federal income tax purposes, payments made to people who aren’t directly employed by the company must be reported to the internal revenue service (irs).

What Is Form 1099NEC?

All forms are printable and downloadable. Web instructions for recipient recipient’s taxpayer identification number (tin). Send to your state’s tax department. You can complete the form using irs free file or a tax filing software. Quick & secure online filing.

What the 1099NEC Coming Back Means for your Business Chortek

Irs form 1099 nec is due to the irs and to the contractor annually on “ january 31st of the following calendar year”. Web file with form 1096. Write your and the recipient's tin. How does tax filing work for freelancers? Use fill to complete blank online irs pdf forms for free.

Fillable Form 1099 Nec Form Resume Examples o7Y3LqkVBN

If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. Web www.irs.gov/form1099nec (if checked) federal income tax withheld copy b for recipient this is important tax information and is being furnished to the irs. For privacy.

1099 Tax Form Fill Online, Printable, Fillable, Blank pdfFiller

All forms are printable and downloadable. You can complete the form using irs free file or a tax filing software. If you have made a payment of $600 or more to an independent contractor or if you have withheld any taxes, you must. Simple, and easy to use no software downloads or installation required. Once completed you can sign your.

1099NEC Form Print Template for Word or PDF 1096 Transmittal Etsy

Get your online template and fill it in using progressive features. Account number (see instructions) 2nd tin not. Once completed you can sign your fillable form or send for signing. Examples of this include freelance work or driving for doordash or uber. Copy b and copy 2:

1099 NEC Form 2022

Account number (see instructions) 2nd tin not. 72590n do not cut or separate forms on this page — do not cut or separate forms on this page Web instructions for recipient recipient’s taxpayer identification number (tin). Simple, and easy to use no software downloads or installation required. If you have made a payment of $600 or more to an independent.

2021 Form IRS 1099NEC Fill Online, Printable, Fillable, Blank pdfFiller

Web a version of the form is downloadable and a fillable online pdf format is available on the irs website. Once completed you can sign your fillable form or send for signing. Web www.irs.gov/form1099nec (if checked) federal income tax withheld copy b for recipient this is important tax information and is being furnished to the irs. Click the fill out.

Nonemployee Compensation now reported on Form 1099NEC instead of Form

Copy b and copy 2: Web instructions for recipient recipient’s taxpayer identification number (tin). If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. For privacy act and paperwork reduction act notice, see the 2020 general.

The New 1099NEC IRS Form for Second Shooters & Independent Contractors

72590n do not cut or separate forms on this page — do not cut or separate forms on this page If you are required to file a return, a negligence penalty or other sanction may be imposed on you if this income is taxable and the irs determines that it has not been reported. Pricing starts as low as $2.75/form..

[最も選択された] form 1099nec schedule c instructions 231161How to fill out

Web file with form 1096. Get your online template and fill it in using progressive features. Use fill to complete blank online irs pdf forms for free. Click the fill out form button. Web instructions for recipient recipient’s taxpayer identification number (tin).

Web Instructions For Recipient Recipient’s Taxpayer Identification Number (Tin).

How does tax filing work for freelancers? Irs form 1099 nec is due to the irs and to the contractor annually on “ january 31st of the following calendar year”. You can complete the form using irs free file or a tax filing software. Write your and the recipient's tin.

Web File With Form 1096.

Click the fill out form button. Web how it works open form follow the instructions easily sign the form with your finger send filled & signed form or save 1099 nec 2021 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 28 votes how to fill out and sign 1099 nec form 2021 online? For privacy act and paperwork reduction act notice, see the 2020 general instructions for certain information returns. Pricing starts as low as $2.75/form.

Simple, And Easy To Use No Software Downloads Or Installation Required.

Use fill to complete blank online irs pdf forms for free. Web a version of the form is downloadable and a fillable online pdf format is available on the irs website. All forms are printable and downloadable. Quick & secure online filing.

For Your Protection, This Form May Show Only The Last Four Digits Of Your Social Security Number (Ssn), Individual Taxpayer Identification Number (Itin), Adoption Taxpayer Identification Number (Atin), Or Employer Identification Number (Ein).

Copy b and copy 2: Once completed you can sign your fillable form or send for signing. Examples of this include freelance work or driving for doordash or uber. Step by step video tutorial where can i find related tax.

/https://specials-images.forbesimg.com/imageserve/6011f71d9357d52c817e0b2e/0x0.jpg)

![[最も選択された] form 1099nec schedule c instructions 231161How to fill out](https://efile360.com/images/forms-assets/Form 1099-NEC.png)