1099 Form Michigan

1099 Form Michigan - Web contents hide 1 does michigan require state 1099 tax filing? These where to file addresses. The statements are prepared by uia and report how much. Web where can i get a 1099 form? Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web michigan treasury online (mto): Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in michigan. To whom you paid amounts reportable in boxes 1, 3 and 8 of at least $10 (or at least $600 of interest paid in. Web 13 rows michigan requires. 2 which forms does michigan require?

These where to file addresses. Web 13 rows michigan requires. Web michigan treasury online (mto): Web contents hide 1 does michigan require state 1099 tax filing? Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in michigan. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Form 5081 is the annual reconciliation form used to report the total income taxes withheld from employees. Web where can i get a 1099 form? You should receive your form 1099 (s) in the mail or electronically, or you may be able to access them in your financial institution. 3 how must forms 1099 be filed with michigan ?

When is michigan 1099 due? 2 which forms does michigan require? Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in michigan. Takes 5 minutes or less to complete. To whom you paid amounts reportable in boxes 1, 3 and 8 of at least $10 (or at least $600 of interest paid in. 3 how must forms 1099 be filed with michigan ? Web where can i get a 1099 form? Simply answer a few question to instantly download, print & share your form. Michigan will delay the release of tax forms needed for residents to report how much they earned in unemployment benefits in 2021.

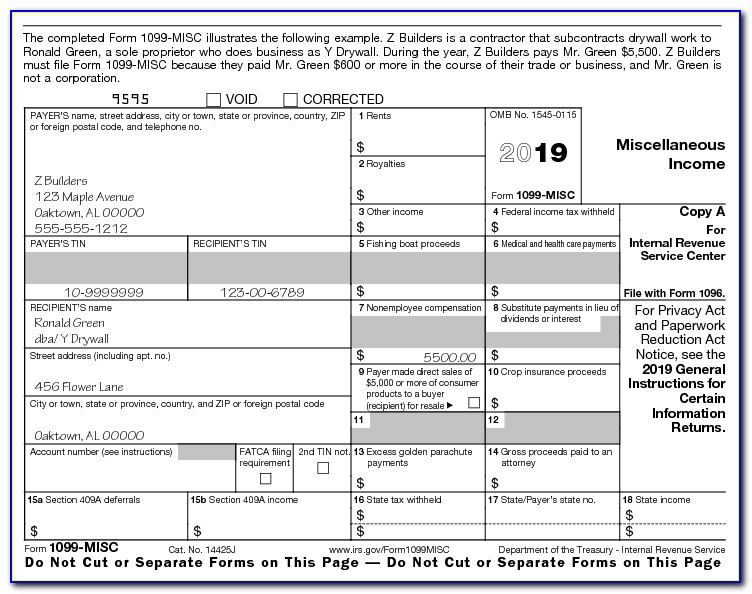

1099 G Tax Form Michigan Form Resume Examples K75Pp4X5l2

Web where can i get a 1099 form? When is michigan 1099 due? Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. 2 which forms does michigan require? To whom you paid amounts reportable in boxes 1, 3 and 8 of at least $10 (or at least $600 of interest paid in.

Michigan Form 1099 G Form Resume Examples 7NYA0gLR9p

You should receive your form 1099 (s) in the mail or electronically, or you may be able to access them in your financial institution. Michigan will delay the release of tax forms needed for residents to report how much they earned in unemployment benefits in 2021. Ap leaders rely on iofm’s expertise to keep them up to date on changing.

Michigan Substitute Form 1099 G Form Resume Examples qeYzMGNR98

Takes 5 minutes or less to complete. These where to file addresses. Michigan will delay the release of tax forms needed for residents to report how much they earned in unemployment benefits in 2021. Form 5081 is the annual reconciliation form used to report the total income taxes withheld from employees. 2 which forms does michigan require?

Michigan 1099 Form 2020 Form Resume Examples Pw1gJzDo8Y

The statements are prepared by uia and report how much. Web contents hide 1 does michigan require state 1099 tax filing? When is michigan 1099 due? Takes 5 minutes or less to complete. Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations.

What to Know About the 1099K Michigan Tax Attorneys

These where to file addresses. Web what is form 5081? Web where can i get a 1099 form? Form 5081 is the annual reconciliation form used to report the total income taxes withheld from employees. Web which form should i look for?

Peoples Choice Tax Tax Documents To Bring We provide Tax

Web 13 rows michigan requires. Web what is form 5081? You should receive your form 1099 (s) in the mail or electronically, or you may be able to access them in your financial institution. Form 5081 is the annual reconciliation form used to report the total income taxes withheld from employees. The statements are prepared by uia and report how.

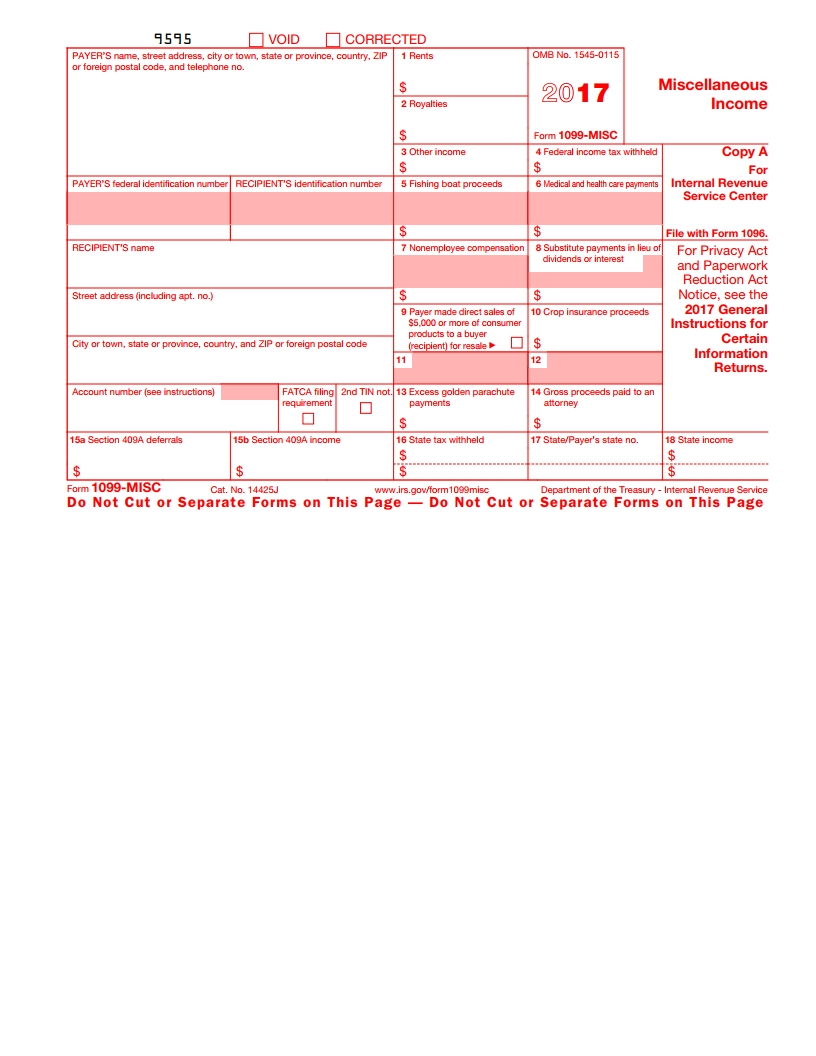

The New 1099NEC Form in 2021 Business education, Photography

Web michigan treasury online (mto): Web where can i get a 1099 form? The statements are prepared by uia and report how much. 3 how must forms 1099 be filed with michigan ? Web which form should i look for?

Do You Get A 1099 R For A Rollover Armando Friend's Template

These where to file addresses. When is michigan 1099 due? Web 13 rows michigan requires. Form 5081 is the annual reconciliation form used to report the total income taxes withheld from employees. Michigan will delay the release of tax forms needed for residents to report how much they earned in unemployment benefits in 2021.

Michigan Unemployment Tax Form 1099 Universal Network

These where to file addresses. Form 5081 is the annual reconciliation form used to report the total income taxes withheld from employees. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. 3 how must forms 1099 be filed with michigan ? The statements are prepared by uia and report how much.

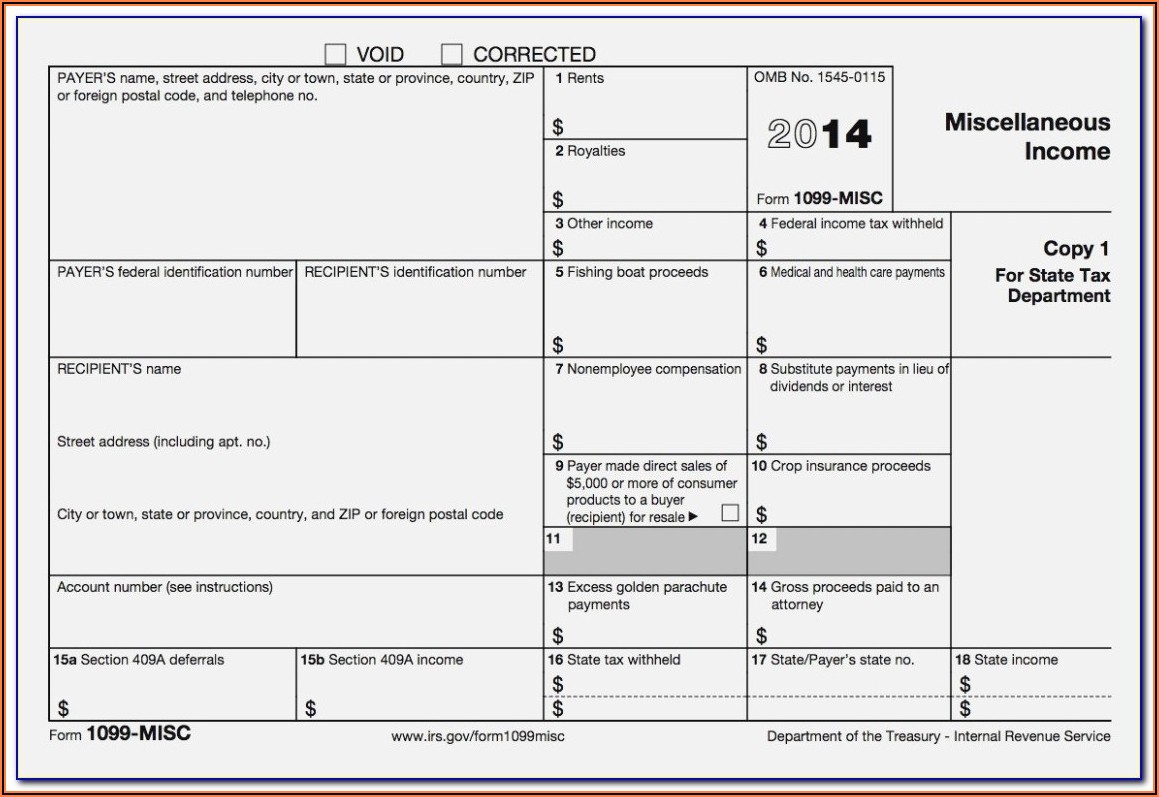

Irs Forms 1099 Are Critical, And Due Early In 2017 Free Printable

To whom you paid amounts reportable in boxes 1, 3 and 8 of at least $10 (or at least $600 of interest paid in. Web which form should i look for? Web what is form 5081? You should receive your form 1099 (s) in the mail or electronically, or you may be able to access them in your financial institution..

Form 5081 Is The Annual Reconciliation Form Used To Report The Total Income Taxes Withheld From Employees.

Michigan will delay the release of tax forms needed for residents to report how much they earned in unemployment benefits in 2021. Ad ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. When is michigan 1099 due? 3 how must forms 1099 be filed with michigan ?

Web What Is Form 5081?

Web where can i get a 1099 form? These where to file addresses. Web 13 rows michigan requires. Web contents hide 1 does michigan require state 1099 tax filing?

Web Which Form Should I Look For?

You should receive your form 1099 (s) in the mail or electronically, or you may be able to access them in your financial institution. Web michigan treasury online (mto): Takes 5 minutes or less to complete. Web find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in michigan.

Simply Answer A Few Question To Instantly Download, Print & Share Your Form.

2 which forms does michigan require? Ap leaders rely on iofm’s expertise to keep them up to date on changing irs regulations. The statements are prepared by uia and report how much. To whom you paid amounts reportable in boxes 1, 3 and 8 of at least $10 (or at least $600 of interest paid in.