1099 Form Image

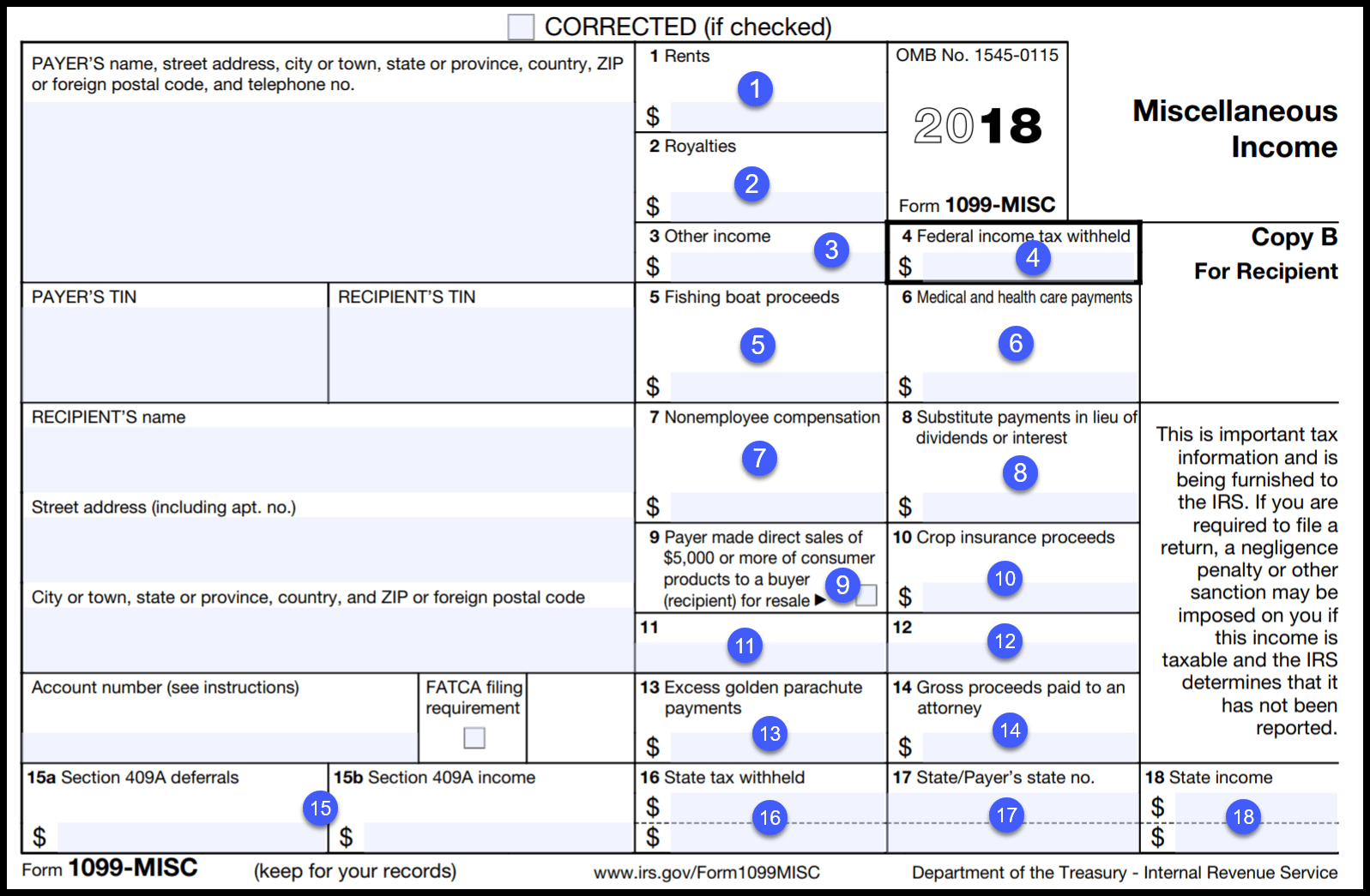

1099 Form Image - Copy a for internal revenue service center. Form 1099 nec nonemployee compensation Web a 1099 form is a tax record that an entity or person — not your employer — gave or paid you money. See how various types of irs form 1099 work. The payer fills out the form with the appropriate details and sends copies to you and the irs, reporting payments made during the tax year. Web income on the “other income” line of schedule 1 (form 1040). Photographed with the canon eos 5dsr at 50mp and the 100mm 2.8 l (is) lens. Both the forms and instructions will be updated as needed. Web the irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn’t your employer. Web instructions for recipient recipient’s taxpayer identification number (tin).

For privacy act and paperwork reduction act notice, see the. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Web instructions for recipient recipient’s taxpayer identification number (tin). The payer fills out the form with the appropriate details and sends copies to you and the irs, reporting payments made during the tax year. Form 1099g for unemployment benefits with w2, cash. For more information, see pub. There are more than a dozen different varieties of 1099 forms, and the reporting requirements for each is different. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Web a 1099 form is a tax record that an entity or person — not your employer — gave or paid you money. Medical and health care payments.

Form 1099 nec nonemployee compensation Web income on the “other income” line of schedule 1 (form 1040). For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). See how various types of irs form 1099 work. What is a 1099 form? For more information, see pub. Medical and health care payments. Closeup of a form 1099g certain government payments for unemployment benefits atop a w2 form and dollar bill, with stack of $5 bills. Both the forms and instructions will be updated as needed. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec.

Blank 1099 Form Blank 1099 Form 2021 eSign Genie

Web the irs 1099 form is a collection of tax forms documenting different types of payments made by an individual or a business that typically isn’t your employer. Copy a for internal revenue service center. What is a 1099 form? Web income on the “other income” line of schedule 1 (form 1040). Web a stock photograph of a 1099 misc.

What is a 1099 & 5498? uDirect IRA Services, LLC

Photographed with the canon eos 5dsr at 50mp and the 100mm 2.8 l (is) lens. Web a stock photograph of a 1099 misc tax form. Web march 29, 2023, at 9:49 a.m. What is a 1099 form? For privacy act and paperwork reduction act notice, see the.

IRS Form 1099 Reporting for Small Business Owners

Web income on the “other income” line of schedule 1 (form 1040). There are more than a dozen different varieties of 1099 forms, and the reporting requirements for each is different. Copy a for internal revenue service center. Web a stock photograph of a 1099 misc tax form. Form 1099 nec nonemployee compensation

What Is A 1099? Explaining All Form 1099 Types CPA Solutions

See how various types of irs form 1099 work. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Web instructions for recipient recipient’s taxpayer identification number (tin). Web a 1099 form is a tax record that an entity or person — not your employer — gave or paid you money. What is a 1099 form?

How to Calculate Taxable Amount on a 1099R for Life Insurance

The payer fills out the form with the appropriate details and sends copies to you and the irs, reporting payments made during the tax year. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). What is.

What is a 1099Misc Form? Financial Strategy Center

What is a 1099 form? Medical and health care payments. The payer fills out the form with the appropriate details and sends copies to you and the irs, reporting payments made during the tax year. Web march 29, 2023, at 9:49 a.m. Form 1099 nec nonemployee compensation

FileForm 1099R, 2015.jpg Wikipedia

Form 1099 nec nonemployee compensation Photographed with the canon eos 5dsr at 50mp and the 100mm 2.8 l (is) lens. Web a 1099 form is a tax record that an entity or person — not your employer — gave or paid you money. What is a 1099 form? For more information, see pub.

How to Interpret a 1099MISC

Medical and health care payments. For privacy act and paperwork reduction act notice, see the. Both the forms and instructions will be updated as needed. Copy a for internal revenue service center. The payer fills out the form with the appropriate details and sends copies to you and the irs, reporting payments made during the tax year.

Example Of Non Ssa 1099 Form / Publication 915 (2020), Social Security

Copy a for internal revenue service center. For more information, see pub. Form 1099 nec nonemployee compensation Web a stock photograph of a 1099 misc tax form. Photographed with the canon eos 5dsr at 50mp and the 100mm 2.8 l (is) lens.

Now is the Time to Start Preparing for Vendor 1099 Forms Innovative

Form 1099g for unemployment benefits with w2, cash. Photographed with the canon eos 5dsr at 50mp and the 100mm 2.8 l (is) lens. Web march 29, 2023, at 9:49 a.m. Both the forms and instructions will be updated as needed. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer.

For More Information, See Pub.

Web march 29, 2023, at 9:49 a.m. Closeup of a form 1099g certain government payments for unemployment benefits atop a w2 form and dollar bill, with stack of $5 bills. For the most recent version, go to irs.gov/form1099misc or irs.gov/form1099nec. Photographed with the canon eos 5dsr at 50mp and the 100mm 2.8 l (is) lens.

Web The Irs 1099 Form Is A Collection Of Tax Forms Documenting Different Types Of Payments Made By An Individual Or A Business That Typically Isn’t Your Employer.

Both the forms and instructions will be updated as needed. For privacy act and paperwork reduction act notice, see the. Web a stock photograph of a 1099 misc tax form. Web income on the “other income” line of schedule 1 (form 1040).

See How Various Types Of Irs Form 1099 Work.

What is a 1099 form? Copy a for internal revenue service center. There are more than a dozen different varieties of 1099 forms, and the reporting requirements for each is different. Form 1099 nec nonemployee compensation

Web Instructions For Recipient Recipient’s Taxpayer Identification Number (Tin).

Form 1099g for unemployment benefits with w2, cash. The payer fills out the form with the appropriate details and sends copies to you and the irs, reporting payments made during the tax year. Web a 1099 form is a tax record that an entity or person — not your employer — gave or paid you money. Medical and health care payments.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.31.57PM-22f2d44f32ac447aa561bd652c2c11e4.png)