1099 Form For Real Estate Sale

1099 Form For Real Estate Sale - If you must report it, complete form 8949 before schedule d. Jackson county may file a lawsuit seeking a judgment of foreclosure for unpaid delinquent taxes. Buyer shall pay for mortgagee’s title. If a real estate parcel has a delinquent tax that is 3 years old, that property faces a foreclosure sale to recover back taxes. Provide the note holder with copy of paid receipts for real estate taxes on an annual basis. Web 3.earnest monies and additional deposits: To determine if you have to report the sale or exchange of your main home on your tax return, see the instructions for schedule d (form 1040). Sale of your main home Where you report information on the form depends on how you use the property: Buyer and seller acknowledge and.

Buyer shall pay for mortgagee’s title. Web who is in the tax sale? Main home, timeshare/vacation home, investment property, business, or rental. Web how do i report my loss? Report the sale or exchange of your main home on form 8949 if: Uslegalforms allows users to edit, sign, fill & share all type of documents online. Where you report information on the form depends on how you use the property: Jackson county may file a lawsuit seeking a judgment of foreclosure for unpaid delinquent taxes. Web for sales or exchanges of certain real estate, the person responsible for closing a real estate transaction must report the real estate proceeds to the irs and must furnish this statement to you. Why do i have to report capital gains from my mutual funds if i never sold any shares of that mutual fund?

Uslegalforms allows users to edit, sign, fill & share all type of documents online. Web how do i report my loss? Web for sales or exchanges of certain real estate, the person responsible for closing a real estate transaction must report the real estate proceeds to the irs and must furnish this statement to you. Main home, timeshare/vacation home, investment property, business, or rental. You will report the information on a specific part of the form, depending on how you use the property: Edit, sign and save real estate proceeds form. Web who is in the tax sale? Jackson county may file a lawsuit seeking a judgment of foreclosure for unpaid delinquent taxes. If a real estate parcel has a delinquent tax that is 3 years old, that property faces a foreclosure sale to recover back taxes. Ap leaders rely on iofm’s expertise to keep them up to date on irs regulations.

1099 Contract Template HQ Printable Documents

Ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Web 3.earnest monies and additional deposits: Edit, sign and save real estate proceeds form. How do i report this? Buyer and seller acknowledge and.

What is a 1099 & 5498? uDirect IRA Services, LLC

Sale of your main home To determine if you have to report the sale or exchange of your main home on your tax return, see the instructions for schedule d (form 1040). Web said note, in the event of the sale, transfer or other conveyance of the properly described herein,. If a real estate parcel has a delinquent tax that.

Everything You Need To Know About Form 1099S Blog TaxBandits

Main home, timeshare/vacation home, investment property, business, or rental. Why do i have to report capital gains from my mutual funds if i never sold any shares of that mutual fund? Web for sales or exchanges of certain real estate, the person responsible for closing a real estate transaction must report the real estate proceeds to the irs and must.

Product Reviews

If a real estate parcel has a delinquent tax that is 3 years old, that property faces a foreclosure sale to recover back taxes. Sale of business property is reported on form 4797, otherwise the transaction is reported on form 8949. Nonresident alien with income from missouri Edit, sign and save real estate proceeds form. Why do i have to.

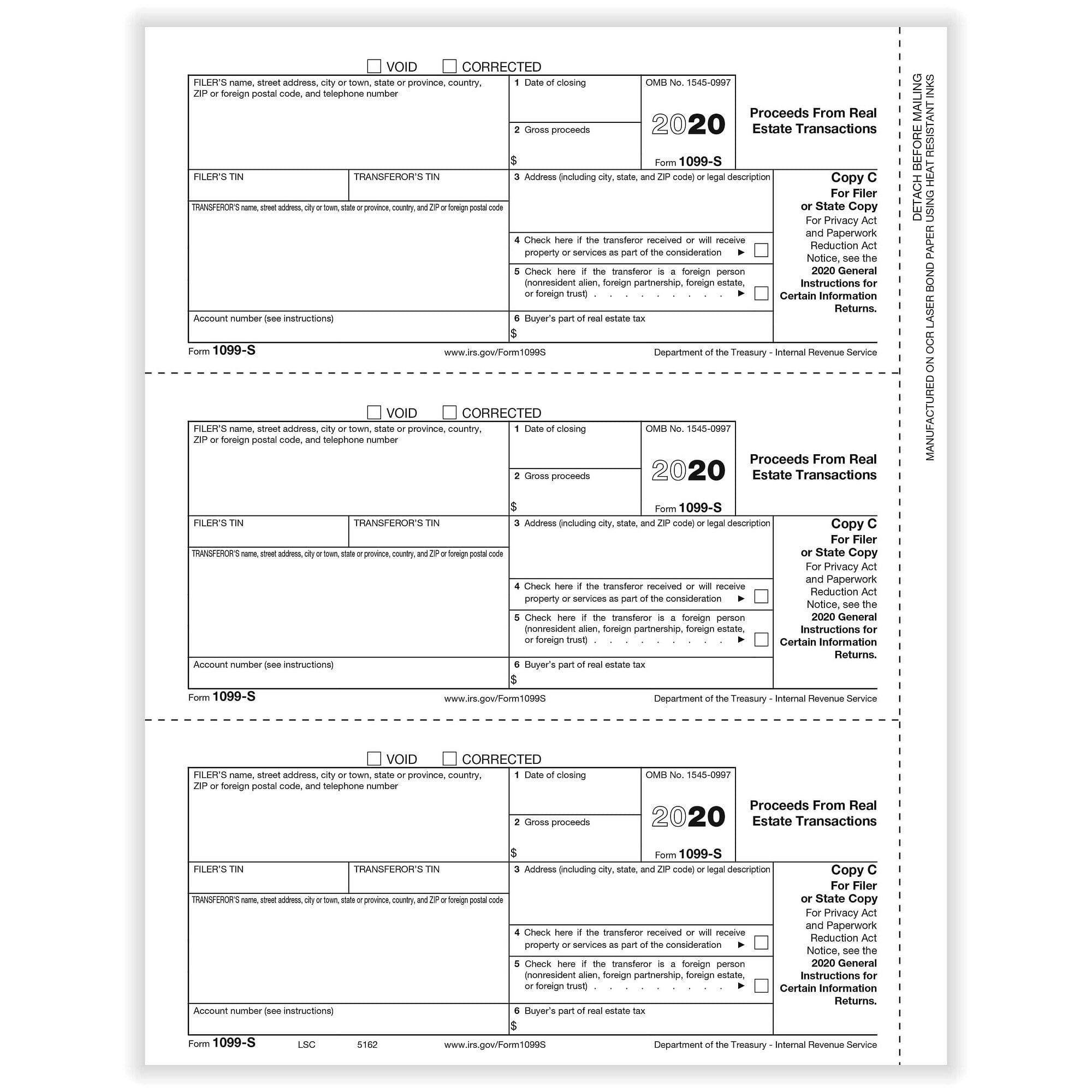

1099S IRS Real Estate Proceeds Form The Supplies Shops

Web 3.earnest monies and additional deposits: Ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Uslegalforms allows users to edit, sign, fill & share all type of documents online. How do i report this? Title insurance and other loan costs:

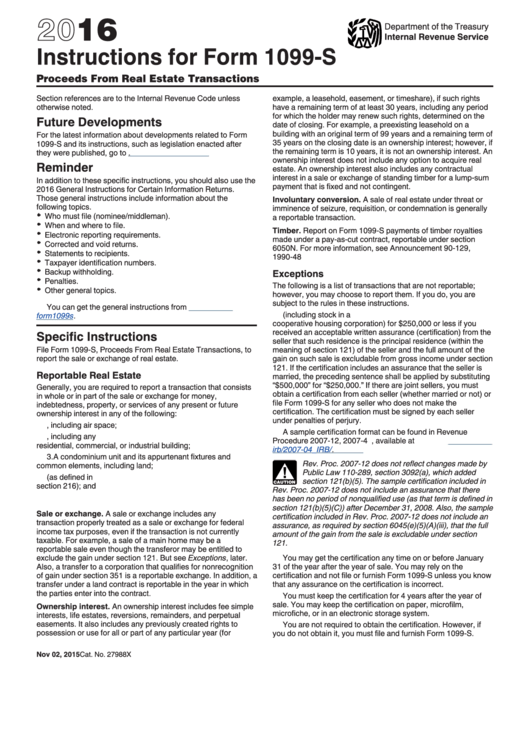

Instructions For Form 1099S Proceeds From Real Estate Transactions

Web for sales or exchanges of certain real estate, the person responsible for closing a real estate transaction must report the real estate proceeds to the irs and must furnish this statement to you. Web said note, in the event of the sale, transfer or other conveyance of the properly described herein,. Provide the note holder with copy of paid.

Form 1099S Proceeds from Real Estate Transactions (2014) Free Download

Provide the note holder with copy of paid receipts for real estate taxes on an annual basis. Why do i have to report capital gains from my mutual funds if i never sold any shares of that mutual fund? Where you report information on the form depends on how you use the property: Title insurance and other loan costs: Buyer.

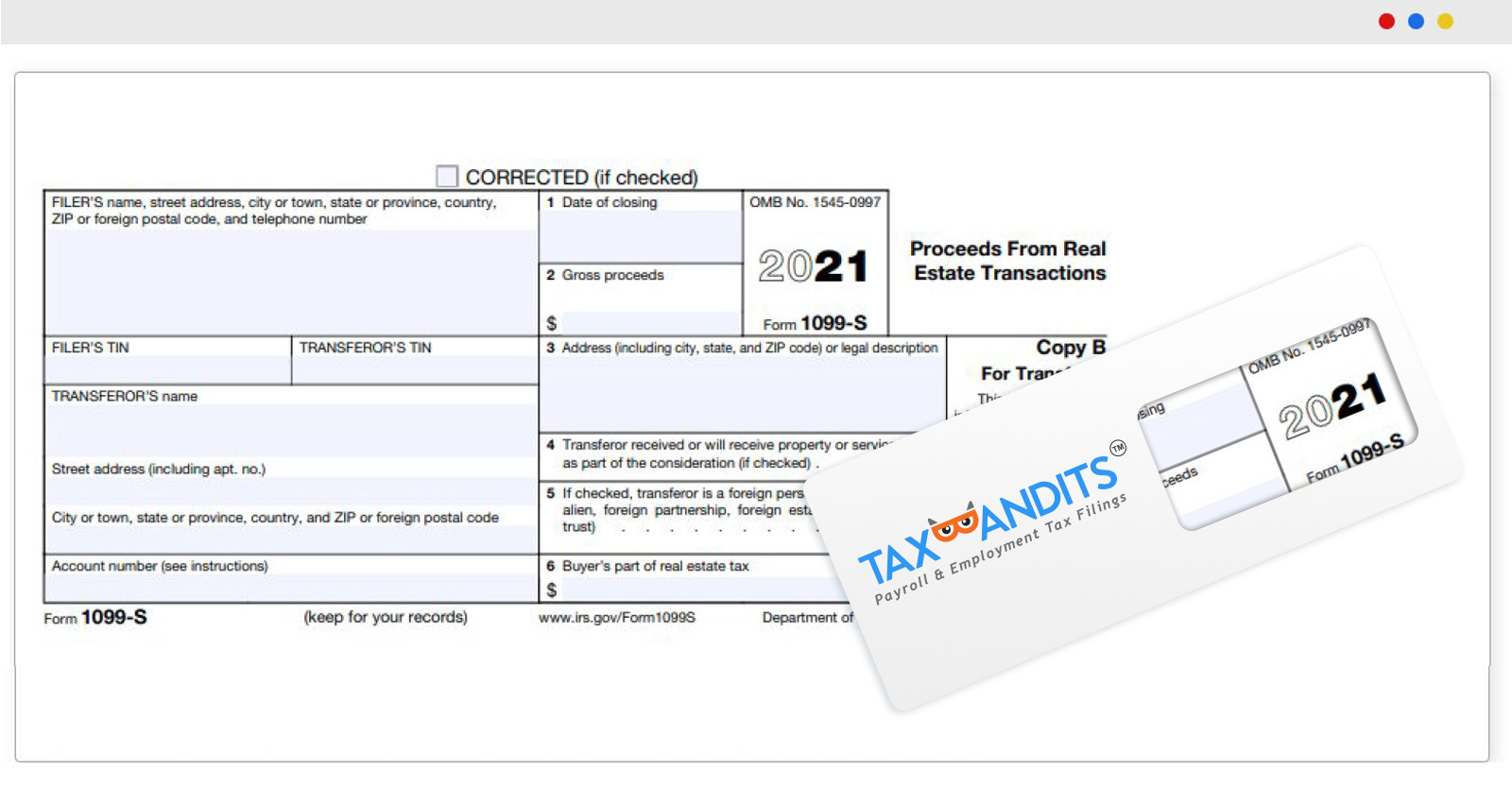

EFile 1099S 2021 Form 1099S Online How to File 1099S

To determine if you have to report the sale or exchange of your main home on your tax return, see the instructions for schedule d (form 1040). Edit, sign and save real estate proceeds form. Sale of your home you may not need to report the sale or exchange of your main home. Jackson county may file a lawsuit seeking.

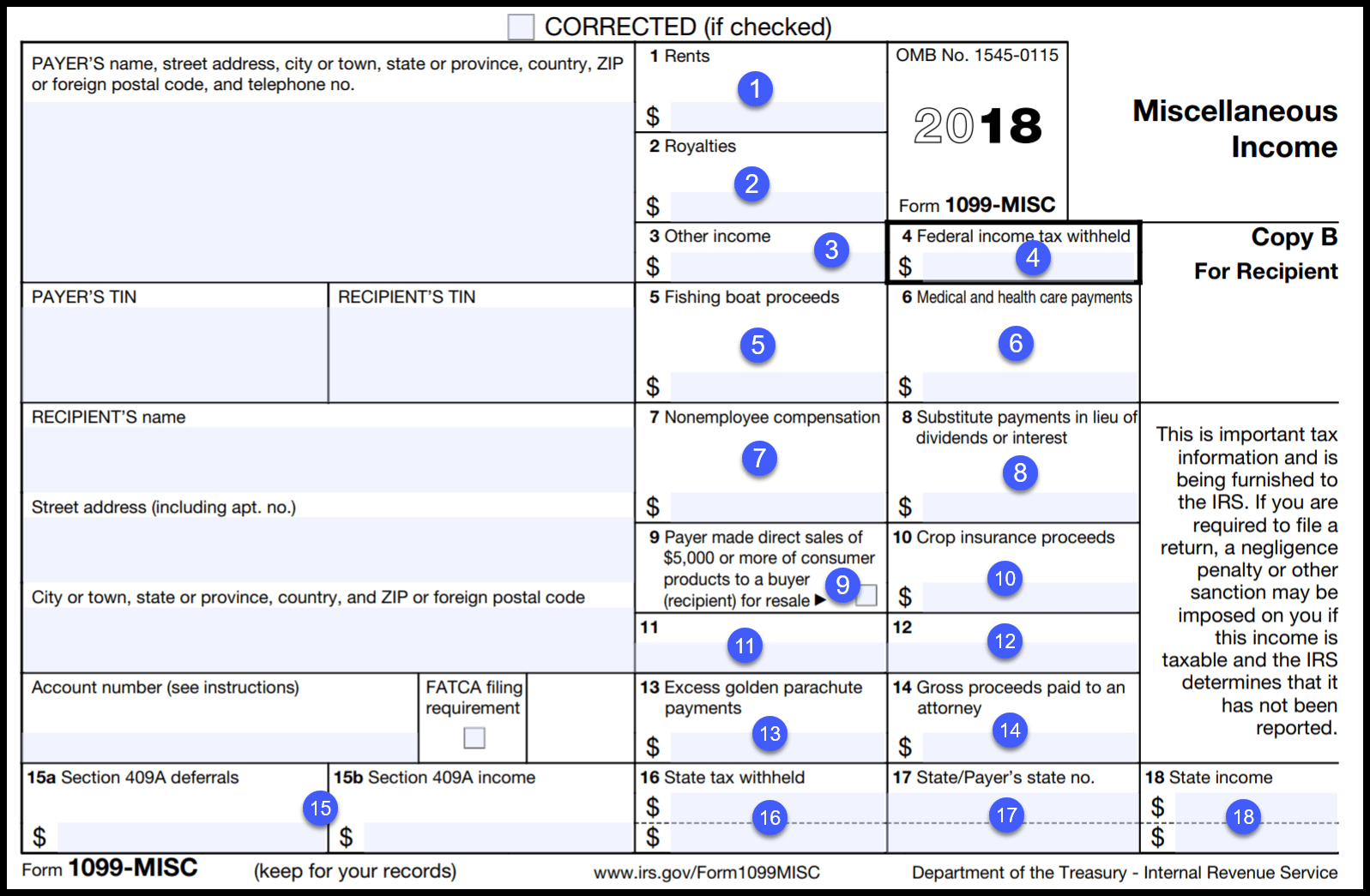

IRS Form 1099 Reporting for Small Business Owners

Buyer and seller acknowledge and. Buyer shall pay for mortgagee’s title. Provide the note holder with copy of paid receipts for real estate taxes on an annual basis. Ap leaders rely on iofm’s expertise to keep them up to date on irs regulations. Sale of your home you may not need to report the sale or exchange of your main.

Form 1099S Proceeds from Real Estate Transactions (2014) Free Download

Title insurance and other loan costs: Upon acceptance of this contract, unless agreed, any earnest money referenced in paragraph 2 (a) shall be deposited within 5 business days of the effective date, in an Uslegalforms allows users to edit, sign, fill & share all type of documents online. Where you report information on the form depends on how you use.

Nonresident Alien With Income From Missouri

Why do i have to report capital gains from my mutual funds if i never sold any shares of that mutual fund? You will report the information on a specific part of the form, depending on how you use the property: If a real estate parcel has a delinquent tax that is 3 years old, that property faces a foreclosure sale to recover back taxes. Web 3.earnest monies and additional deposits:

Provide The Note Holder With Copy Of Paid Receipts For Real Estate Taxes On An Annual Basis.

Report the sale or exchange of your main home on form 8949 if: Main home, timeshare/vacation home, investment property, business, or rental. How do i report this? Main home, timeshare/vacation home, investment property, business, or rental.

Ad Ap Leaders Rely On Iofm’s Expertise To Keep Them Up To Date On Changing Irs Regulations.

Web who is in the tax sale? Title insurance and other loan costs: Web how do i report my loss? Where you report information on the form depends on how you use the property:

If You Must Report It, Complete Form 8949 Before Schedule D.

Edit, sign and save real estate proceeds form. Sale of your home you may not need to report the sale or exchange of your main home. Buyer and seller acknowledge and. Jackson county may file a lawsuit seeking a judgment of foreclosure for unpaid delinquent taxes.