1097 Tax Form

1097 Tax Form - Web if the loss on line 11 includes a loss from form 4684, line 35, column (b)(ii), enter that part of the loss here. Easily fill out pdf blank, edit, and sign them. Issuers of certain tax credit bonds (or their agents) and recipients of. Save or instantly send your ready documents. Web if the loss on line 11 includes a loss from form 4684, line 35, column (b)(ii), enter that part of the loss here. Web this page provides the addresses for taxpayers and tax professionals to mail paper forms 1096 to the irs. Web if using a private delivery service, send your returns to the street address above for the submission processing center (austin, kansas city, or ogden) designated. Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and. Web uncollected social security and medicare or rrta tax (box 12 code a, b, m or n) form 8919: Order information returns and employer returns online, and we’ll mail you the scannable forms and other.

Reportable gambling winnings (box 1) schedule 1, line 8b. Internal revenue service center attn: Web each person who is allowed a tax credit as a holder, directly or indirectly, of a tax credit bond or a stripped credit coupon on one or more credit allowance dates during the. Easily fill out pdf blank, edit, and sign them. Order information returns and employer returns online, and we’ll mail you the scannable forms and other. Save or instantly send your ready documents. Web complete form 1097 online with us legal forms. Web if the loss on line 11 includes a loss from form 4684, line 35, column (b)(ii), enter that part of the loss here. Issuers of certain tax credit bonds (or their agents) and recipients of. Web uncollected social security and medicare or rrta tax (box 12 code a, b, m or n) form 8919:

Web complete form 1097 online with us legal forms. Issuers of certain tax credit bonds (or their agents) and recipients of. Web if using a private delivery service, send your returns to the street address above for the submission processing center (austin, kansas city, or ogden) designated. Internal revenue service center attn: Easily fill out pdf blank, edit, and sign them. Order information returns and employer returns online, and we’ll mail you the scannable forms and other. See form 8912 and its instructions: Web this page provides the addresses for taxpayers and tax professionals to mail paper forms 1096 to the irs. Web if the loss on line 11 includes a loss from form 4684, line 35, column (b)(ii), enter that part of the loss here. Web instructions for completing the inspection and supervision fee return.

EFile 1099 File Form 1099 Online Form 1099 for 2022

Web advance payment of premium tax credit (line 33, column c) see form 8962 and its instructions: Web if using a private delivery service, send your returns to the street address above for the submission processing center (austin, kansas city, or ogden) designated. Order information returns and employer returns online, and we’ll mail you the scannable forms and other. Reportable.

1096 Form 2021 1099 Forms

Save or instantly send your ready documents. Web uncollected social security and medicare or rrta tax (box 12 code a, b, m or n) form 8919: Web complete form 1097 online with us legal forms. Easily fill out pdf blank, edit, and sign them. Web each person who is allowed a tax credit as a holder, directly or indirectly, of.

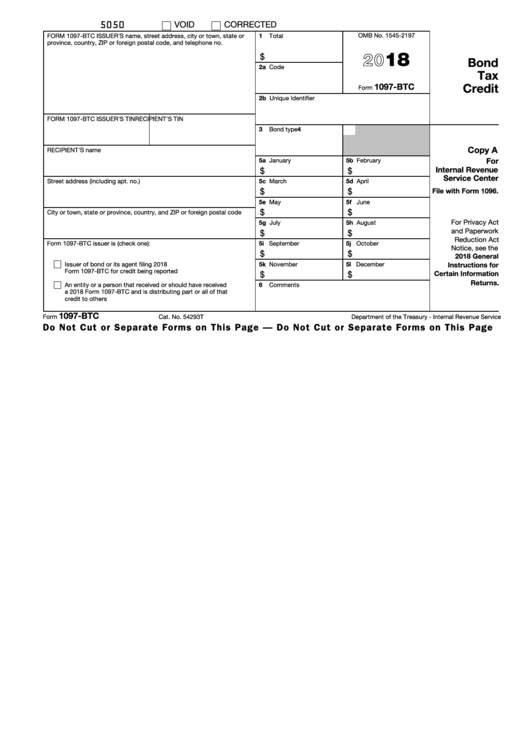

Bond Tax Credit Free Download

Web complete form 1097 online with us legal forms. Easily fill out pdf blank, edit, and sign them. Web if the loss on line 11 includes a loss from form 4684, line 35, column (b)(ii), enter that part of the loss here. See form 8912 and its instructions: Send all information returns filed on paper to the following.

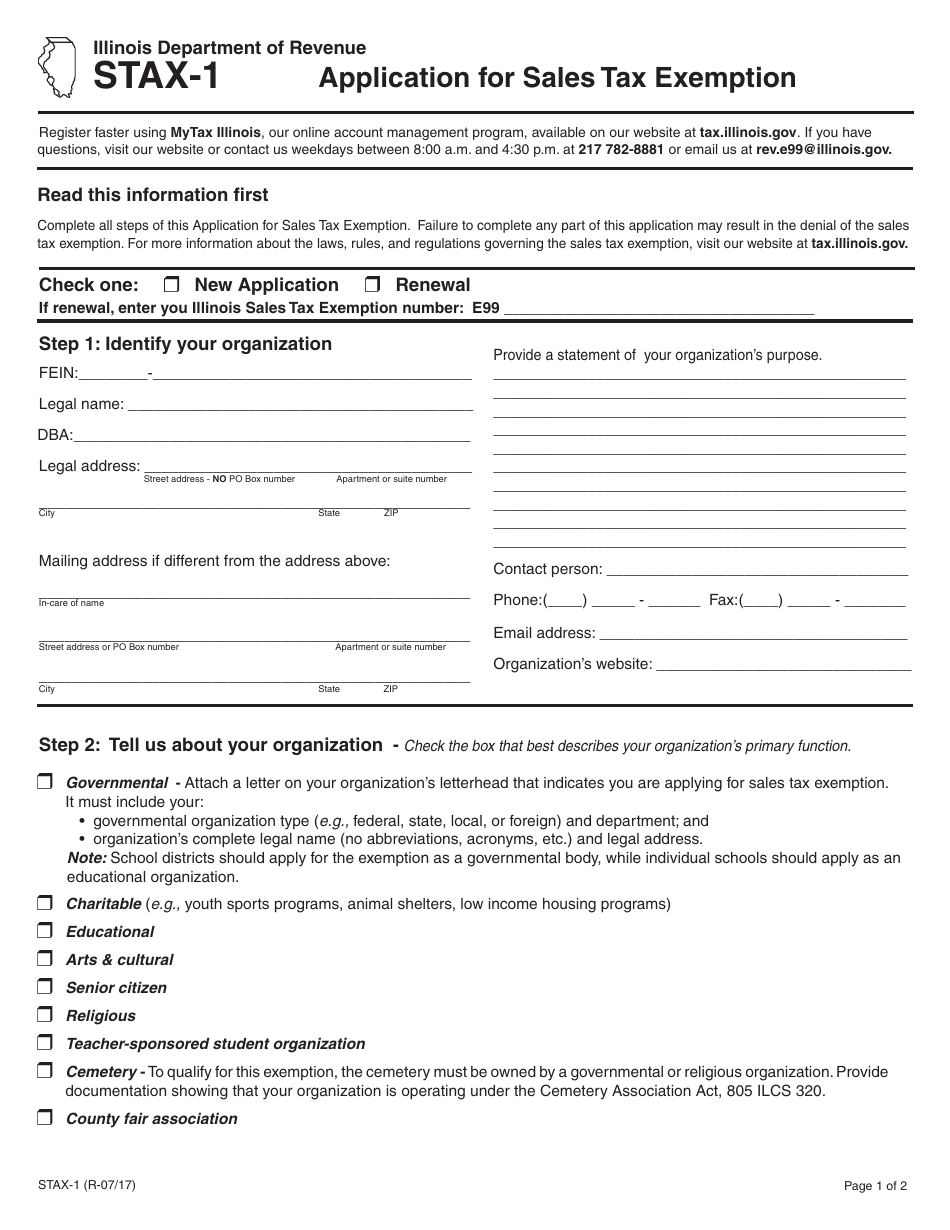

Form STAX1 Download Printable PDF or Fill Online Application for Sales

Web complete form 1097 online with us legal forms. See form 8912 and its instructions: Web if using a private delivery service, send your returns to the street address above for the submission processing center (austin, kansas city, or ogden) designated. Issuers of certain tax credit bonds (or their agents) and recipients of. Web if the loss on line 11.

Fillable Form 1097Btc Bond Tax Credit 2018 printable pdf download

Save or instantly send your ready documents. Web form 4797 department of the treasury internal revenue service sales of business property (also involuntary conversions and recapture amounts under sections 179 and. Web this page provides the addresses for taxpayers and tax professionals to mail paper forms 1096 to the irs. Internal revenue service center attn: Web advance payment of premium.

Coinbase Sends American Clients IRS Tax Form 1099K Bitcoin News http

Web if the loss on line 11 includes a loss from form 4684, line 35, column (b)(ii), enter that part of the loss here. Web uncollected social security and medicare or rrta tax (box 12 code a, b, m or n) form 8919: Issuers of certain tax credit bonds (or their agents) and recipients of. Web if using a private.

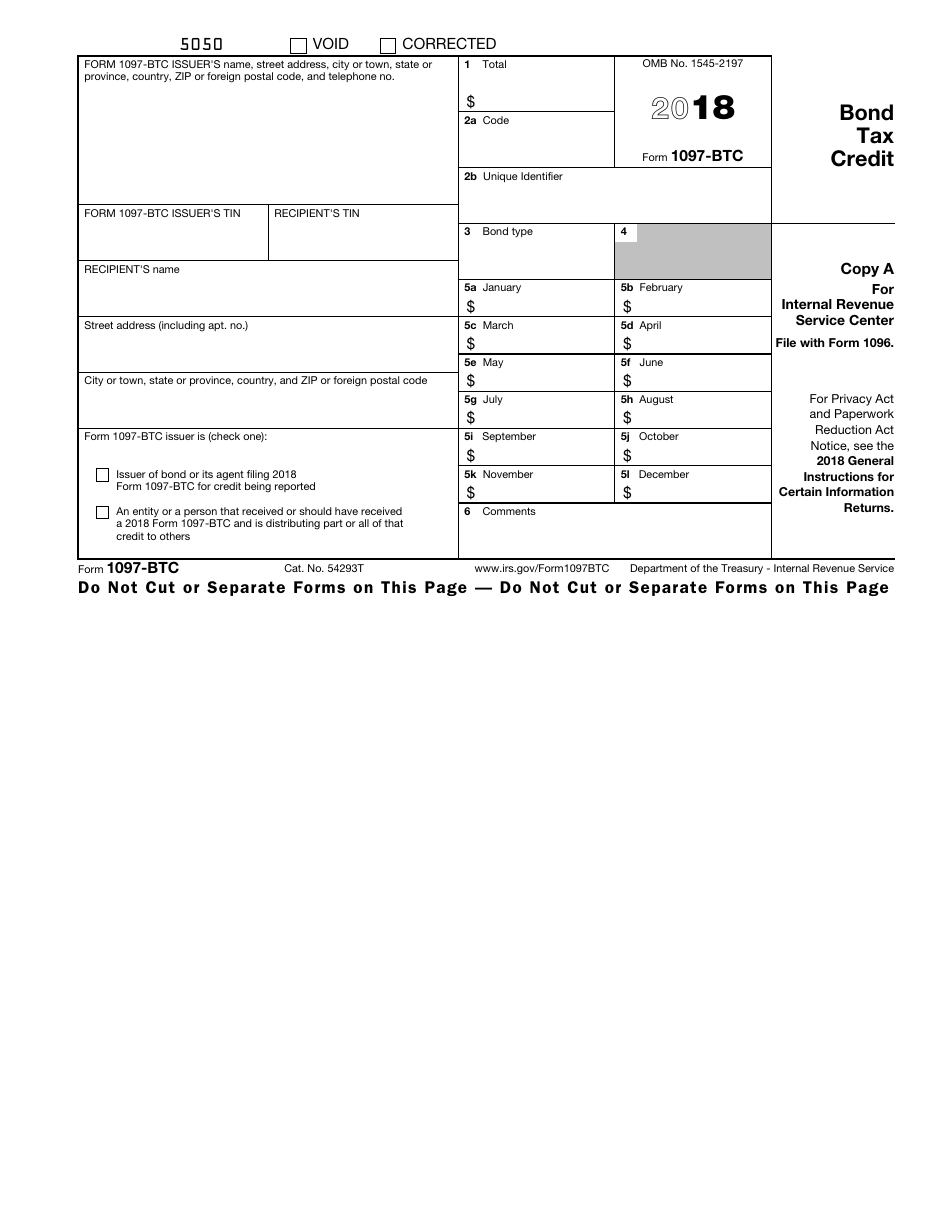

IRS Form 1097BTC Download Fillable PDF or Fill Online Bond Tax Credit

Web if the loss on line 11 includes a loss from form 4684, line 35, column (b)(ii), enter that part of the loss here. Internal revenue service center attn: Order information returns and employer returns online, and we’ll mail you the scannable forms and other. Instructions for the transportation and. Easily fill out pdf blank, edit, and sign them.

IRS 1096 2018 Fill out Tax Template Online US Legal Forms

Web instructions for completing the inspection and supervision fee return. Reportable gambling winnings (box 1) schedule 1, line 8b. Instructions for the transportation and. Web complete form 1097 online with us legal forms. Issuers of certain tax credit bonds (or their agents) and recipients of.

IRS Form 1098 T University of Dayton, Ohio

Internal revenue service center attn: Instructions for the transportation and. Send all information returns filed on paper to the following. Easily fill out pdf blank, edit, and sign them. Web complete form 1097 online with us legal forms.

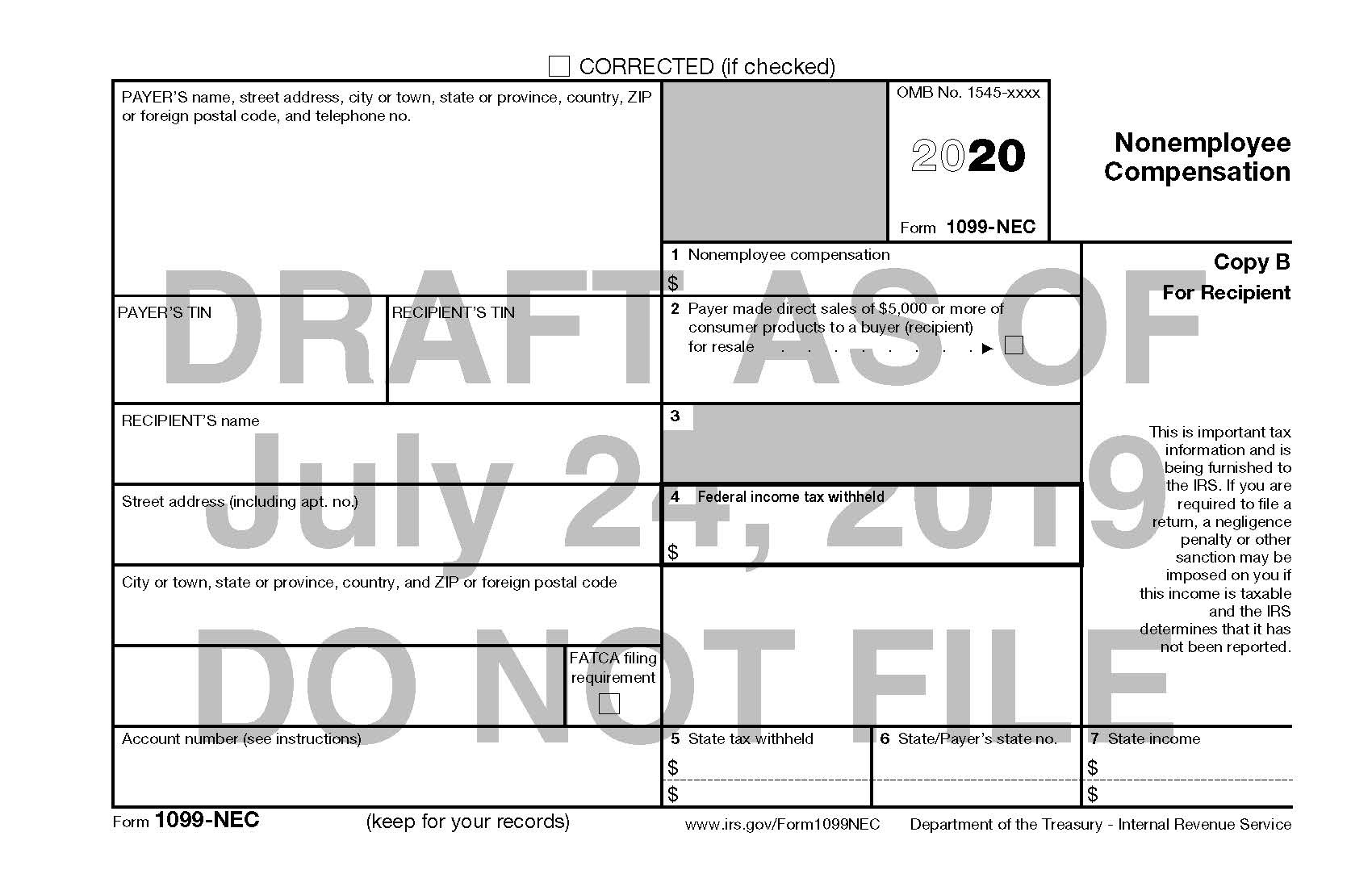

IRS to Bring Back Form 1099NEC, Last Used in 1982 — Current Federal

Order information returns and employer returns online, and we’ll mail you the scannable forms and other. Web instructions for completing the inspection and supervision fee return. Issuers of certain tax credit bonds (or their agents) and recipients of. Web uncollected social security and medicare or rrta tax (box 12 code a, b, m or n) form 8919: Instructions for the.

Web Form 4797 Department Of The Treasury Internal Revenue Service Sales Of Business Property (Also Involuntary Conversions And Recapture Amounts Under Sections 179 And.

Order information returns and employer returns online, and we’ll mail you the scannable forms and other. Web instructions for completing the inspection and supervision fee return. Send all information returns filed on paper to the following. Instructions for the transportation and.

Web If Using A Private Delivery Service, Send Your Returns To The Street Address Above For The Submission Processing Center (Austin, Kansas City, Or Ogden) Designated.

Web uncollected social security and medicare or rrta tax (box 12 code a, b, m or n) form 8919: Web this page provides the addresses for taxpayers and tax professionals to mail paper forms 1096 to the irs. Web advance payment of premium tax credit (line 33, column c) see form 8962 and its instructions: Issuers of certain tax credit bonds (or their agents) and recipients of.

See Form 8912 And Its Instructions:

Web each person who is allowed a tax credit as a holder, directly or indirectly, of a tax credit bond or a stripped credit coupon on one or more credit allowance dates during the. Web if the loss on line 11 includes a loss from form 4684, line 35, column (b)(ii), enter that part of the loss here. Save or instantly send your ready documents. Web complete form 1097 online with us legal forms.

Reportable Gambling Winnings (Box 1) Schedule 1, Line 8B.

Easily fill out pdf blank, edit, and sign them. Web if the loss on line 11 includes a loss from form 4684, line 35, column (b)(ii), enter that part of the loss here. Internal revenue service center attn: