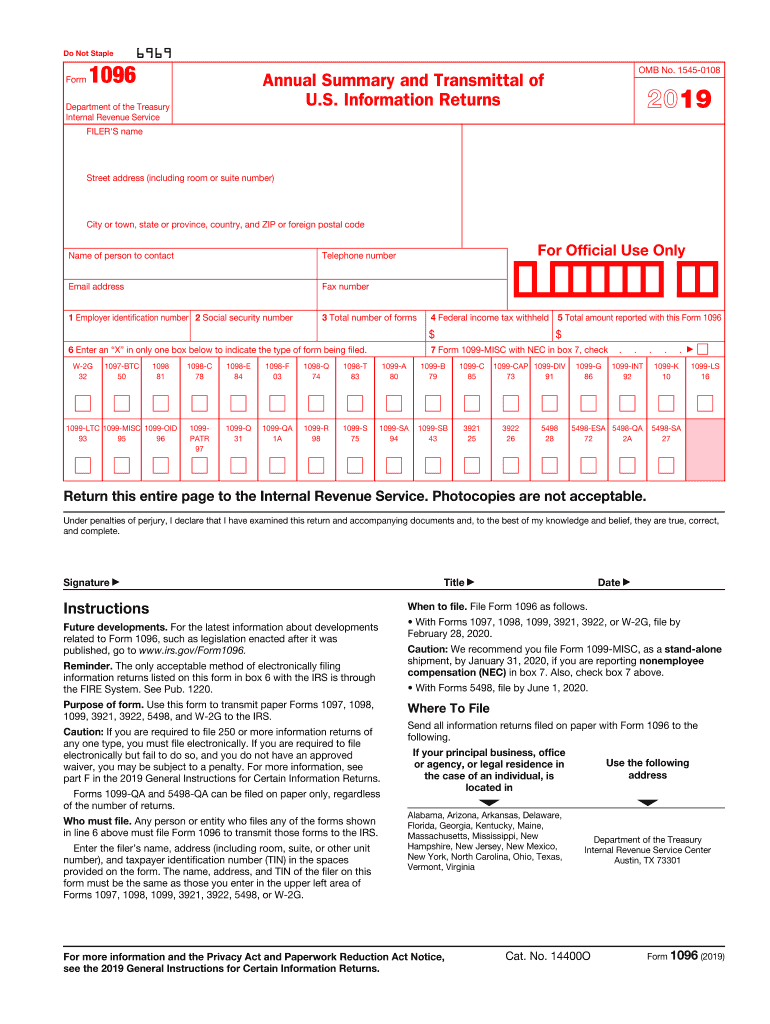

1096 Form 2019

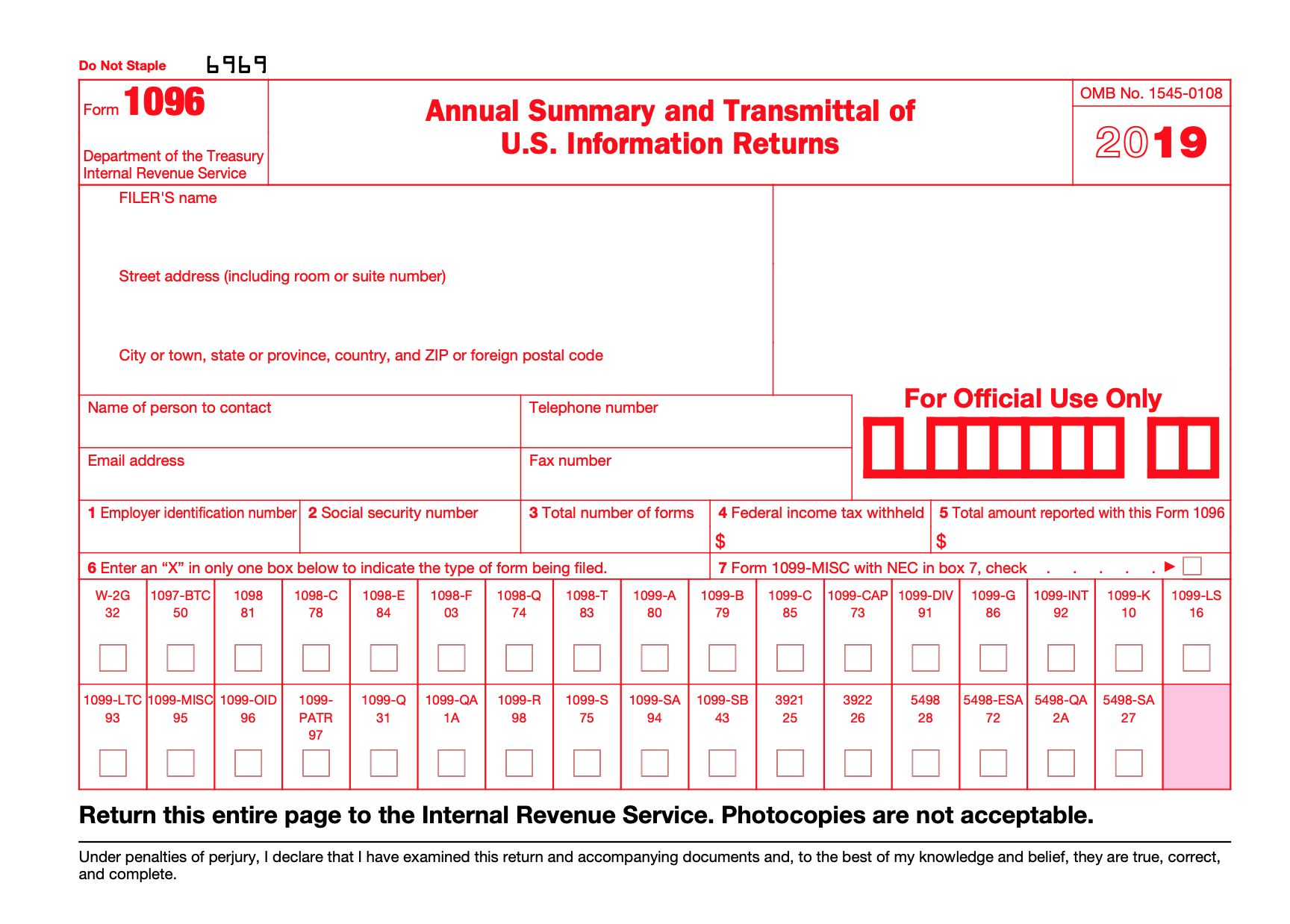

1096 Form 2019 - Information returns) is an internal revenue service(irs)tax form used in the united states used to summarize information returns being sent to the irs. Information returns, is — as its official name implies — a summary document. It is submitted as an accompanying. Web get a 1096 (2019) here. Enter all information correctly for the tax year; Web fill online, printable, fillable, blank f1096 2019 2019 form 1096 (irs) form. Let me show you how to prepare and print it. Your business needs to use it only when you submit those forms to the irs in a paper format. Print your 1099s or 1096 Web information about form 1096, annual summary and transmittal of u.s.

It is submitted as an accompanying. File your state 1099 forms; All forms are printable and downloadable. Web get a 1096 (2019) here. Web you can print your form 1096 after going through the manual process of printing and filing of 1099. If everything looks good, select yes, looks good! Web form 1096 and about form 1096, annual summary and transmittal of u.s. Let me show you how to prepare and print it. Use fill to complete blank online irs pdf forms for free. Enter all information correctly for the tax year;

It's basically an index or a list of the 1099s that are included in the filing. Let me show you how to prepare and print it. This article gives information about the form, how to. Web form 1096 and about form 1096, annual summary and transmittal of u.s. Any person or entity who files any of the forms shown in line 6 above must file form 1096 to transmit those forms to the irs. Enter all information correctly for the tax year; Web fill online, printable, fillable, blank f1096 2019 2019 form 1096 (irs) form. Once completed you can sign your fillable form or send for signing. Web get a 1096 (2019) here. Enter the filer’s name, address (including room, suite, or other unit number), and taxpayer identification number (tin) in the spaces provided on the form.

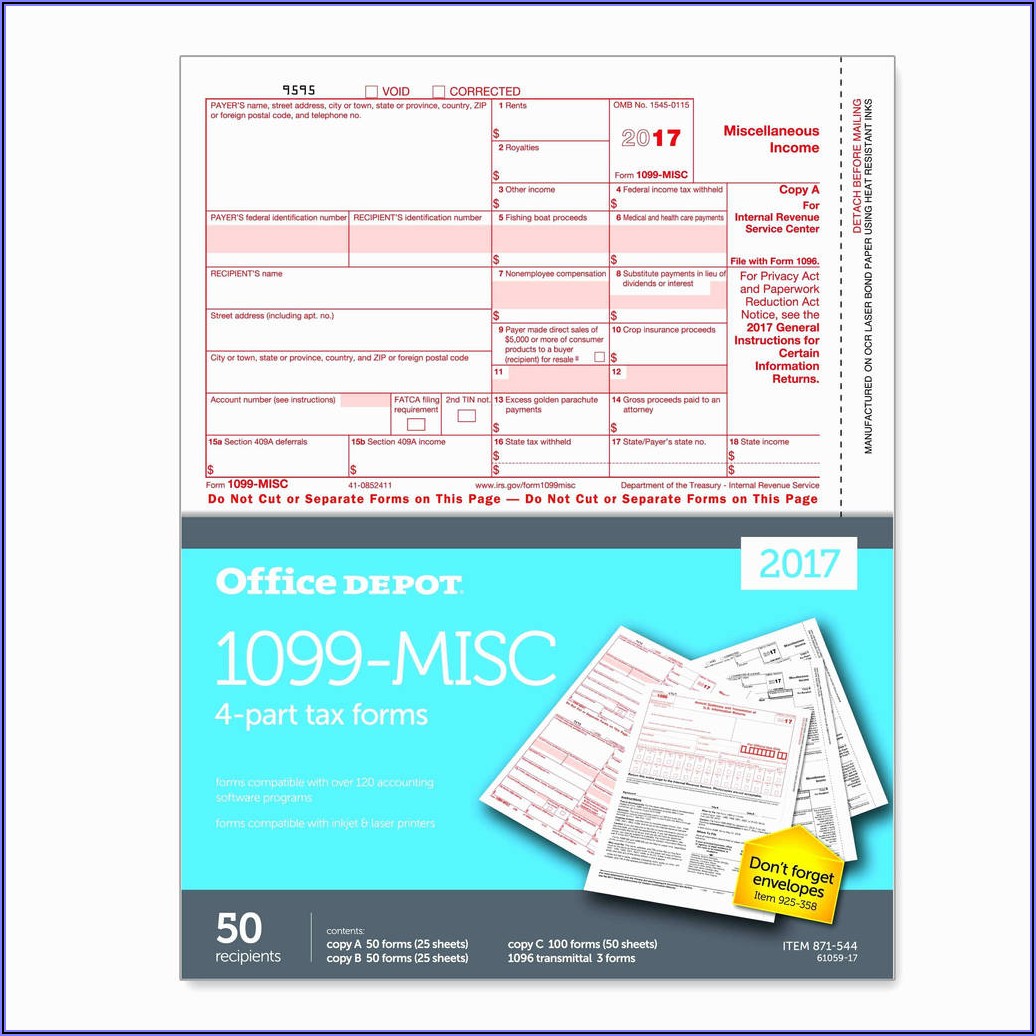

1096 Tax Forms 2019 Form Resume Examples WjYD1nZkVK

Your business needs to use it only when you submit those forms to the irs in a paper format. Go to expenses, then vendors. For the latest information about developments related to form 1096, such as legislation enacted after it was published, go to www.irs.gov/form1096. This article gives information about the form, how to. Print your 1099s or 1096

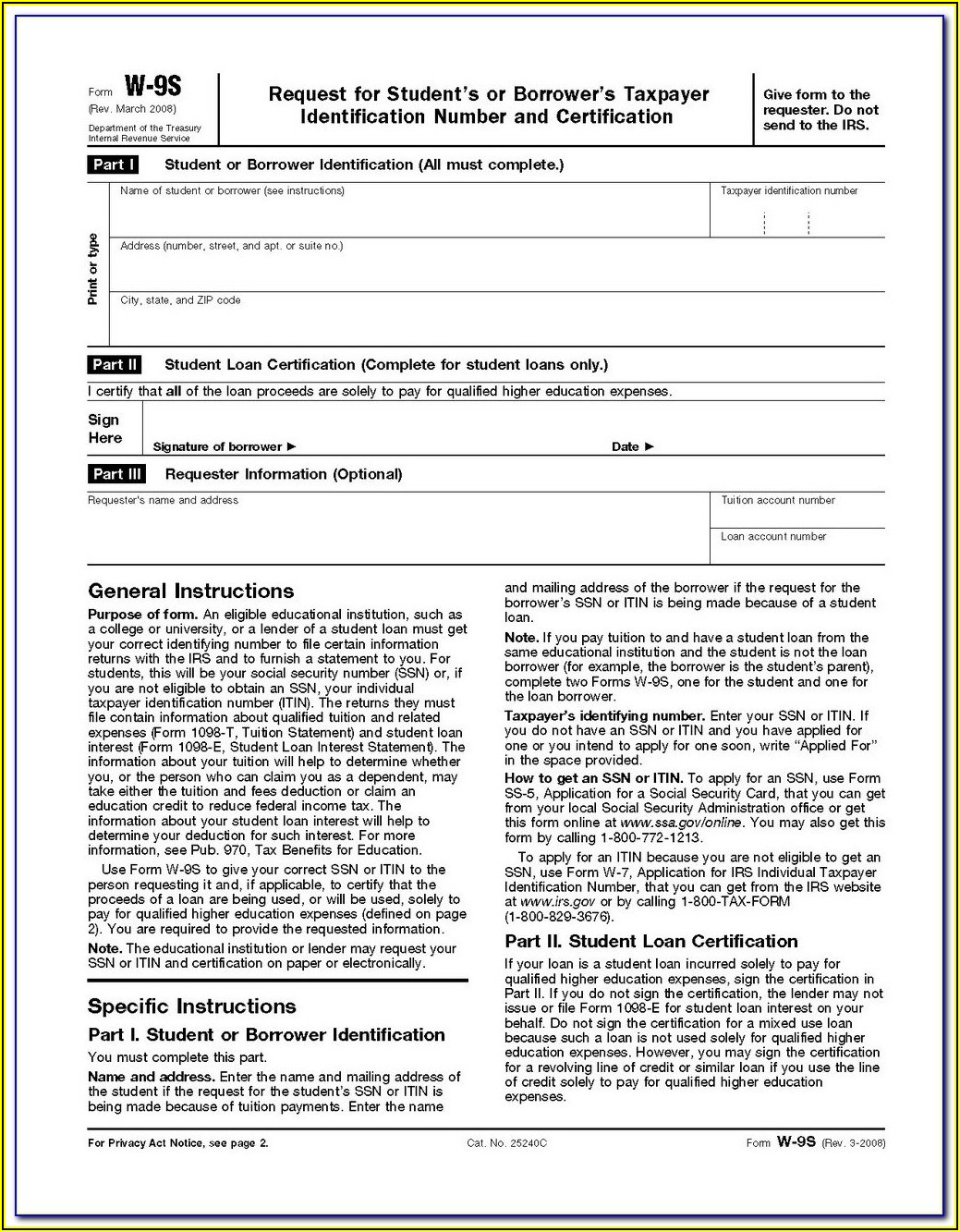

Printable Form 1096 2019 Laser 1096 Transmittal Form Grant Shomire

Information returns, is — as its official name implies — a summary document. Enter the filer’s name, address (including room, suite, or other unit number), and taxpayer identification number (tin) in the spaces provided on the form. Web information about form 1096, annual summary and transmittal of u.s. Information returns) is an internal revenue service(irs)tax form used in the united.

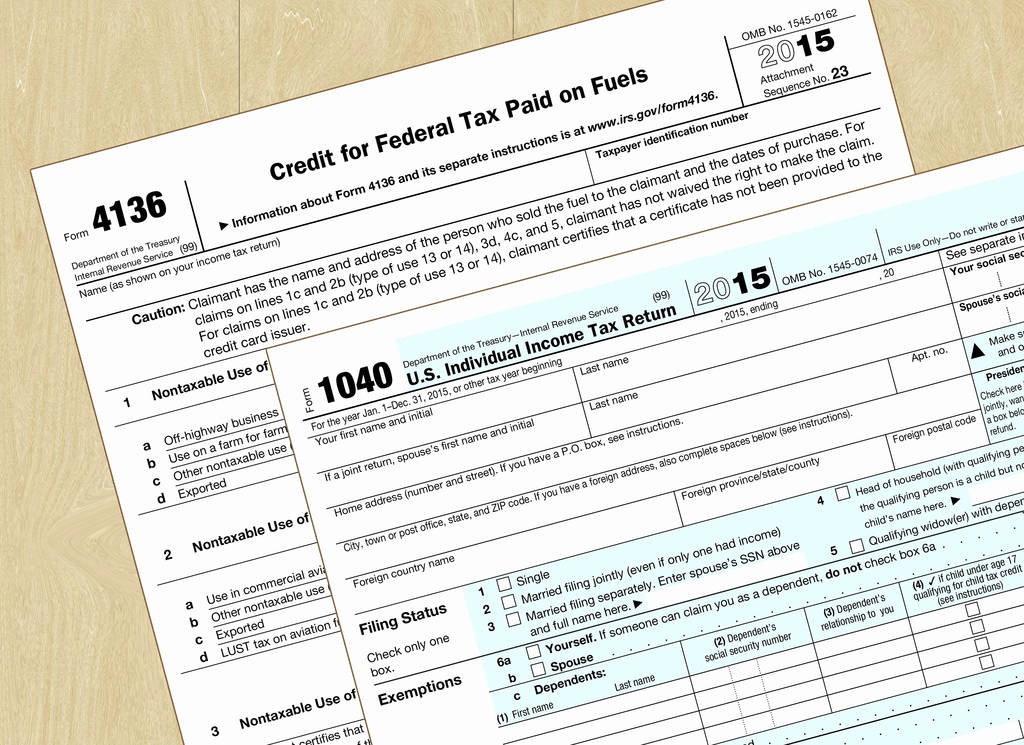

Free Printable 1096 Form 2015 Free Printable

Web fill online, printable, fillable, blank f1096 2019 2019 form 1096 (irs) form. Web form 1096 and about form 1096, annual summary and transmittal of u.s. It's basically an index or a list of the 1099s that are included in the filing. Go to expenses, then vendors. Any person or entity who files any of the forms shown in line.

Irs Form 1096 Year 2016 Universal Network

Web form 1096 is a single transmittal form that reports all payments made to all your contractors. File your state 1099 forms; Information returns) is an internal revenue service(irs)tax form used in the united states used to summarize information returns being sent to the irs. Web fill online, printable, fillable, blank f1096 2019 2019 form 1096 (irs) form. Information returns,.

2019 Form 1096 Fill Out and Sign Printable PDF Template signNow

It's basically an index or a list of the 1099s that are included in the filing. Web information about form 1096, annual summary and transmittal of u.s. Web form 1096 and about form 1096, annual summary and transmittal of u.s. Information returns, including recent updates, related forms and instructions on how to file. Let me show you how to prepare.

1096 Transmittal Form 2015 Universal Network

Web information about form 1096, annual summary and transmittal of u.s. Once completed you can sign your fillable form or send for signing. Enter the filer’s name, address (including room, suite, or other unit number), and taxpayer identification number (tin) in the spaces provided on the form. Web form 1096 is a single transmittal form that reports all payments made.

5100 L1096 1096 2018 Universal Network

Information returns, is — as its official name implies — a summary document. Go to expenses, then vendors. Web get a 1096 (2019) here. It's basically an index or a list of the 1099s that are included in the filing. Web you can print your form 1096 after going through the manual process of printing and filing of 1099.

Form 1096 A Simple Guide Bench Accounting

Web information about form 1096, annual summary and transmittal of u.s. Enter all information correctly for the tax year; It is submitted as an accompanying. File your state 1099 forms; It's basically an index or a list of the 1099s that are included in the filing.

Printable Form 1096 Form 1096 (officially the annual summary and

Any person or entity who files any of the forms shown in line 6 above must file form 1096 to transmit those forms to the irs. Enter the filer’s name, address (including room, suite, or other unit number), and taxpayer identification number (tin) in the spaces provided on the form. Web you can print your form 1096 after going through.

Fill Free fillable Form 1096 2019 Annual Summary and Transmittal U.S

Information returns, is — as its official name implies — a summary document. Web fill online, printable, fillable, blank f1096 2019 2019 form 1096 (irs) form. Use fill to complete blank online irs pdf forms for free. If everything looks good, select yes, looks good! Web get a 1096 (2019) here.

Let Me Show You How To Prepare And Print It.

Any person or entity who files any of the forms shown in line 6 above must file form 1096 to transmit those forms to the irs. Enter the filer’s name, address (including room, suite, or other unit number), and taxpayer identification number (tin) in the spaces provided on the form. Web form 1096 and about form 1096, annual summary and transmittal of u.s. Enter all information correctly for the tax year;

This Article Gives Information About The Form, How To.

Web you can print your form 1096 after going through the manual process of printing and filing of 1099. Information returns, including recent updates, related forms and instructions on how to file. Web information about form 1096, annual summary and transmittal of u.s. Print your 1099s or 1096

File Your State 1099 Forms;

Once completed you can sign your fillable form or send for signing. Go to expenses, then vendors. For the latest information about developments related to form 1096, such as legislation enacted after it was published, go to www.irs.gov/form1096. You'll want to print and mail in time for irs filing and contractor delivery deadlines.

It's Basically An Index Or A List Of The 1099S That Are Included In The Filing.

Web get a 1096 (2019) here. Web irs form 1096, officially known as the annual summary and transmittal of u.s. Information returns) is an internal revenue service(irs)tax form used in the united states used to summarize information returns being sent to the irs. Web fill online, printable, fillable, blank f1096 2019 2019 form 1096 (irs) form.