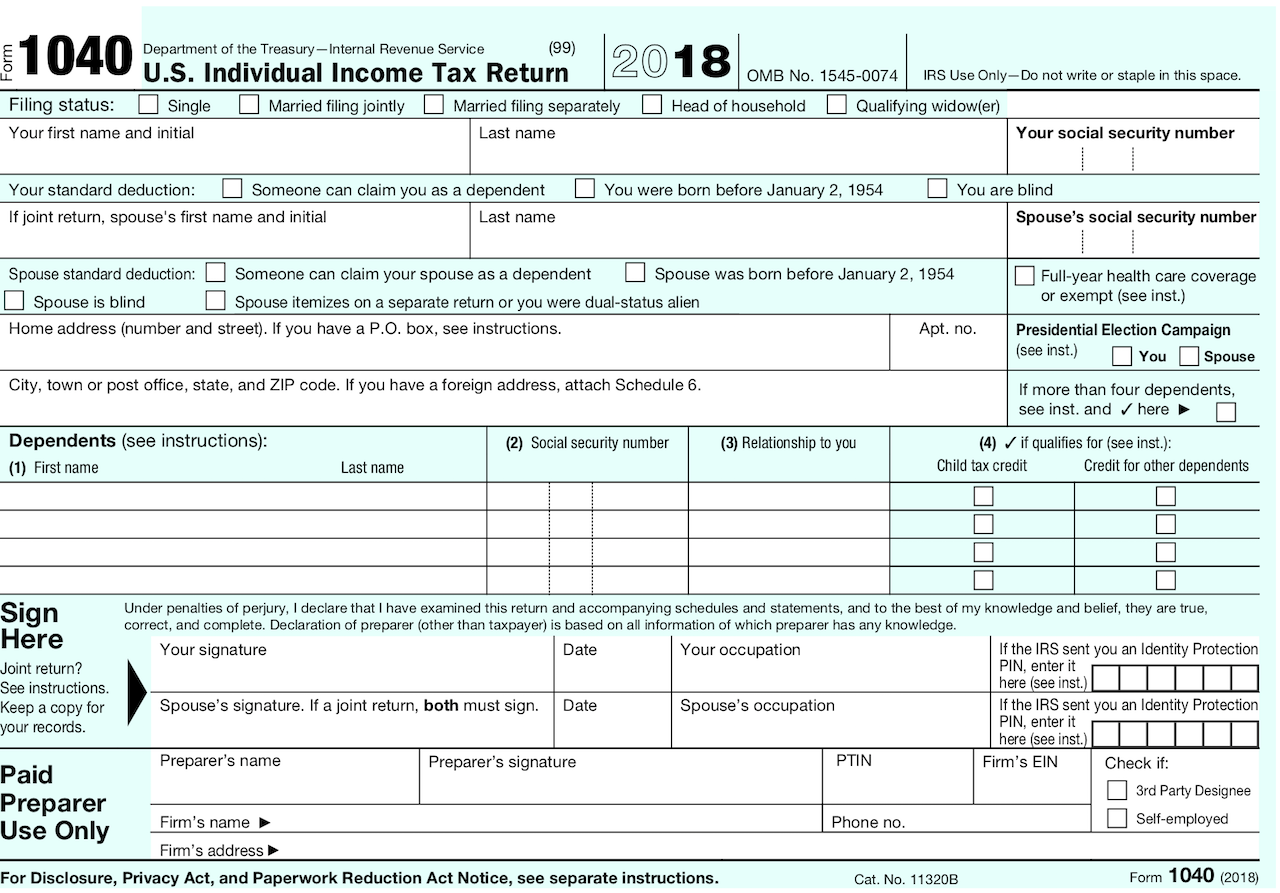

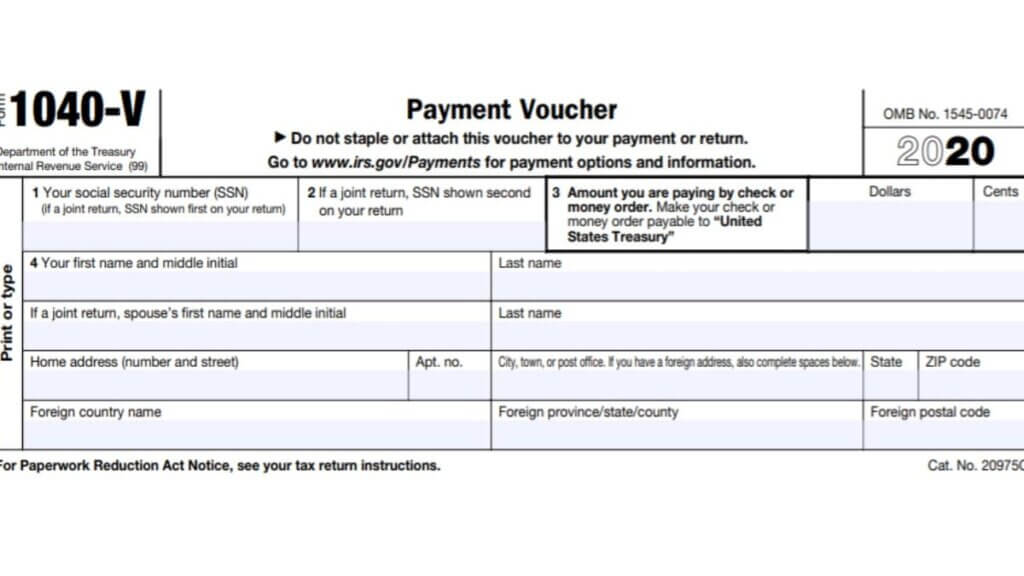

1040 V Form 2022

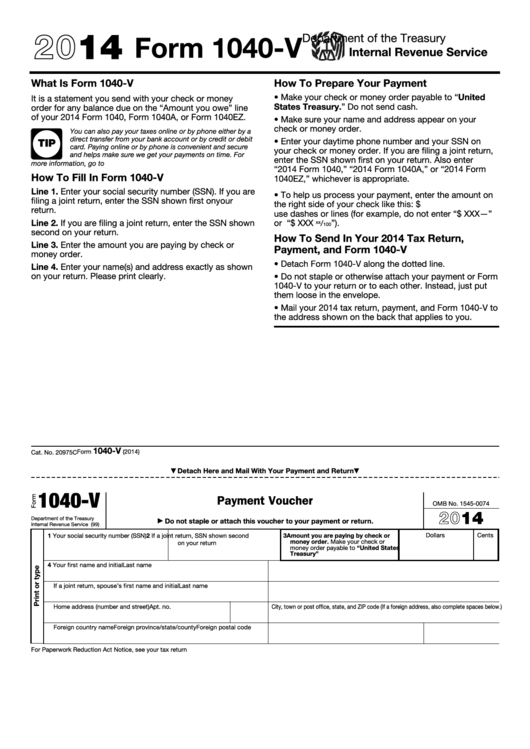

1040 V Form 2022 - Payment voucher is a statement that taxpayers send to the internal revenue service (irs) along with their tax. Don’t send cash for payments to the irs. Make the check or money order payable to the “u.s. If you are claiming a net qualified disaster loss on form 4684, see the instructions for line 16. Tax return for seniors 2021 department of the treasury—internal revenue service (99) omb no. Save or instantly send your ready documents. Consider making your tax payment electronically—it’s easy Estimated taxes for individuals for 2022. If you checked the hoh or qss box, enter the child’s name if the qualifying person is a child but not your dependent: Easily fill out pdf blank, edit, and sign them.

Web taxes get your taxes done still need to file? 2022 tax returns are due on april 18, 2023. Our experts can get your taxes done right. Paying electronically is safe and. Turbotax deluxe online posted january 16, 2022 5:25 pm last updated january 16, 2022 5:25 pm 0 10 2,224 reply Tax return for seniors 2021 department of the treasury—internal revenue service (99) omb no. Make the check or money order payable to the “u.s. Web for instance, if you are sending money owed on your 2022 taxes and you filed a regular form 1040, you would write 2022 form 1040. when writing the amount you're paying on the check or money order, the irs advises you to write the amount in this manner: If you checked the hoh or qss box, enter the child’s name if the qualifying person is a child but not your dependent: Your first name and middle initial last name

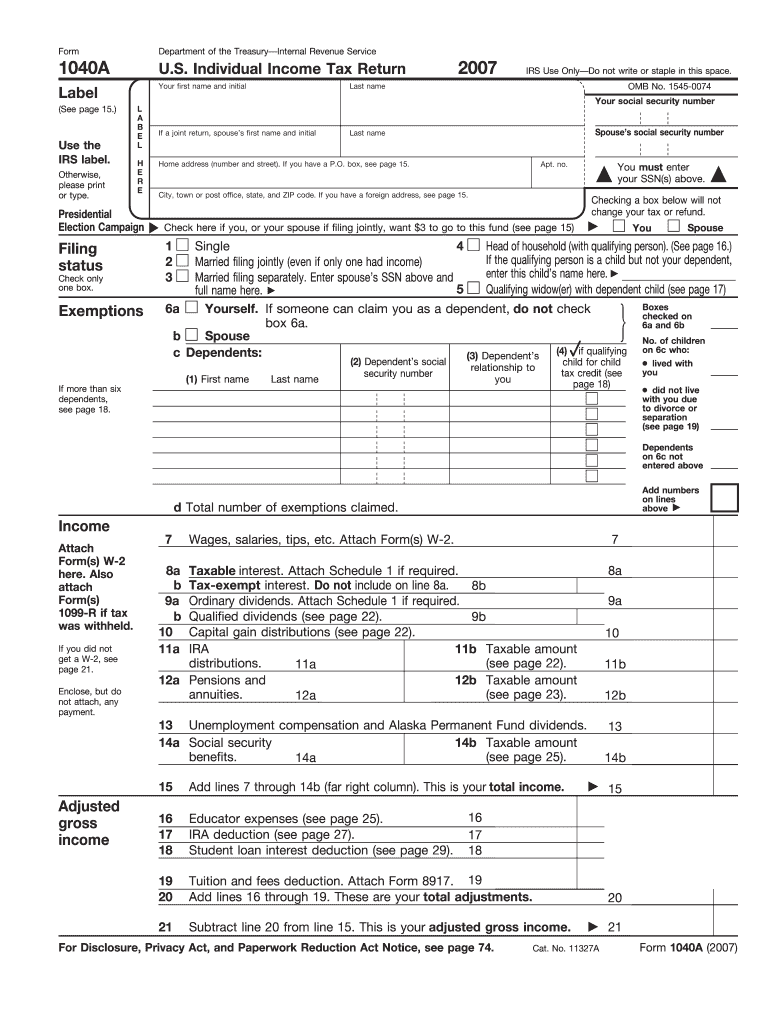

If you are claiming a net qualified disaster loss on form 4684, see the instructions for line 16. Paying electronically is safe and. Our experts can get your taxes done right. Estimated taxes for individuals for 2022. The 1099 form provides information needed to complete a tax return, while the 1040 form is used to file the actual taxes due. Web irs income tax forms, schedules and publications for tax year 2022: 2022 tax returns are due on april 18, 2023. Libraries irs taxpayer assistance centers new 1040 form for older adults the irs has released a new tax filing form for people 65 and older. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web for instance, if you are sending money owed on your 2022 taxes and you filed a regular form 1040, you would write 2022 form 1040. when writing the amount you're paying on the check or money order, the irs advises you to write the amount in this manner:

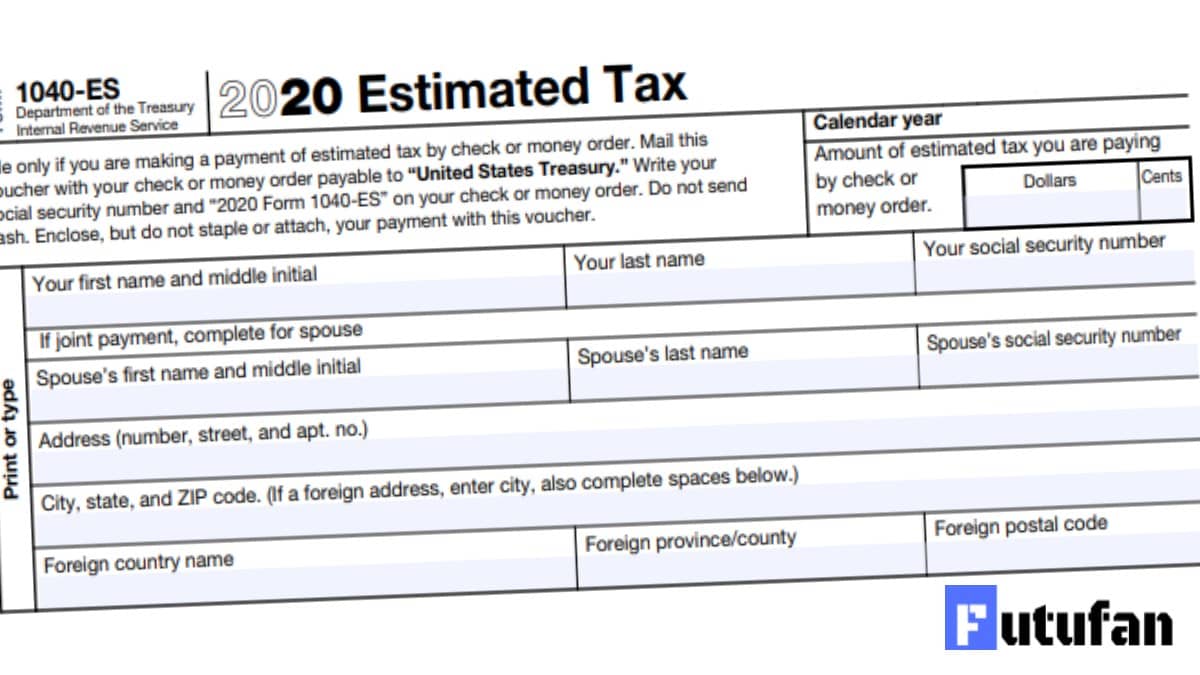

1040 ES Form 2021 1040 Forms

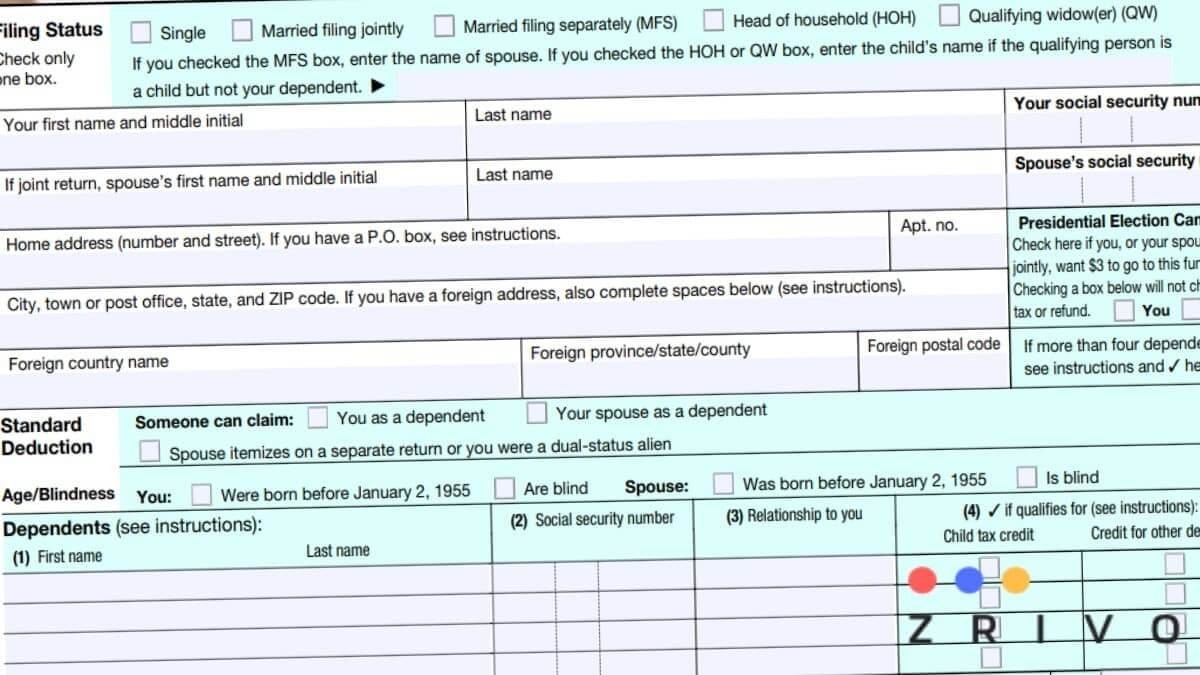

Do not include expenses reimbursed or paid by. If you’re paying by check or money order: Consider making your tax payment electronically—it’s easy you can make electronic payments online, by phone, or from a mobile device. Web single married filing jointly married filing separately (mfs) head of household (hoh) qualifying surviving spouse (qss) if you checked the mfs box, enter.

Form 1040V Payment Voucher Meru Accounting

Web single married filing jointly married filing separately (mfs) head of household (hoh) qualifying surviving spouse (qss) if you checked the mfs box, enter the name of your spouse. Payment voucher is a statement that taxpayers send to the internal revenue service (irs) along with their tax. Turbotax deluxe online posted january 16, 2022 5:25 pm last updated january 16,.

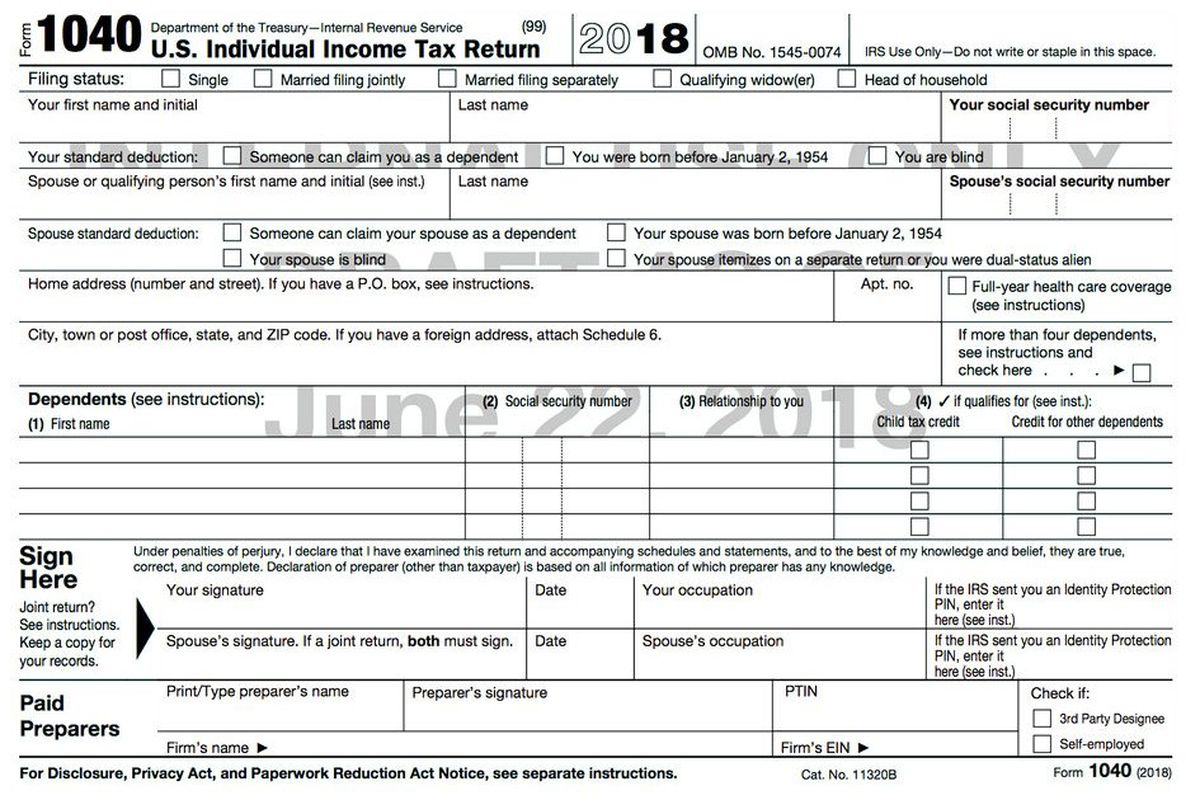

Describes new Form 1040, Schedules & Tax Tables

Your first name and middle initial last name Married filing separately (mfs) head of household (hoh) qualifying widow(er) (qw) Consider making your tax payment electronically—it’s easy Libraries irs taxpayer assistance centers new 1040 form for older adults the irs has released a new tax filing form for people 65 and older. Tax return for seniors 2021 department of the treasury—internal.

Top 9 Form 1040v Templates free to download in PDF format

Do not include expenses reimbursed or paid by. Turbotax deluxe online posted january 16, 2022 5:25 pm last updated january 16, 2022 5:25 pm 0 10 2,224 reply Make the check or money order payable to the “u.s. Don’t send cash for payments to the irs. Download the form and mailing instructions from the irs.

1040ES Form 2023

Consider making your tax payment electronically—it’s easy you can make electronic payments online, by phone, or from a mobile device. Don’t send cash for payments to the irs. Libraries irs taxpayer assistance centers new 1040 form for older adults the irs has released a new tax filing form for people 65 and older. If you are claiming a net qualified.

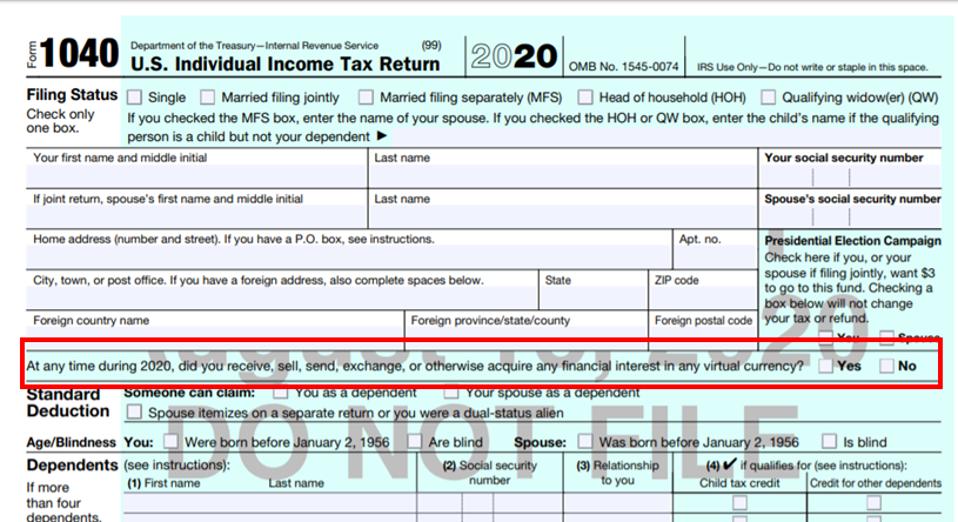

IRS Moves The Controversial Virtual Currency Question To Page 1 Of 1040

Consider making your tax payment electronically—it’s easy Web taxes get your taxes done still need to file? Paying electronically is safe and. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Don’t send cash for payments to the irs.

1040 Form 2021

Paying electronically is safe and. 2022 tax returns are due on april 18, 2023. Consider making your tax payment electronically—it’s easy you can make electronic payments online, by phone, or from a mobile device. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their.

The IRS Shrinks The 1040 Tax Form But The Workload Stays 1040 Form

Save or instantly send your ready documents. Web irs income tax forms, schedules and publications for tax year 2022: Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Your first name and middle initial last name Estimated taxes for individuals for.

2021 Printable Irs Forms Calendar Template Printable

Web for instance, if you are sending money owed on your 2022 taxes and you filed a regular form 1040, you would write 2022 form 1040. when writing the amount you're paying on the check or money order, the irs advises you to write the amount in this manner: $xxx.xx. you should not use dashes or lines such as $xxx—.

Form 1040a for Fill Out and Sign Printable PDF Template signNow

The 1099 form provides information needed to complete a tax return, while the 1040 form is used to file the actual taxes due. Your first name and middle initial last name If you checked the hoh or qss box, enter the child’s name if the qualifying person is a child but not your dependent: Don’t send cash for payments to.

The 1099 Form Provides Information Needed To Complete A Tax Return, While The 1040 Form Is Used To File The Actual Taxes Due.

If you’re paying by check or money order: Being aware of tax terms as well as both 1040 and 1099 rules is beneficial. Web single married filing jointly married filing separately (mfs) head of household (hoh) qualifying surviving spouse (qss) if you checked the mfs box, enter the name of your spouse. Web taxes get your taxes done still need to file?

Estimated Taxes For Individuals For 2022.

Consider making your tax payment electronically—it’s easy you can make electronic payments online, by phone, or from a mobile device. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web irs income tax forms, schedules and publications for tax year 2022: If you checked the hoh or qss box, enter the child’s name if the qualifying person is a child but not your dependent:

Make The Check Or Money Order Payable To The “U.s.

Save or instantly send your ready documents. Married filing separately (mfs) head of household (hoh) qualifying widow(er) (qw) Turbotax deluxe online posted january 16, 2022 5:25 pm last updated january 16, 2022 5:25 pm 0 10 2,224 reply Don’t send cash for payments to the irs.

Consider Making Your Tax Payment Electronically—It’s Easy

Download the form and mailing instructions from the irs. Web for instance, if you are sending money owed on your 2022 taxes and you filed a regular form 1040, you would write 2022 form 1040. when writing the amount you're paying on the check or money order, the irs advises you to write the amount in this manner: $xxx.xx. you should not use dashes or lines such as $xxx— or. Libraries irs taxpayer assistance centers new 1040 form for older adults the irs has released a new tax filing form for people 65 and older.