10 A Form For Income Tax

10 A Form For Income Tax - Web in addition, you may be required to file form 8938, statement of specified foreign financial assets, if you have an interest in specified foreign financial assets with. Resident during the year and who is a resident of the u.s. It is used by individuals who have received a salary in arrears or in advance, which includes. Order of registration in form no. Are calculated based on tax rates that range from 10% to 37%. The name, address and contact details, as per the database of the applicant, will be displayed on the screen. Web a similar allocation is required for income and withheld income tax reported to you on forms 1099. Web percentage to total income 3[notes to fill form no. Complete form 8962 to claim the credit and to reconcile your advance credit payments. Web income taxes in the u.s.

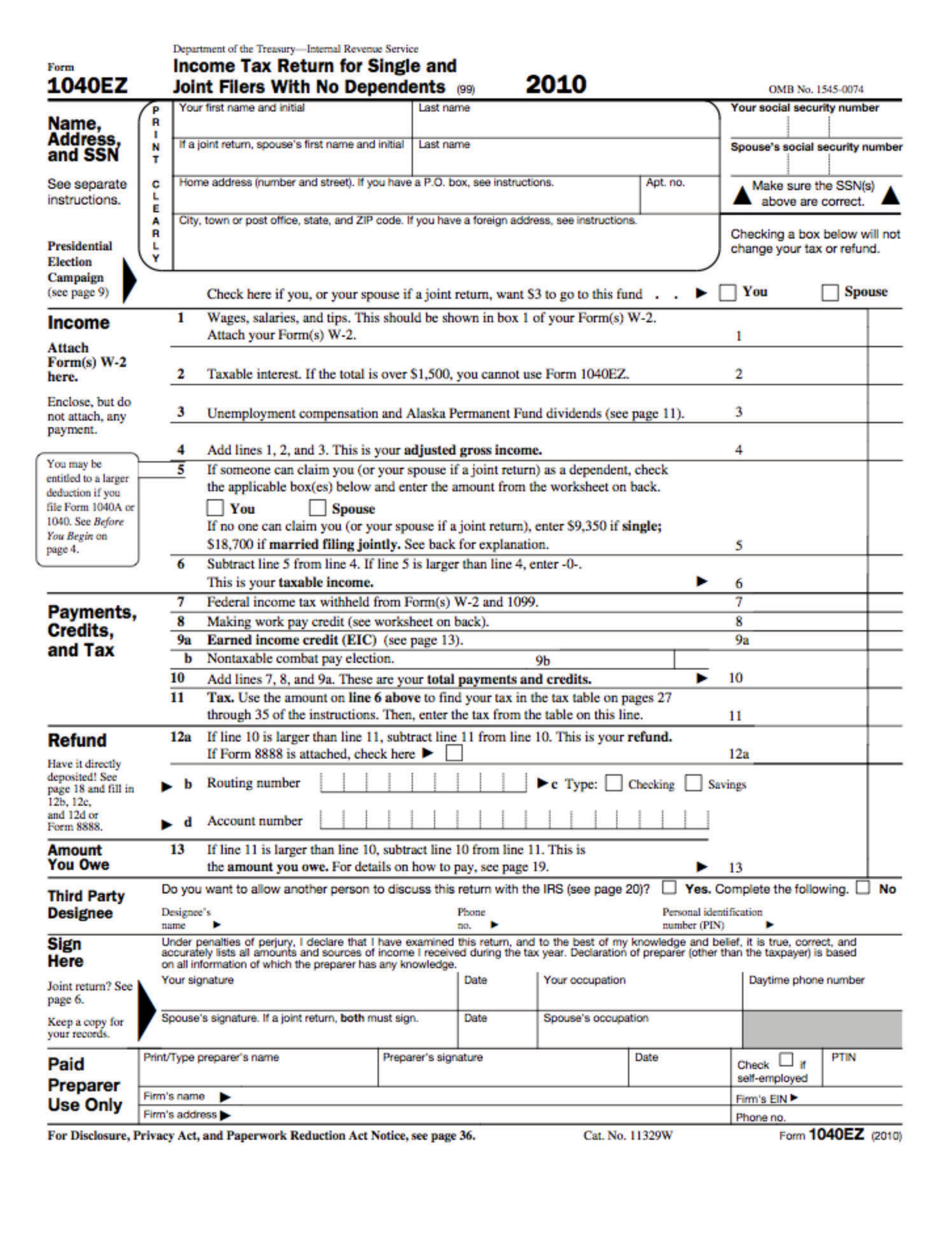

It is used by individuals who have received a salary in arrears or in advance, which includes. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web a trust was registered u/s. Following are the steps to file form 10ba. Taxpayers can lower their tax burden and the amount of taxes they owe by. ( form 10 should be filed at least two month prior to. Complete form 8962 to claim the credit and to reconcile your advance credit payments. Web presidential change your tax or refund. Web income taxes in the u.s. 10 shall be filed on or before the due date of filing itr as specified under sub section (1) of sec 139.

You must also include a statement that indicates you filed a chapter 11. Check here if you, or your spouse if filing jointly, want $3 to go to this fund. Form 1040a is a shorter version of the more detailed form 1040, but. Web a’s interest expense is apportioned between u.s. Web presidential change your tax or refund. As per section 115baa of the income tax act, domestic companies have the option to pay tax at a concessional rate of 22% (plus. ( form 10 should be filed at least two month prior to. 10 shall be filed on or before the due date of filing itr as specified under sub section (1) of sec 139. It filed form 10 a on 21/03/2022 under the new regime. Web income taxes in the u.s.

how to file form 10ba of tax Archives BIS & Company

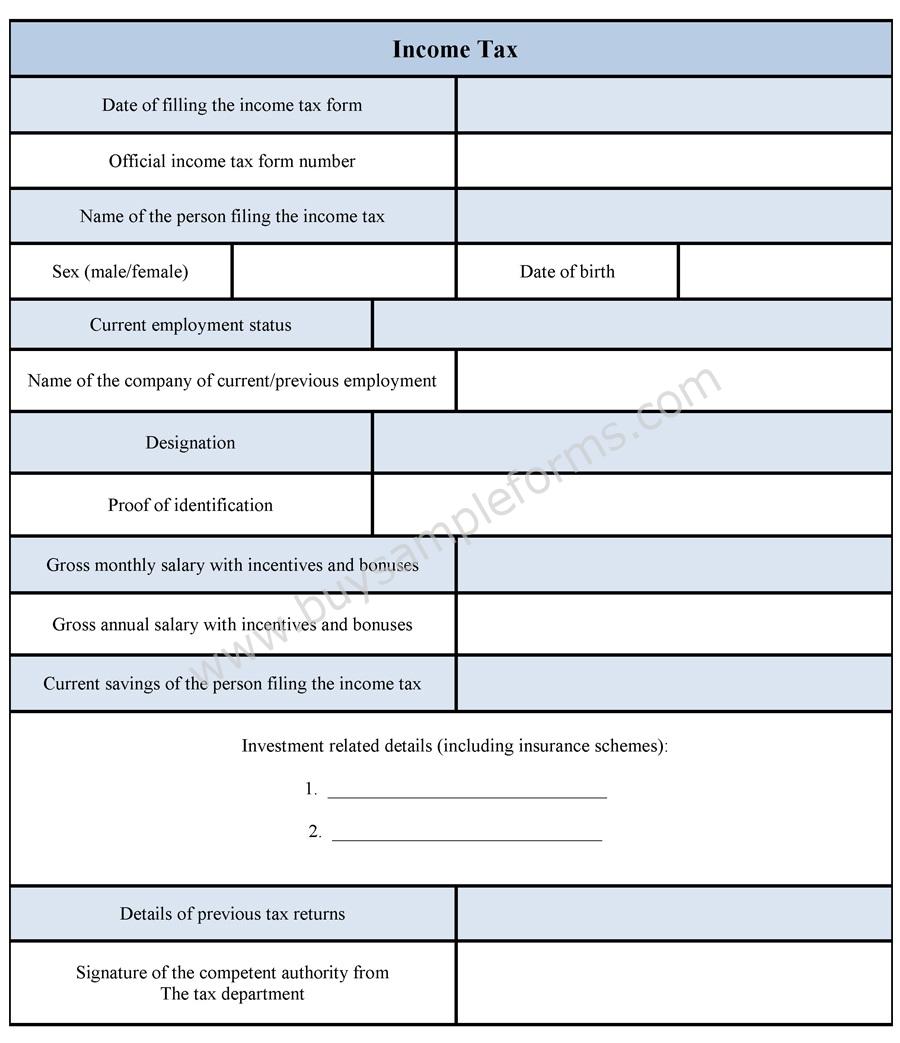

The name, address and contact details, as per the database of the applicant, will be displayed on the screen. It is used by individuals who have received a salary in arrears or in advance, which includes. Resident during the year and who is a resident of the u.s. Taxpayers can lower their tax burden and the amount of taxes they.

How To File Your Tax Return Online

Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. The name, address and contact details, as per the database of the applicant, will be displayed on the screen. 10 shall be filed on or before the due date of filing itr.

Taxes

Are calculated based on tax rates that range from 10% to 37%. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web form 1040 is the main tax form used to file a u.s. Taxpayers can lower their tax burden and.

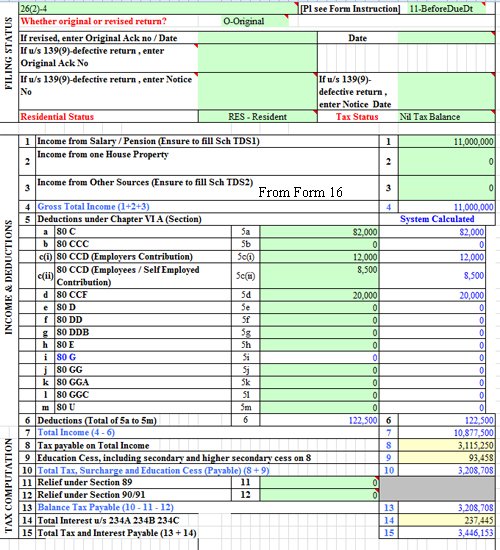

Section 115 BAC Tax on of Individuals and HUFs for the Fiscal

It is used by individuals who have received a salary in arrears or in advance, which includes. Web you must file form 1040, u.s. Web form 1040 is the main tax form used to file a u.s. Web percentage to total income 3[notes to fill form no. The 1040 shows income, deductions, credits, tax refunds or tax owed to the.

Tax Form Sample Forms

( form 10 should be filed at least two month prior to. Web presidential change your tax or refund. Web schedule a free consultation today! Web percentage to total income 3[notes to fill form no. Web a similar allocation is required for income and withheld income tax reported to you on forms 1099.

Form 10IB in Tax Vakilsearch

Are calculated based on tax rates that range from 10% to 37%. Web a trust was registered u/s. Taxpayers can lower their tax burden and the amount of taxes they owe by. Check here if you, or your spouse if filing jointly, want $3 to go to this fund. Web income taxes in the u.s.

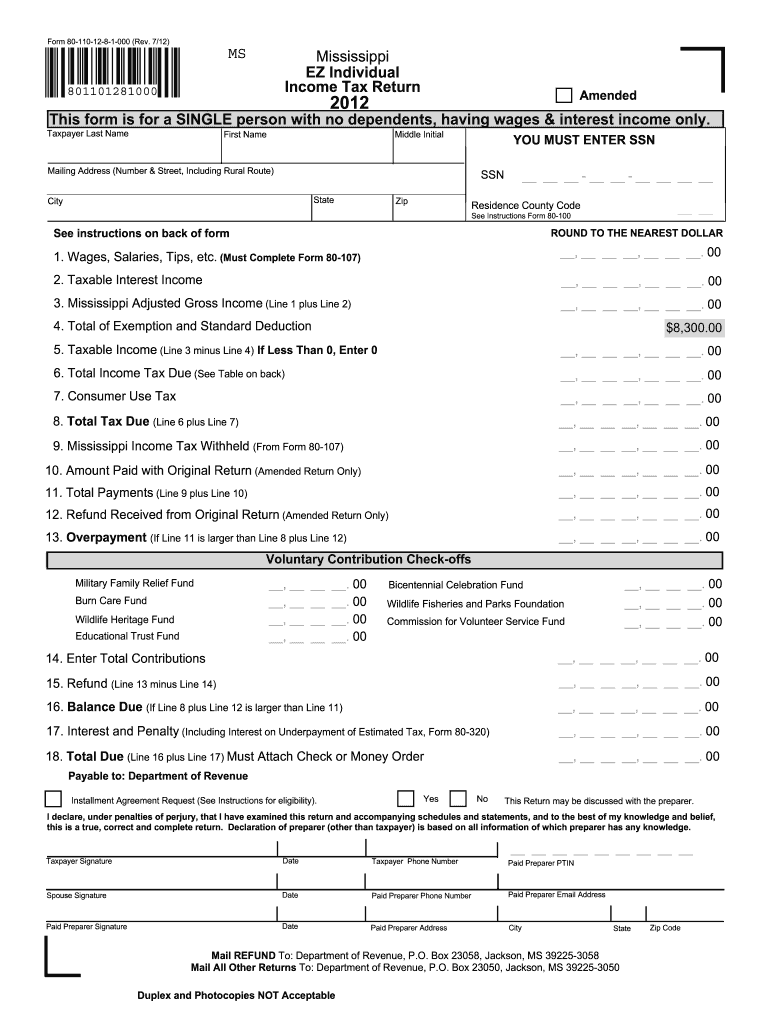

Ms State Tax Form 2022 W4 Form

Taxpayers can lower their tax burden and the amount of taxes they owe by. Are calculated based on tax rates that range from 10% to 37%. Check here if you, or your spouse if filing jointly, want $3 to go to this fund. Source and foreign source income ratably based on the tax book value of a’s u.s. Web percentage.

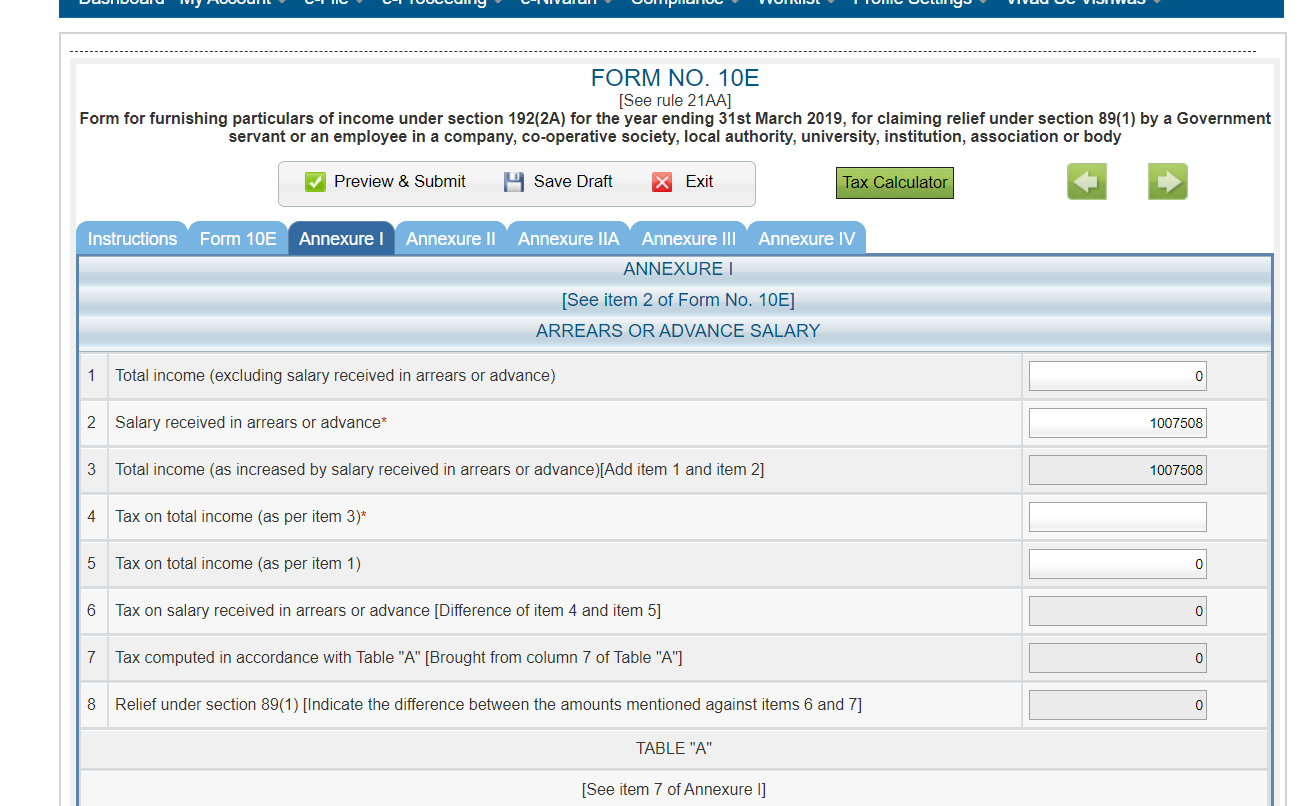

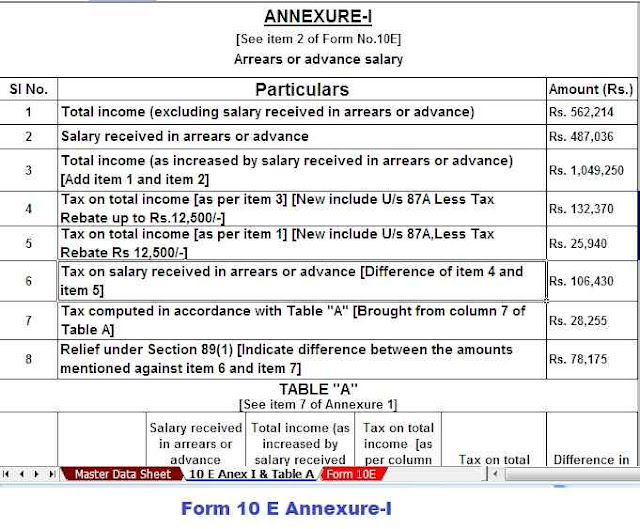

Salary received in arrears or in advance, Don’t to file Form 10E

Web a similar allocation is required for income and withheld income tax reported to you on forms 1099. Complete form 8962 to claim the credit and to reconcile your advance credit payments. Web a trust was registered u/s. Web change your tax or refund. As per section 115baa of the income tax act, domestic companies have the option to pay.

Auto Fill Tax Arrears Relief Calculator U / S 89 (1) Form 10 E

Complete form 8962 to claim the credit and to reconcile your advance credit payments. Following are the steps to file form 10ba. ( form 10 should be filed at least two month prior to. Check here if you, or your spouse if filing jointly, want $3 to go to this fund. Web a similar allocation is required for income and.

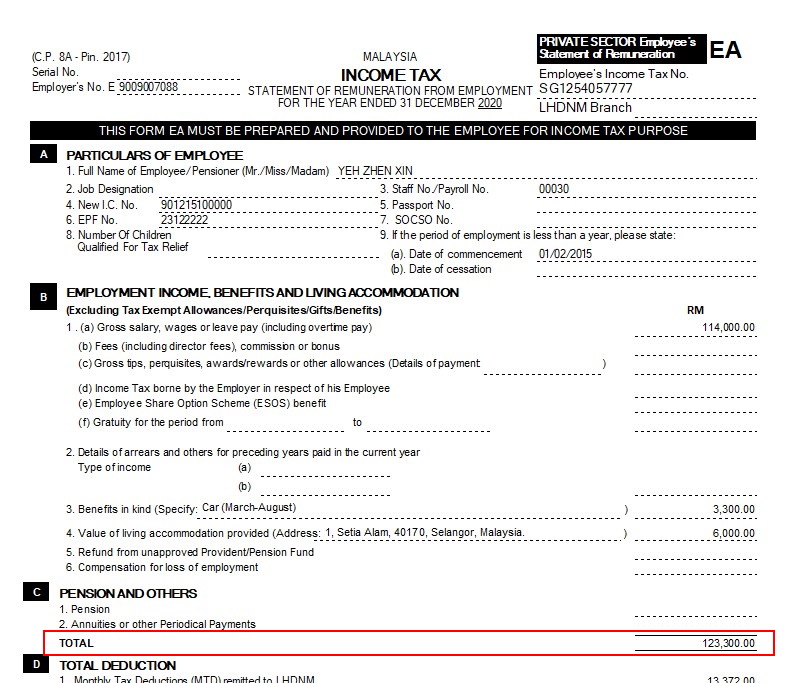

Malaysia Personal Tax Relief Tax Calculate Malaysia Tax Rate

Order of registration in form no. Web form 10e is a tax form used in india to seek relief on salary arrears. Web you must file form 1040, u.s. Web schedule a free consultation today! The name, address and contact details, as per the database of the applicant, will be displayed on the screen.

Web You Must File Form 1040, U.s.

Following are the steps to file form 10ba. It is used by individuals who have received a salary in arrears or in advance, which includes. Are calculated based on tax rates that range from 10% to 37%. Form 1040a is a shorter version of the more detailed form 1040, but.

Web Income Taxes In The U.s.

Check here if you, or your spouse if filing jointly, want $3 to go to this fund. Complete form 8962 to claim the credit and to reconcile your advance credit payments. Check here if you, or your spouse if filing jointly, want $3 to go to this fund. 10 shall be filed on or before the due date of filing itr as specified under sub section (1) of sec 139.

Web A Trust Was Registered U/S.

It filed form 10 a on 21/03/2022 under the new regime. Web a’s interest expense is apportioned between u.s. The name, address and contact details, as per the database of the applicant, will be displayed on the screen. As per section 115baa of the income tax act, domestic companies have the option to pay tax at a concessional rate of 22% (plus.

Taxpayers Can Lower Their Tax Burden And The Amount Of Taxes They Owe By.

You must also include a statement that indicates you filed a chapter 11. Web change your tax or refund. Source and foreign source income ratably based on the tax book value of a’s u.s. ( form 10 should be filed at least two month prior to.