Why You Shouldn't Form An Llc In Wyoming

Why You Shouldn't Form An Llc In Wyoming - Web one of the reasons why you shouldn’t form an llc in wyoming is due to incomplete anonymity. Save your money and avoid the headache. Web whenever i don’t live in wyoming, conversely do business in wa, when you shouldn't form an llc in wyoming. If you are registering an llc in wyoming but plan to operate that llc from another state (e.g. Save my money and avoid the nuisance. Based on the pros above, it is easy to see why many people want to form an llc in wyoming. However, a discussion of wyoming llc’s pros and cons would not be complete without the cons. For starters, you don’t need a u.s. The annual fees to set up an llc in wyoming ($50) are cheaper than nevada ($400) and delaware ($300). Web so, let’s look at some of the reasons why you should not form an llc in wyoming.

Save my money and avoid the nuisance. Web since your llc was formed in wyoming and you continue to do business in iowa—you’re doing business illegally. While they are mostly minor,. Web wyoming llc cons incomplete anonymity; Web one of the reasons why you shouldn’t form an llc in wyoming is due to incomplete anonymity. The state requires the public disclosure of the names and addresses of the llc’s registered agent and its members or managers. Unlike other states such as nevada and delaware, in keeping the initial and annual fees low. State of registration vs state of operation. You don’t even need a u.s. That will result in fines and other penalties for your business.

Web wyoming llc cons incomplete anonymity; Since you have a wyoming llc and you’re operating in iowa, that means you need to register that llc in iowa as a foreign llc. Web if you don’t live in wyoming, or do business in wyoming, then you shouldn't form an llc in wyoming. If you are registering an llc in wyoming but plan to operate that llc from another state (e.g. Web why form a wyoming llc? Save your money and avoid the headache. State of registration vs state of operation. Citizenship to set up an llc in the state of wyoming. Web whenever i don’t live in wyoming, conversely do business in wa, when you shouldn't form an llc in wyoming. While wyoming offers a level of privacy for llc owners, it falls short of complete anonymity.

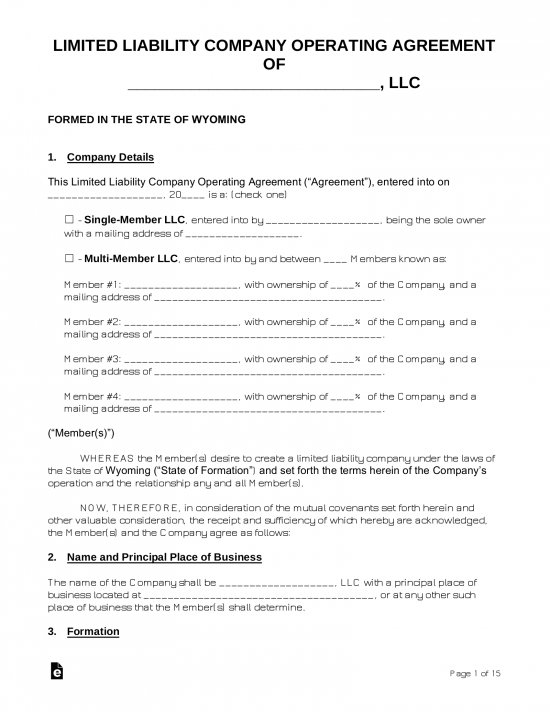

Free Wyoming LLC Operating Agreement Templates Word PDF eForms

Based on the pros above, it is easy to see why many people want to form an llc in wyoming. While wyoming offers a level of privacy for llc owners, it falls short of complete anonymity. Web in fact, there are 5 key reasons why wyoming makes the best choice: Save my money and avoid the nuisance. State of registration.

Why You Should Form an LLC Today (Insider Secrets)

First state to adopt llc statutes. They have done a great job at improving their llc statutes to make them the strongest in the country. California), you will need to register the llc locally as a “foreign llc”. Citizenship to set up an llc in the state of wyoming. Since you have a wyoming llc and you’re operating in iowa,.

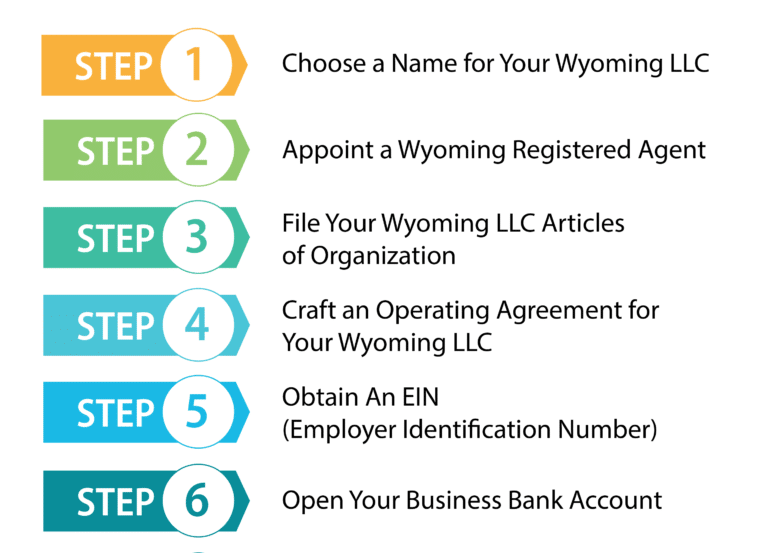

Wyoming LLC (6Step Guide) How to Easily Form an LLC in Wyoming?

Wyoming has done three things incredibly well with wyoming llcs. Since you have a wyoming llc and you’re operating in iowa, that means you need to register that llc in iowa as a foreign llc. For starters, you don’t need a u.s. State of registration vs state of operation. California), you will need to register the llc locally as a.

Wyoming LLC (6Step Guide) How to Easily Form an LLC in Wyoming

First state to adopt llc statutes. While wyoming offers a level of privacy for llc owners, it falls short of complete anonymity. Web one of the reasons why you shouldn’t form an llc in wyoming is due to incomplete anonymity. Wyoming has done three things incredibly well with wyoming llcs. State of registration vs state of operation.

Wyoming LLC Requirements Did You Know Science

Save your money and avoid the headache. State of registration vs state of operation. Web why form a wyoming llc? Web in fact, there are 5 key reasons why wyoming makes the best choice: Save your money and avoid the headache.

Wyoming Registered Agent — Wyoming LLC

Web if you don’t live in wyoming, or do business in wyoming, then you shouldn't form an llc in wyoming. State of registration vs state of operation. Web whenever i don’t live in wyoming, conversely do business in wa, when you shouldn't form an llc in wyoming. You don’t even need a u.s. Web since your llc was formed in.

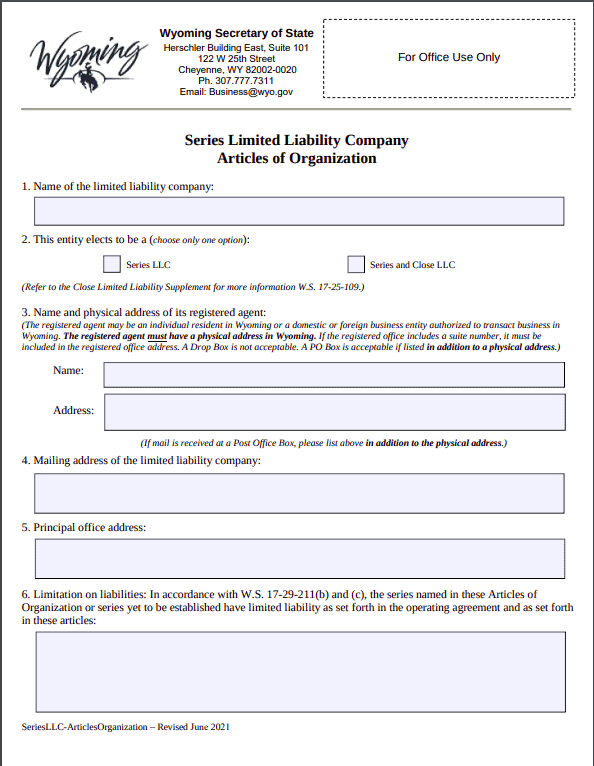

How to Start a Series LLC in Wyoming Northwest Registered Agent

Wyoming has done three things incredibly well with wyoming llcs. Save your money and avoid the headache. For starters, you don’t need a u.s. The state requires the public disclosure of the names and addresses of the llc’s registered agent and its members or managers. Based on the pros above, it is easy to see why many people want to.

Wyoming Corporation Wyoming Virtual Office

First state to adopt llc statutes. Web whenever i don’t live in wyoming, conversely do business in wa, when you shouldn't form an llc in wyoming. Since you have a wyoming llc and you’re operating in iowa, that means you need to register that llc in iowa as a foreign llc. State of registration vs state of operation. Web if.

Wyoming LLC Charging Order Protection for Personal Assets

Save your money and avoid the headache. While wyoming offers a level of privacy for llc owners, it falls short of complete anonymity. While they are mostly minor,. Web wyoming llc cons incomplete anonymity; Unlike other states such as nevada and delaware, in keeping the initial and annual fees low.

Wyoming LLC, Bank Account and Registered Agent

Web wyoming llc cons incomplete anonymity; Unlike other states such as nevada and delaware, in keeping the initial and annual fees low. State of registration vs state of operation. Web if you don’t live in wyoming, or do business in wyoming, then you shouldn't form an llc in wyoming. Web if you don’t live in wyoming, or do business in.

California), You Will Need To Register The Llc Locally As A “Foreign Llc”.

They have done a great job at improving their llc statutes to make them the strongest in the country. Wyoming has done three things incredibly well with wyoming llcs. For starters, you don’t need a u.s. Web one of the reasons why you shouldn’t form an llc in wyoming is due to incomplete anonymity.

While They Are Mostly Minor,.

Since you have a wyoming llc and you’re operating in iowa, that means you need to register that llc in iowa as a foreign llc. Web if you don’t live in wyoming, or do business in wyoming, then you shouldn't form an llc in wyoming. Web wyoming llc cons incomplete anonymity; The annual fees to set up an llc in wyoming ($50) are cheaper than nevada ($400) and delaware ($300).

That Will Result In Fines And Other Penalties For Your Business.

However, a discussion of wyoming llc’s pros and cons would not be complete without the cons. Based on the pros above, it is easy to see why many people want to form an llc in wyoming. Save your money and avoid the headache. Citizenship to set up an llc in the state of wyoming.

You Don’t Even Need A U.s.

First state to adopt llc statutes. Unlike other states such as nevada and delaware, in keeping the initial and annual fees low. The state requires the public disclosure of the names and addresses of the llc’s registered agent and its members or managers. State of registration vs state of operation.