What's The Difference Between Chapter 7 11 And 13

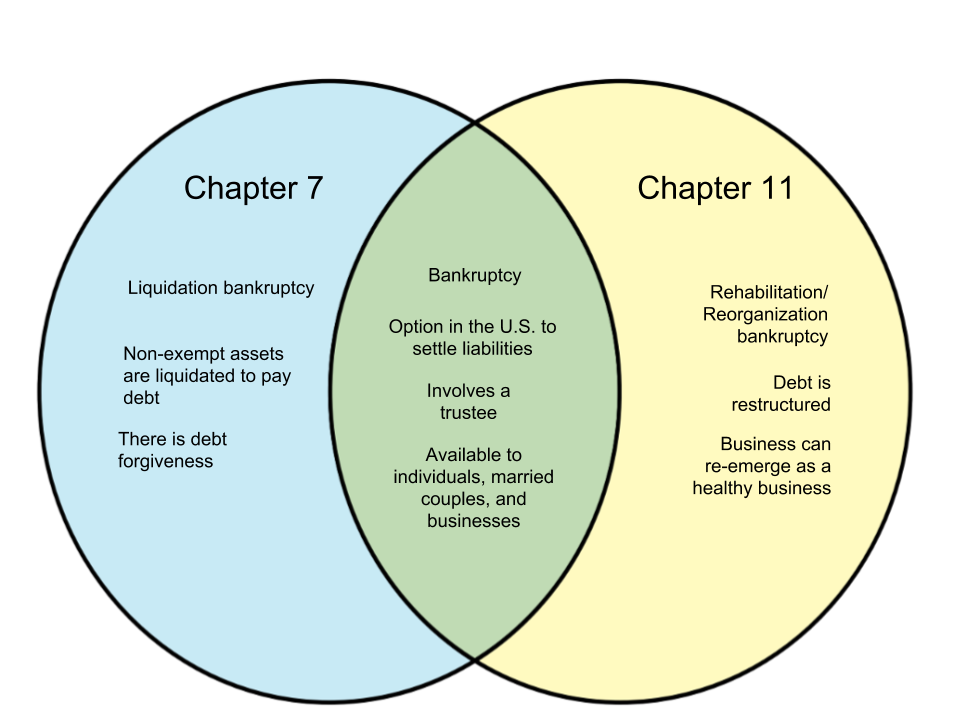

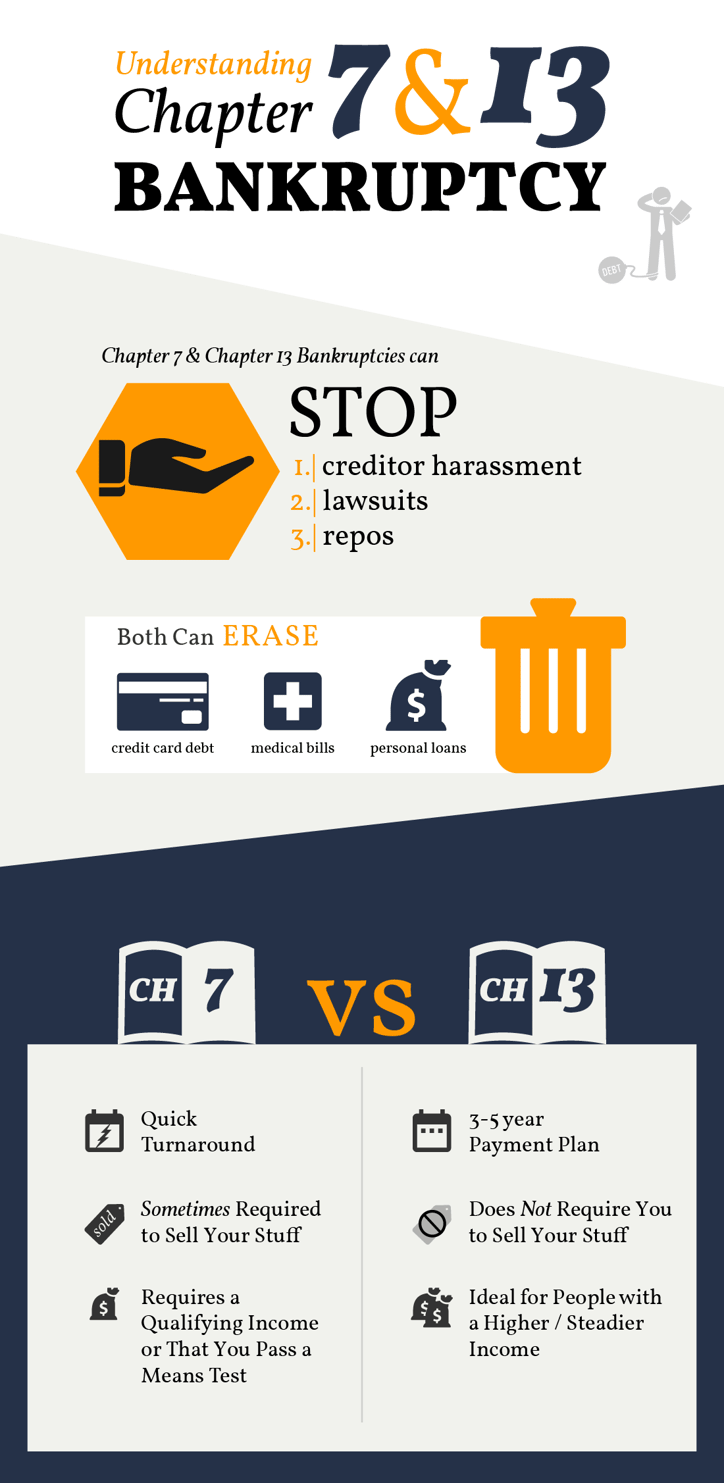

What's The Difference Between Chapter 7 11 And 13 - Often called the liquidation chapter, chapter 7 is used by individuals, partnerships, or corporations who are unable to repair their financial situation. Web chapter 7 and chapter 13 are very different types of bankruptcy. This is because chapter 7 typically results in the liquidation of the entire company, and chapter 13 is not available for business entities. The critical difference is that chapter 7 revolves around the liquidation of assets to repay debts. Either way, filing for bankruptcy can help waive those away. [track latest developments in bankruptcy with bloomberg law.] chapter 7 bankruptcy and chapter 11 bankruptcy are both common options for businesses in declaring bankruptcy. Chapter 13 bankruptcy the biggest differences between chapter 7 and chapter 13 bankruptcy are what happens to your property and who qualifies financially. Web the main difference between the two is the amount of money the debtor owes. Web child support or alimony student loans auto loans chapter 7 bankruptcy vs. Web perhaps it was unsecured creditors like credit card companies.

The plan may call for full or partial repayment. This chapter of the u.s. Often called the liquidation chapter, chapter 7 is used by individuals, partnerships, or corporations who are unable to repair their financial situation. Rarely businesses — sell their. But there are different types of bankruptcies, and the most common ones are chapter 7, 11, and 13… Web what is the difference between chapter 7, 11, 12 & 13 cases? In contrast, chapter 13 is a debt. Web chapter 7 vs. Web chapter 7 provides liquidation of an individual’s property and then distributes it to creditors. Chapter 13 bankruptcy the biggest differences between chapter 7 and chapter 13 bankruptcy are what happens to your property and who qualifies financially.

Web rescuing your business chapter 11 is generally the best way to alleviate your liabilities without going out of business. Individuals are allowed to keep “exempt property.” the courts may provide businesses that file chapter 7. Web the main difference between the two is the amount of money the debtor owes. Either way, filing for bankruptcy can help waive those away. Web chapter 7 provides liquidation of an individual’s property and then distributes it to creditors. Often called the liquidation chapter, chapter 7 is used by individuals, partnerships, or corporations who are unable to repair their financial situation. Web child support or alimony student loans auto loans chapter 7 bankruptcy vs. Web perhaps it was unsecured creditors like credit card companies. Chapter 13 focuses on restructuring debt to be fully or partially paid off over. The critical difference is that chapter 7 revolves around the liquidation of assets to repay debts.

What's the Difference Between Chapter 7 and Chapter 13 Bankruptcy?

Web chapter 7 is the type of bankruptcy that most people imagine when they think of bankruptcy: Web chapter 7 and chapter 13 are very different types of bankruptcy. The critical difference is that chapter 7 revolves around the liquidation of assets to repay debts. In contrast, chapter 13 is a debt. Web perhaps it was unsecured creditors like credit.

45+ Difference Between Chapter 7 And Chapter 11

Web chapter 7 and chapter 13 are very different types of bankruptcy. Web chapter 7 is the type of bankruptcy that most people imagine when they think of bankruptcy: Corporations cannot file under chapter 13. Web chapter 7 vs. Chapter 13 focuses on restructuring debt to be fully or partially paid off over.

What's the Difference Between Chapter 13 and Chapter 7 Bankruptcy?

Web perhaps it was unsecured creditors like credit card companies. The plan may call for full or partial repayment. Web rescuing your business chapter 11 is generally the best way to alleviate your liabilities without going out of business. Web emily norris updated june 21, 2022 reviewed by pamela rodriguez companies that find themselves in a dire financial situation where.

Difference Between Chapter and Lesson Compare the Difference Between

Corporations cannot file under chapter 13. Web chapter 13 enables individuals with regular incomes, under court supervision and protection, to repay their debts over an extended period of time according to a plan. The critical difference is that chapter 7 revolves around the liquidation of assets to repay debts. Web chapter 7 vs. For some people, the time period must.

What's the Difference Between a Chapter 7 and 13 Bankruptcy?

Chapter 7 is designed to eliminate debt by liquidating assets. Web chapter 7 is the type of bankruptcy that most people imagine when they think of bankruptcy: Corporations cannot file under chapter 13. Chapter 13 bankruptcy the biggest differences between chapter 7 and chapter 13 bankruptcy are what happens to your property and who qualifies financially. Web the main difference.

The Difference Between Chapter 7 & Chapter 13 Bankruptcies

Web emily norris updated june 21, 2022 reviewed by pamela rodriguez companies that find themselves in a dire financial situation where bankruptcy is their best—or only—option have two basic. Web perhaps it was unsecured creditors like credit card companies. If the court approves the plan of payment, the debts will be paid in full or partially by the chapter 13..

The Difference Between Chapter 11 and Chapter 7 Bankruptcy Ritter Spencer

Individuals are allowed to keep “exempt property.” the courts may provide businesses that file chapter 7. In a chapter 13 proceeding, the debtor must pay all or part of his debts from the future income over a period of three to five years through his chapter 13 plan. Often called the liquidation chapter, chapter 7 is used by individuals, partnerships,.

37+ Can I File Chapter 7 Before 8 Years KhamShunji

Often called the liquidation chapter, chapter 7 is used by individuals, partnerships, or corporations who are unable to repair their financial situation. Web child support or alimony student loans auto loans chapter 7 bankruptcy vs. This chapter of the u.s. In chapter 7 asset cases, the debtor's. Web chapter 7 vs.

Bankruptcy Chapter 7 vs 13 What is The Difference

Web chapter 13 enables individuals with regular incomes, under court supervision and protection, to repay their debts over an extended period of time according to a plan. [track latest developments in bankruptcy with bloomberg law.] chapter 7 bankruptcy and chapter 11 bankruptcy are both common options for businesses in declaring bankruptcy. Web the main difference between the two is the.

Tampa Bankruptcy Chapter 7 vs Chapter 13 Galewski Law Group

For some people, the time period must be five years. Web perhaps it was unsecured creditors like credit card companies. Chapter 13 bankruptcy the biggest differences between chapter 7 and chapter 13 bankruptcy are what happens to your property and who qualifies financially. The plan may call for full or partial repayment. Individuals are allowed to keep “exempt property.” the.

Web The Main Difference Between The Two Is The Amount Of Money The Debtor Owes.

Individuals are allowed to keep “exempt property.” the courts may provide businesses that file chapter 7. Web emily norris updated june 21, 2022 reviewed by pamela rodriguez companies that find themselves in a dire financial situation where bankruptcy is their best—or only—option have two basic. Rarely businesses — sell their. In a chapter 13 proceeding, the debtor must pay all or part of his debts from the future income over a period of three to five years through his chapter 13 plan.

Web Chapter 7 Provides Liquidation Of An Individual’s Property And Then Distributes It To Creditors.

Chapter 13 bankruptcy the biggest differences between chapter 7 and chapter 13 bankruptcy are what happens to your property and who qualifies financially. Web chapter 13 enables individuals with regular incomes, under court supervision and protection, to repay their debts over an extended period of time according to a plan. In contrast, chapter 13 is a debt. Chapter 13 focuses on restructuring debt to be fully or partially paid off over.

Often Called The Liquidation Chapter, Chapter 7 Is Used By Individuals, Partnerships, Or Corporations Who Are Unable To Repair Their Financial Situation.

This is because chapter 7 typically results in the liquidation of the entire company, and chapter 13 is not available for business entities. In chapter 7 asset cases, the debtor's. If you are running a sole proprietorship, however, chapter 13. Web chapter 7 vs.

There Is No Limit To The Amount Of Money Owed By Debtors Filing For Chapter 11.

[track latest developments in bankruptcy with bloomberg law.] chapter 7 bankruptcy and chapter 11 bankruptcy are both common options for businesses in declaring bankruptcy. Web perhaps it was unsecured creditors like credit card companies. Web what is the difference between chapter 7, 11, 12 & 13 cases? For some people, the time period must be five years.