Ma Form 1-Nr/Py Instructions 2022

Ma Form 1-Nr/Py Instructions 2022 - The days of terrifying complex tax and legal forms have ended. Web 42 massachusetts income tax withheld. You are a nonresident if you are not a resident of massachusetts as defined above but received massachusetts source income (e.g. Web follow the simple instructions below: A powerhouse editor is already at your fingertips providing you with a range. Follow the simple instructions below: If line 7 of your massachusetts agi worksheet is lower than. Web 3 amount of deductible alimony paid (from us return; From a job in massachusetts). Last name taxpayer’s social security number spouse’s first name m.i.

Web 2022 massachusetts personal income tax forms & instructions form 1: Then prepare your resident state return and it will generate a credit for your income already being taxed. Follow the simple instructions below: Web follow the simple instructions below: Last name taxpayer’s social security number spouse’s first name m.i. Please use the link below. There are three easy and convenient ways to do it. 42 00 43 2020 overpayment applied to your 2021 estimated tax (from 2020 form 1, line. If line 7 of your massachusetts agi worksheet is lower than. Web 3 amount of deductible alimony paid (from us return;

Web file form 1, massachusetts resident income tax return. The credit will be the lower of the state tax liabilities on the same. Web 3 amount of deductible alimony paid (from us return; You are a nonresident if you are not a resident of massachusetts as defined above but received massachusetts source income (e.g. If line 7 of your massachusetts agi worksheet is lower than. Fill in the “nonresident” oval at the top of the. From a job in massachusetts). 42 00 43 2020 overpayment applied to your 2021 estimated tax (from 2020 form 1, line. 3 00 4 amounts excludible under mgl ch. Web follow the simple instructions below:

Form 1 Massachusetts Resident Tax Return YouTube

The credit will be the lower of the state tax liabilities on the same. Please use the link below. The days of terrifying complex tax and legal forms have ended. There are three easy and convenient ways to do it. Web 3 amount of deductible alimony paid (from us return;

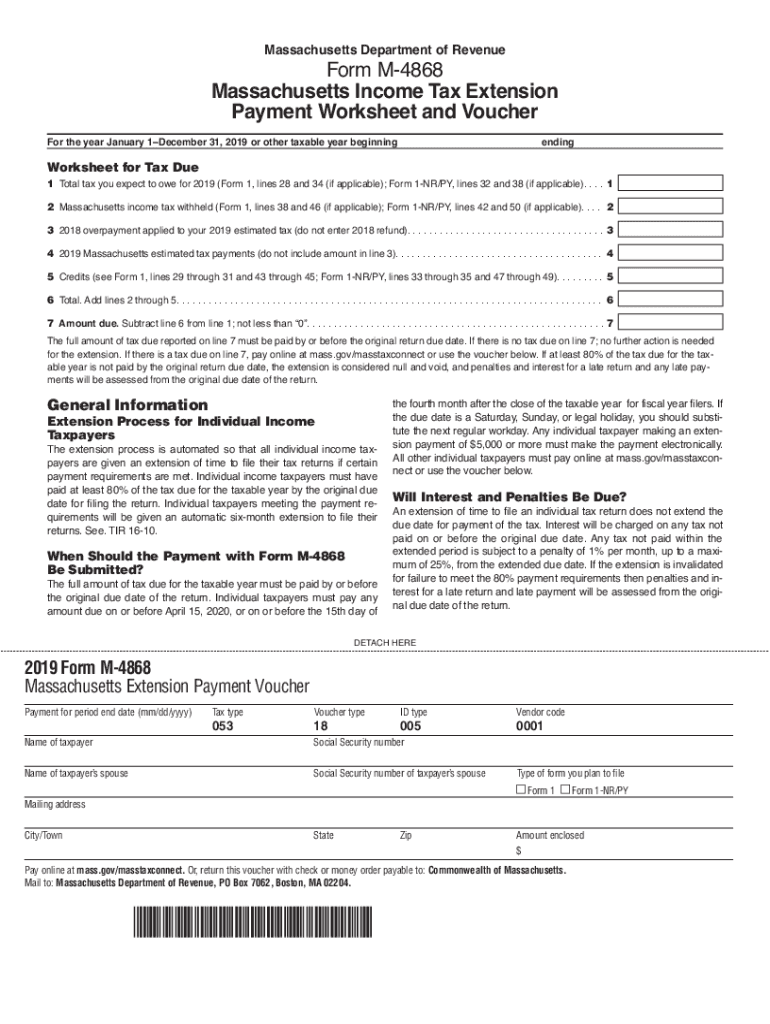

Tax Extention Forms Ma Fill Out and Sign Printable PDF Template signNow

The days of terrifying complex tax and legal forms have ended. Web how to fill out and sign ma form 1 nr py instructions 2022 online? The credit will be the lower of the state tax liabilities on the same. Follow the simple instructions below: A powerhouse editor is already at your fingertips providing you with a range.

Form 1 nr py Fill out & sign online DocHub

Last name taxpayer’s social security number spouse’s first name m.i. Please use the link below. A powerhouse editor is already at your fingertips providing you with a range. Fill in the “nonresident” oval at the top of the. There are three easy and convenient ways to do it.

60mL ENFit Syringe Purple Sterile Avanos Medical Devices

Enjoy smart fillable fields and interactivity. The credit will be the lower of the state tax liabilities on the same. From a job in massachusetts). You are a nonresident if you are not a resident of massachusetts as defined above but received massachusetts source income (e.g. There are three easy and convenient ways to do it.

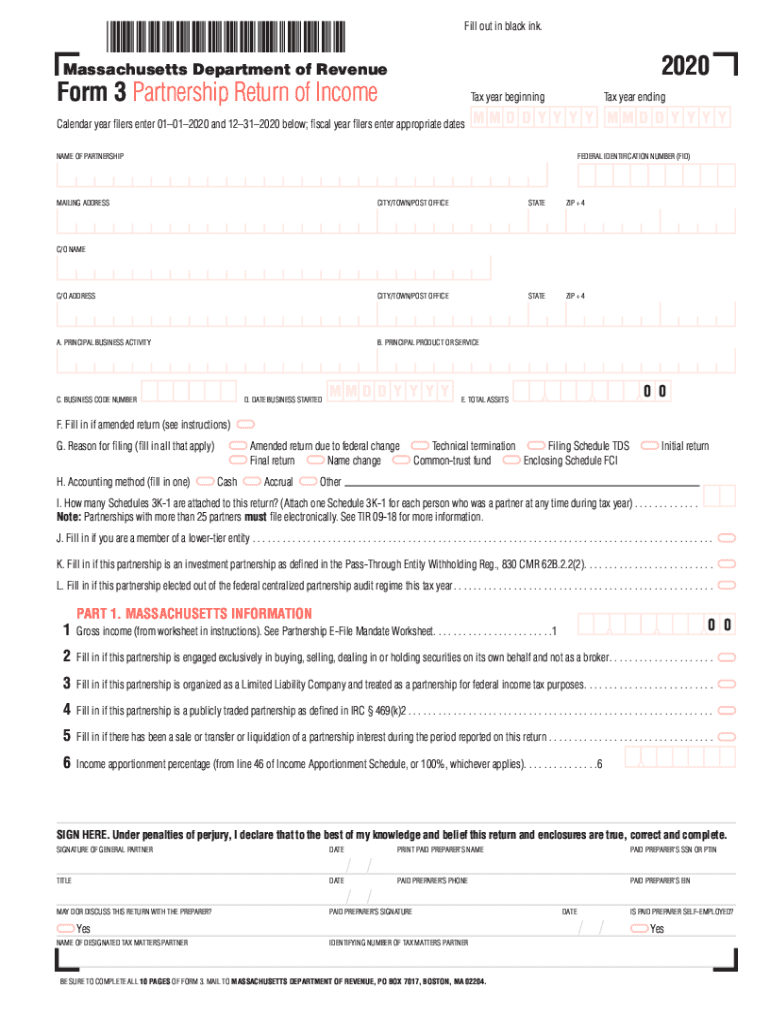

MA Form 3 2020 Fill out Tax Template Online US Legal Forms

42 00 43 2020 overpayment applied to your 2021 estimated tax (from 2020 form 1, line. Get your online template and fill it in using progressive features. Web 2022 massachusetts personal income tax forms & instructions form 1: Web 3 amount of deductible alimony paid (from us return; A powerhouse editor is already at your fingertips providing you with a.

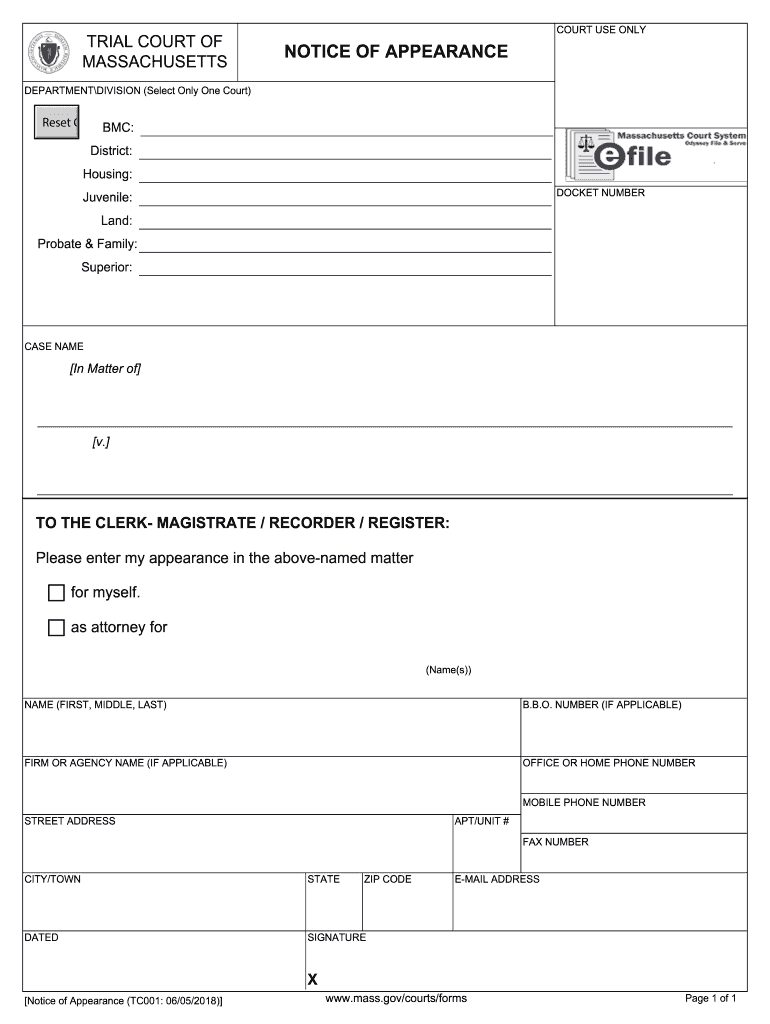

MA TC001 20182022 Complete Legal Document Online US Legal Forms

Fill in the “nonresident” oval at the top of the. Web 42 massachusetts income tax withheld. 42 00 43 2020 overpayment applied to your 2021 estimated tax (from 2020 form 1, line. Web a massachusetts resident to establish a residence outside the state. Follow the simple instructions below:

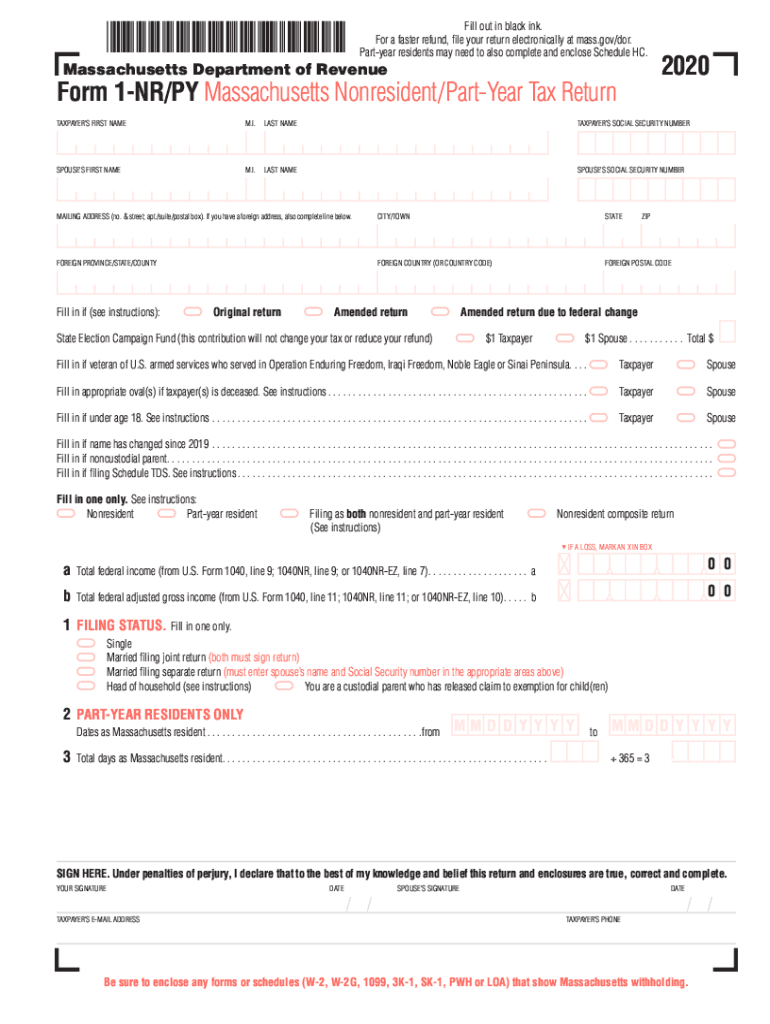

2020 Form MA DoR 1NR/PY Fill Online, Printable, Fillable, Blank

You are a nonresident if you are not a resident of massachusetts as defined above but received massachusetts source income (e.g. Fill in the “nonresident” oval at the top of the. 3 00 4 amounts excludible under mgl ch. There are three easy and convenient ways to do it. Web a massachusetts resident to establish a residence outside the state.

MA Form 1 2011 Fill out Tax Template Online US Legal Forms

Web 42 massachusetts income tax withheld. From a job in massachusetts). Last name taxpayer’s social security number spouse’s first name m.i. Follow the simple instructions below: Web 2022 massachusetts personal income tax forms & instructions form 1:

Ma Form Fill Online, Printable, Fillable, Blank pdfFiller

There are three easy and convenient ways to do it. You are a nonresident if you are not a resident of massachusetts as defined above but received massachusetts source income (e.g. Web how to fill out and sign ma form 1 nr py instructions 2022 online? If line 7 of your massachusetts agi worksheet is lower than. Web follow the.

MA Form 1 2019 Fill out Tax Template Online US Legal Forms

You are a nonresident if you are not a resident of massachusetts as defined above but received massachusetts source income (e.g. Fill in the “nonresident” oval at the top of the. There are three easy and convenient ways to do it. If line 7 of your massachusetts agi worksheet is lower than. Get your online template and fill it in.

Get Your Online Template And Fill It In Using Progressive Features.

You are a nonresident if you are not a resident of massachusetts as defined above but received massachusetts source income (e.g. Web follow the simple instructions below: Web 3 amount of deductible alimony paid (from us return; The credit will be the lower of the state tax liabilities on the same.

From A Job In Massachusetts).

Then prepare your resident state return and it will generate a credit for your income already being taxed. Fill in the “nonresident” oval at the top of the. There are three easy and convenient ways to do it. Web a massachusetts resident to establish a residence outside the state.

3 00 4 Amounts Excludible Under Mgl Ch.

If line 7 of your massachusetts agi worksheet is lower than. Please use the link below. Web file form 1, massachusetts resident income tax return. Last name taxpayer’s social security number spouse’s first name m.i.

There Are Three Easy And Convenient Ways To Do It.

Web 2022 massachusetts personal income tax forms & instructions form 1: Enjoy smart fillable fields and interactivity. A powerhouse editor is already at your fingertips providing you with a range. 42 00 43 2020 overpayment applied to your 2021 estimated tax (from 2020 form 1, line.