How To Get Your Crypto.com Tax Form

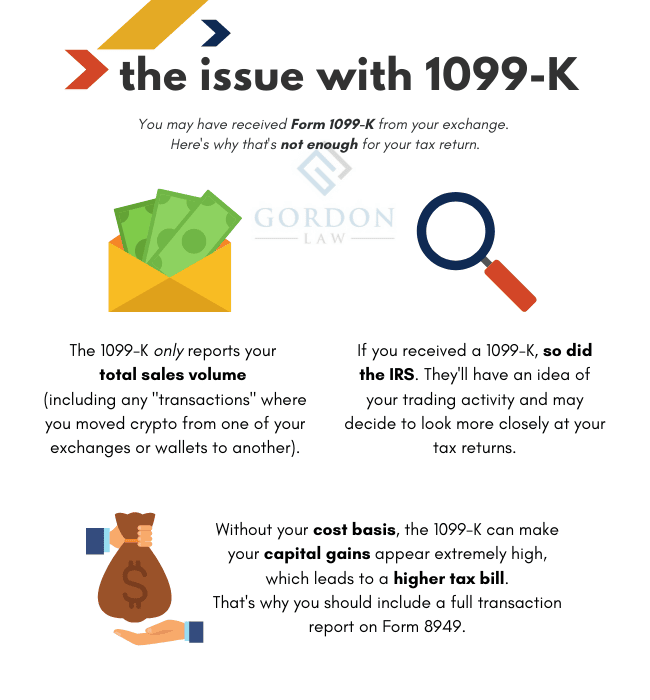

How To Get Your Crypto.com Tax Form - So if you have 2k in cro then use that to buy 2k in eth, you've now held 4k worth of property. This means all transactions, from selling coins to. Web how to get crypto.com tax forms _____new project channel: Person who has earned usd $600 or more in rewards from crypto.com. Web reporting crypto activity can require a handful of crypto tax forms depending on the type of transaction and the type of account. Web it's because crypto is viewed as property and not currency. Web this is done in just seconds and at no cost. Include your totals from 8949 on. Web two forms are the stars of the show: Calculate your crypto gains and losses.

Web input your tax data into the online tax software. So if you have 2k in cro then use that to buy 2k in eth, you've now held 4k worth of property. But the good times were over by november 2021. Web crypto can be taxed in two ways: Register your account in crypto.com tax step 2: 19, 2021, bitcoin’s (btc) price rose 93% and ethereum (eth) grew by 495%. Login to taxact and click help center in the top right corner. What’s more, this detailed crypto tax report includes the user’s transaction history and full record of capital gains and. Web how is cryptocurrency taxed? Web sending a gift generally is not subject to capital gains/losses.

So if you have 2k in cro then use that to buy 2k in eth, you've now held 4k worth of property. This means all transactions, from selling coins to. But the good times were over by november 2021. Web this is done in just seconds and at no cost. You might need any of these crypto. This is a distinction from income tax;. A wage and income transcript provides. Calculate your crypto gains and losses. However, as the donor of a gift, you may be subject to gift tax (note: Either as income (a federal tax on the money you earned), or as a capital gain (a federal tax on the profits you made from selling certain.

Beginners Guide How To Make Money With Crypto Arbitrage in 2020

Web download the taxact csv file under your tax reports page in crypto.com tax. 19, 2021, bitcoin’s (btc) price rose 93% and ethereum (eth) grew by 495%. Web how is cryptocurrency taxed? What’s more, this detailed crypto tax report includes the user’s transaction history and full record of capital gains and. You might need any of these crypto.

Cryptocurrency Tax Form Cryptocurrency Tax Forms BearTax / Any

You need to know your capital gains, losses, income and expenses. Login to taxact and click help center in the top right corner. 19, 2021, bitcoin’s (btc) price rose 93% and ethereum (eth) grew by 495%. Web how is cryptocurrency taxed? Select the tax settings you’d like to generate your tax reports.

When You Pay Your Taxes, You Love Your Neighbor Good Faith Media

19, 2021, bitcoin’s (btc) price rose 93% and ethereum (eth) grew by 495%. Generally, the irs taxes cryptocurrency like property and investments, not currency. Web crypto can be taxed in two ways: Web it's because crypto is viewed as property and not currency. Web input your tax data into the online tax software.

Your Crypto Tax Questions Answered by a Tax Attorney & CPA

Web this is done in just seconds and at no cost. You need to know your capital gains, losses, income and expenses. Web crypto can be taxed in two ways: Web download the taxact csv file under your tax reports page in crypto.com tax. Web a record of account transcript combines your tax return transcript and tax account transcript into.

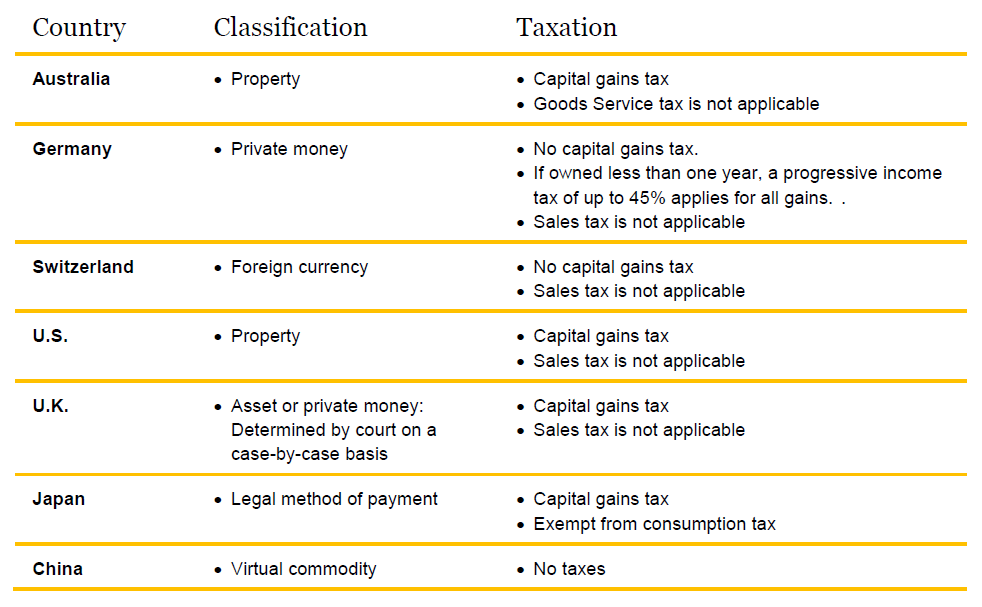

Best Country For Crypto Tax Vincendes

However, as the donor of a gift, you may be subject to gift tax (note: Either as income (a federal tax on the money you earned), or as a capital gain (a federal tax on the profits you made from selling certain. Generally, the irs taxes cryptocurrency like property and investments, not currency. Web download the taxact csv file under.

Your Crypto Tax Questions Answered by a Tax Attorney & CPA

Select the tax settings you’d like to generate your tax reports. Web sending a gift generally is not subject to capital gains/losses. Either as income (a federal tax on the money you earned), or as a capital gain (a federal tax on the profits you made from selling certain. Web it's because crypto is viewed as property and not currency..

Tax Introduces New Features

But the good times were over by november 2021. Web key takeaways • the irs treats cryptocurrency as property, meaning that when you buy, sell or exchange it, this counts as a taxable event and typically results in. However, as the donor of a gift, you may be subject to gift tax (note: Web crypto can be taxed in two.

Crypto Tax Calculator Free Crypto Com Tax Get Your Crypto Taxes Done

Web how to file your crypto taxes in 2023. So if you have 2k in cro then use that to buy 2k in eth, you've now held 4k worth of property. Web how is cryptocurrency taxed? Include your totals from 8949 on. This is a distinction from income tax;.

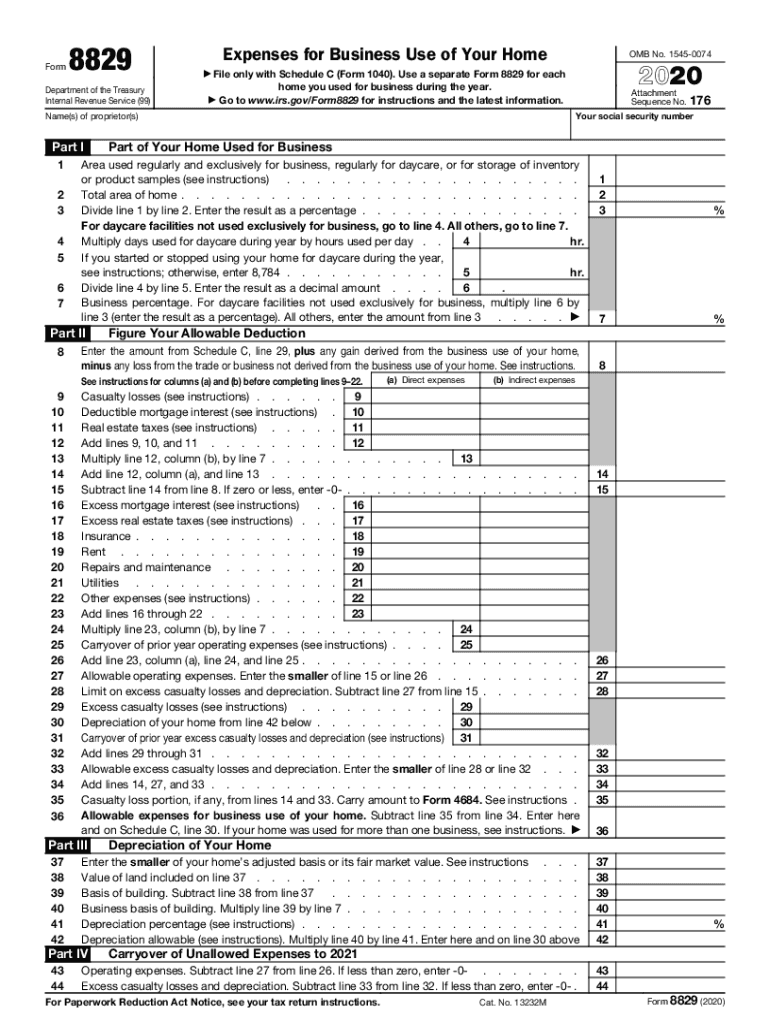

2020 Form IRS 8829 Fill Online, Printable, Fillable, Blank pdfFiller

Web how to get crypto.com tax forms _____new project channel: This means all transactions, from selling coins to. Web reporting crypto activity can require a handful of crypto tax forms depending on the type of transaction and the type of account. Web download the taxact csv file under your tax reports page in crypto.com tax. Web key takeaways • the.

How To Get Tax Forms 🔴 YouTube

Web sending a gift generally is not subject to capital gains/losses. Generally, the irs taxes cryptocurrency like property and investments, not currency. 19, 2021, bitcoin’s (btc) price rose 93% and ethereum (eth) grew by 495%. It only becomes a taxable. Include your totals from 8949 on.

Calculate Your Crypto Gains And Losses.

Web how is cryptocurrency taxed? Login to taxact and click help center in the top right corner. It only becomes a taxable. Web how to file your crypto taxes in 2023.

Web A Record Of Account Transcript Combines Your Tax Return Transcript And Tax Account Transcript Into One Complete Version.

Web download the taxact csv file under your tax reports page in crypto.com tax. What’s more, this detailed crypto tax report includes the user’s transaction history and full record of capital gains and. You might need any of these crypto. Type “ csv ” in the.

Web How To Get Crypto.com Tax Forms _____New Project Channel:

Web key takeaways • the irs treats cryptocurrency as property, meaning that when you buy, sell or exchange it, this counts as a taxable event and typically results in. So if you have 2k in cro then use that to buy 2k in eth, you've now held 4k worth of property. Typically, if you expect a. 19, 2021, bitcoin’s (btc) price rose 93% and ethereum (eth) grew by 495%.

You May Refer To This Section On How To Set Up Your Tax.

Web the tax situation becomes more favorable if you hold your crypto for more than a year and then sell. This is a distinction from income tax;. This means all transactions, from selling coins to. The standard form 1040 tax return now asks whether you engaged in any virtual currency transactions during the year.