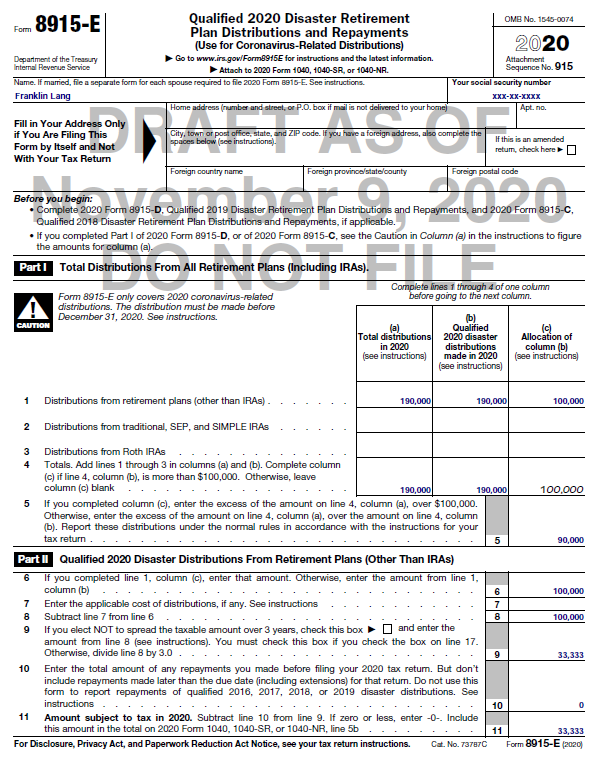

Form 8915 - E

Form 8915 - E - Any repayments you make will reduce the amount of qualified 2020 disaster. We last updated the qualified hurricane retirement plan distributions. Qualified 2020 disaster retirement plan distributions and repayments. Web taxpayers deferred taxation of distributions from 401k accounts in 2020 if covid related. Any distributions you took within the 2021 tax year will be taxable on your federal return. This will also include any coronavirus relate. The qualified 2020 disaster distributions for qualified. Will that deferred amount automatically carry over to our client's 2021 tax. Department of the treasury internal revenue service.

Will that deferred amount automatically carry over to our client's 2021 tax. Department of the treasury internal revenue service. Qualified 2020 disaster retirement plan distributions and repayments. Any distributions you took within the 2021 tax year will be taxable on your federal return. The qualified 2020 disaster distributions for qualified. Any repayments you make will reduce the amount of qualified 2020 disaster. This will also include any coronavirus relate. Web taxpayers deferred taxation of distributions from 401k accounts in 2020 if covid related. We last updated the qualified hurricane retirement plan distributions.

This will also include any coronavirus relate. Will that deferred amount automatically carry over to our client's 2021 tax. We last updated the qualified hurricane retirement plan distributions. Department of the treasury internal revenue service. Any repayments you make will reduce the amount of qualified 2020 disaster. Qualified 2020 disaster retirement plan distributions and repayments. The qualified 2020 disaster distributions for qualified. Web taxpayers deferred taxation of distributions from 401k accounts in 2020 if covid related. Any distributions you took within the 2021 tax year will be taxable on your federal return.

A Guide to the New 2020 Form 8915E

This will also include any coronavirus relate. Qualified 2020 disaster retirement plan distributions and repayments. Any repayments you make will reduce the amount of qualified 2020 disaster. Web taxpayers deferred taxation of distributions from 401k accounts in 2020 if covid related. Department of the treasury internal revenue service.

8915e tax form release date Chaffin

Any repayments you make will reduce the amount of qualified 2020 disaster. Qualified 2020 disaster retirement plan distributions and repayments. Will that deferred amount automatically carry over to our client's 2021 tax. Any distributions you took within the 2021 tax year will be taxable on your federal return. Web taxpayers deferred taxation of distributions from 401k accounts in 2020 if.

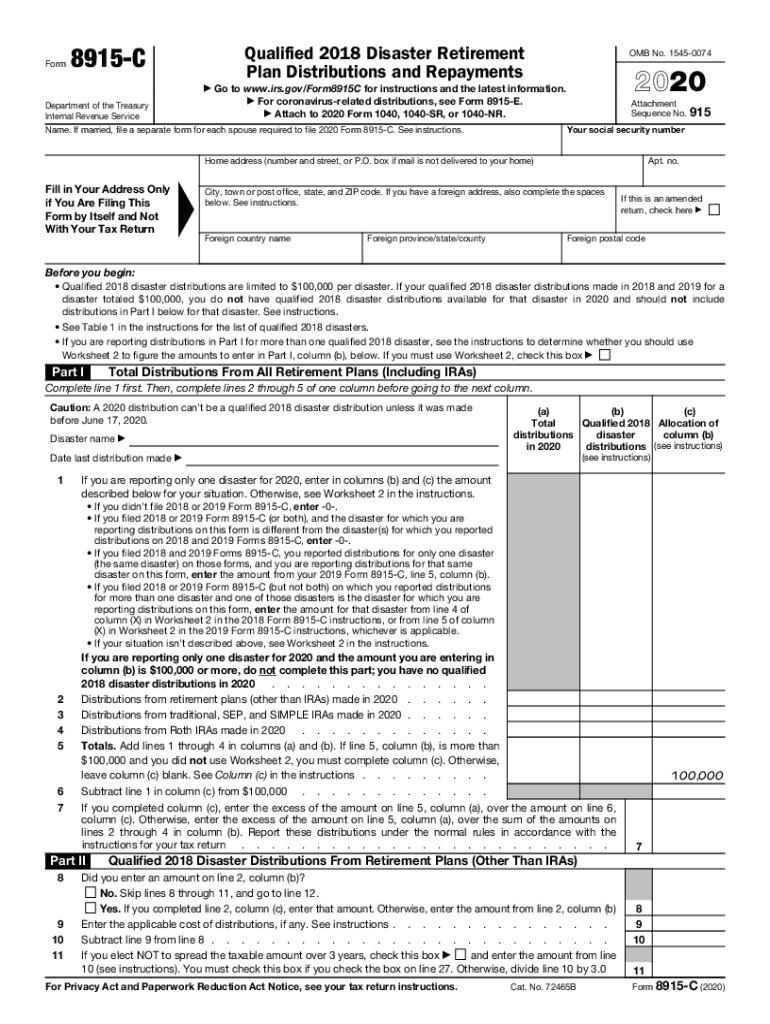

2020 Form IRS 8915C Fill Online, Printable, Fillable, Blank pdfFiller

Will that deferred amount automatically carry over to our client's 2021 tax. Any distributions you took within the 2021 tax year will be taxable on your federal return. Web taxpayers deferred taxation of distributions from 401k accounts in 2020 if covid related. Department of the treasury internal revenue service. The qualified 2020 disaster distributions for qualified.

Fill Free fillable Form 8915E Plan Distributions and Repayments

Any repayments you make will reduce the amount of qualified 2020 disaster. We last updated the qualified hurricane retirement plan distributions. Will that deferred amount automatically carry over to our client's 2021 tax. Web taxpayers deferred taxation of distributions from 401k accounts in 2020 if covid related. Qualified 2020 disaster retirement plan distributions and repayments.

National Association of Tax Professionals Blog

Qualified 2020 disaster retirement plan distributions and repayments. The qualified 2020 disaster distributions for qualified. Will that deferred amount automatically carry over to our client's 2021 tax. Any distributions you took within the 2021 tax year will be taxable on your federal return. Department of the treasury internal revenue service.

8915e tax form instructions Somer Langley

Web taxpayers deferred taxation of distributions from 401k accounts in 2020 if covid related. Any distributions you took within the 2021 tax year will be taxable on your federal return. This will also include any coronavirus relate. Will that deferred amount automatically carry over to our client's 2021 tax. Qualified 2020 disaster retirement plan distributions and repayments.

Kandy Snell

Any repayments you make will reduce the amount of qualified 2020 disaster. Will that deferred amount automatically carry over to our client's 2021 tax. Web taxpayers deferred taxation of distributions from 401k accounts in 2020 if covid related. We last updated the qualified hurricane retirement plan distributions. The qualified 2020 disaster distributions for qualified.

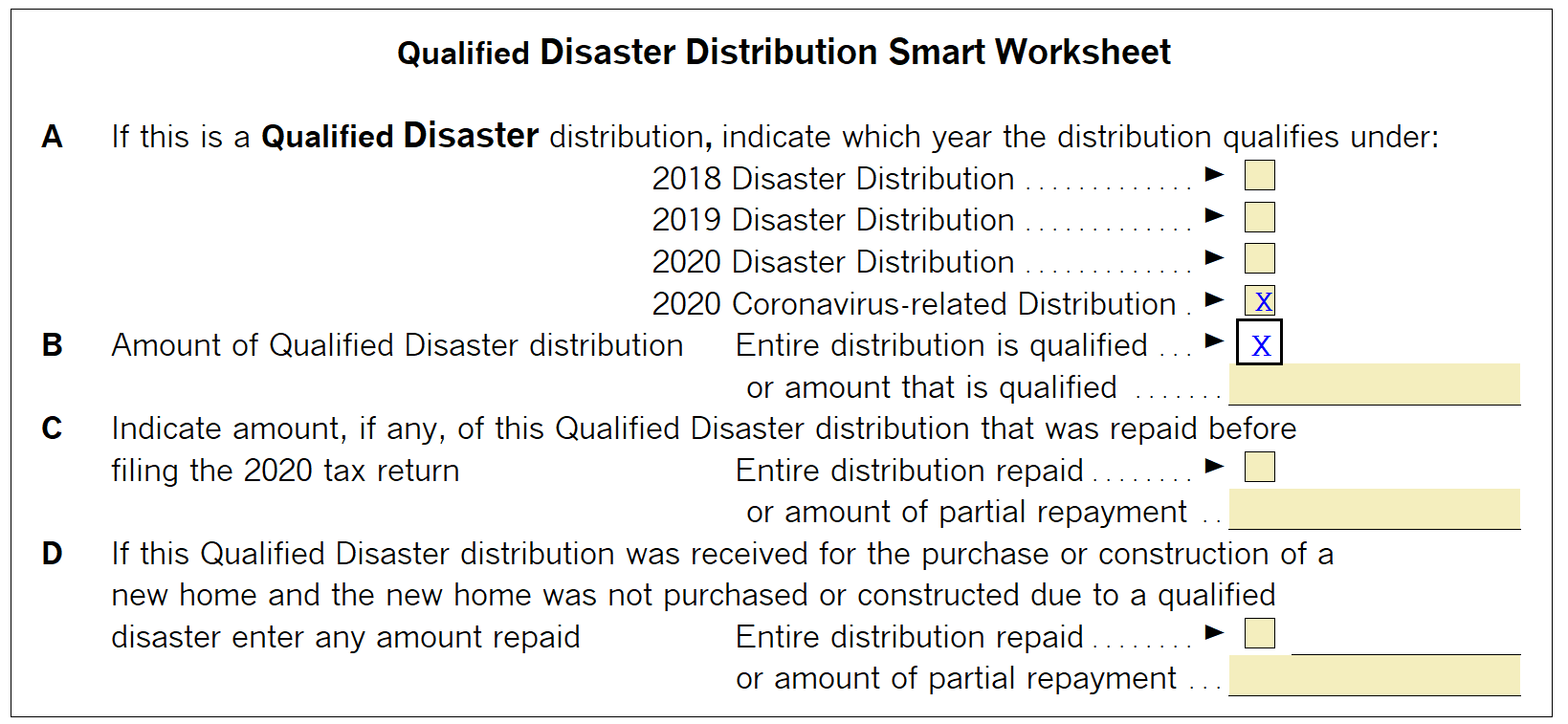

Generating Form 8915E in ProSeries Intuit Accountants Community

Will that deferred amount automatically carry over to our client's 2021 tax. This will also include any coronavirus relate. Department of the treasury internal revenue service. Qualified 2020 disaster retirement plan distributions and repayments. The qualified 2020 disaster distributions for qualified.

Re When will form 8915E 2020 be available in tur... Page 19

Department of the treasury internal revenue service. Any repayments you make will reduce the amount of qualified 2020 disaster. Qualified 2020 disaster retirement plan distributions and repayments. Web taxpayers deferred taxation of distributions from 401k accounts in 2020 if covid related. We last updated the qualified hurricane retirement plan distributions.

Generating Form 8915E in ProSeries Intuit Accountants Community

Any repayments you make will reduce the amount of qualified 2020 disaster. Web taxpayers deferred taxation of distributions from 401k accounts in 2020 if covid related. Will that deferred amount automatically carry over to our client's 2021 tax. This will also include any coronavirus relate. Qualified 2020 disaster retirement plan distributions and repayments.

Any Distributions You Took Within The 2021 Tax Year Will Be Taxable On Your Federal Return.

Qualified 2020 disaster retirement plan distributions and repayments. We last updated the qualified hurricane retirement plan distributions. This will also include any coronavirus relate. Will that deferred amount automatically carry over to our client's 2021 tax.

Any Repayments You Make Will Reduce The Amount Of Qualified 2020 Disaster.

Web taxpayers deferred taxation of distributions from 401k accounts in 2020 if covid related. Department of the treasury internal revenue service. The qualified 2020 disaster distributions for qualified.

.jpeg)