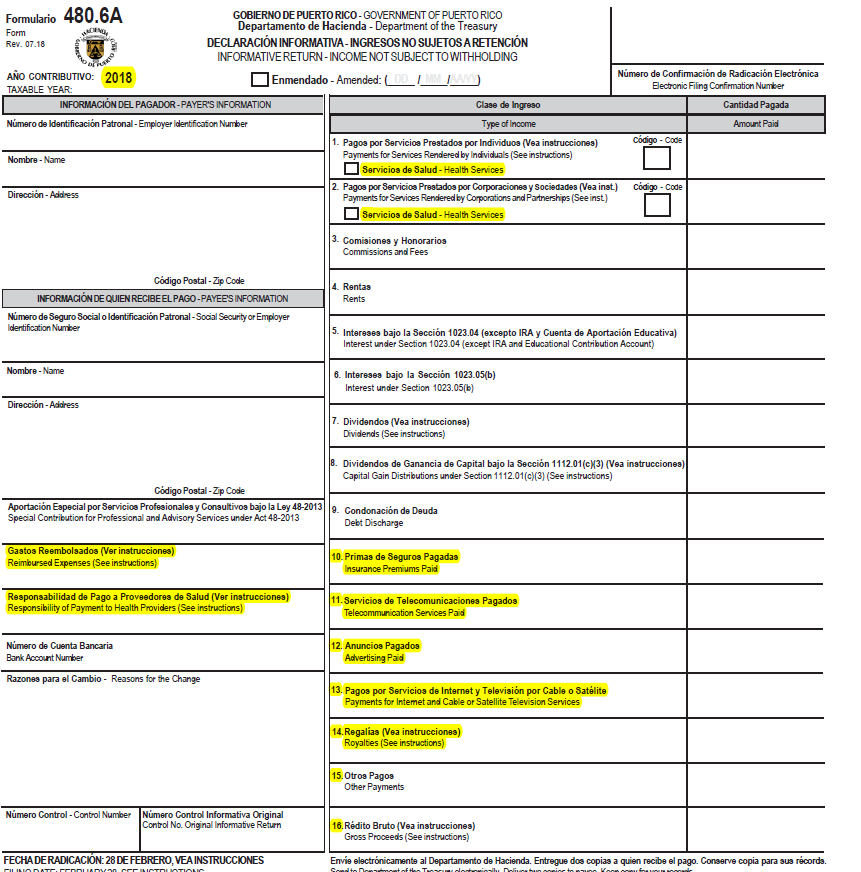

480.6A Form

480.6A Form - Web forms 480.6sp, 480.6sp.1 and 480.6sp.2 — services rendered to report payments for services rendered during the year that were previously reported on forms 480.6a,. What is the puerto rico withholding tax?. Web complete 480 6a 2020 online with us legal forms. Save or instantly send your ready documents. Web 1 best answer ds30 new member yes, you will need to report this puerto rican bank interest as income on your income tax returns. The forms (480.6a, 480.6b, 480.6d, & 480.7f) must be file by february 28, 2022. Web en el ca so de intereses, se requerirá un formulario 480.6a cuando la cantidad pagada en el año sea de $50 o más. Web what is tax form 480.6a? Web series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. Web form 480.6a is issued by the government of puerto rico for the filing of informative returns on income not subject to withholding.

Web forms 480.6a and 480.6d bppr is required by law to send informative statements about any amount of money forgiven to a mortgage customer. Web form import fields; Make adjustments to the template. An heir files this form to report the. When would you need to file a 480.6a? What is the puerto rico withholding tax?. Web 16 rows tax form (click on the link) form name. Web 1 best answer ds30 new member yes, you will need to report this puerto rican bank interest as income on your income tax returns. Web series 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. You can include this pr.

Web back i received form 480.6a, but i understand that the debt discharge reported should be exempt by reason of insolvency. Upload 480 6a from your device, the cloud, or a protected link. Easily fill out pdf blank, edit, and sign them. Web form 480.6a is issued by the government of puerto rico for the filing of informative returns on income not subject to withholding. Make adjustments to the template. You can include this pr. Web en el ca so de intereses, se requerirá un formulario 480.6a cuando la cantidad pagada en el año sea de $50 o más. If you receive these forms, it is. An heir files this form to report the. Web forms 480.6sp, 480.6sp.1 and 480.6sp.2 — services rendered to report payments for services rendered during the year that were previously reported on forms 480.6a,.

480.6A 2019 Public Documents 1099 Pro Wiki

Web complete 480 6a 2020 online with us legal forms. Web 16 rows tax form (click on the link) form name. What is the puerto rico withholding tax?. Web form 480.6a is issued by the government of puerto rico for the filing of informative returns on income not subject to withholding. An heir files this form to report the.

480.6SP 2019 Public Documents 1099 Pro Wiki

Form 480.6a reports any taxable dividends and/or gross proceeds from realized capital gains or losses in your taxable investment account. Web complete 480 6a 2020 online with us legal forms. Web back i received form 480.6a, but i understand that the debt discharge reported should be exempt by reason of insolvency. Web what is tax form 480.6a? Web 16 rows.

B6A3 form

Web 16 rows tax form (click on the link) form name. La declaración deberá prepararse a base de año natural y. Web aii persons engaged in trade or business within puerto rico, that made payments to corporations and partnerships for services rendered or to individuals for any of the. Save or instantly send your ready documents. When would you need.

2015 Form PR 480.2 Fill Online, Printable, Fillable, Blank pdfFiller

La declaración deberá prepararse a base de año natural y. Web complete 480 6a 2020 online with us legal forms. Web form 480.6a is issued by the government of puerto rico for the filing of informative returns on income not subject to withholding. Web what is tax form 480.6a? You can include this pr.

Government Regulation Reaches The Decentralized Space With 1099DA

Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. Web what is tax form 480.6a? If you receive these forms, it is. When would you need to file a 480.6a?

2016 Form PR 480.30(II) Fill Online, Printable, Fillable, Blank pdfFiller

Web 1 best answer ds30 new member yes, you will need to report this puerto rican bank interest as income on your income tax returns. An heir files this form to report the. Easily fill out pdf blank, edit, and sign them. Web forms 480.6a and 480.6d bppr is required by law to send informative statements about any amount of.

Update The IRS Is Creating A New Form 1099DA For Cryptocurrency Reporting

Upload 480 6a from your device, the cloud, or a protected link. Web back i received form 480.6a, but i understand that the debt discharge reported should be exempt by reason of insolvency. La declaración deberá prepararse a base de año natural y. You can include this pr. Easily fill out pdf blank, edit, and sign them.

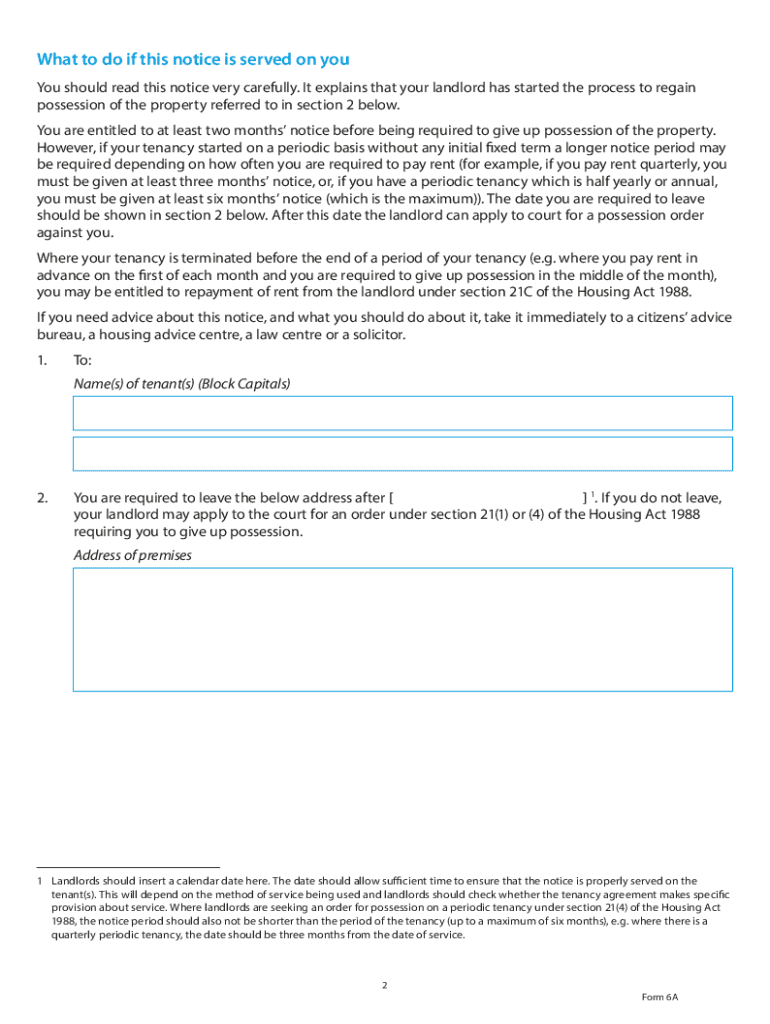

Form 6a Fill Out and Sign Printable PDF Template signNow

Web aii persons engaged in trade or business within puerto rico, that made payments to corporations and partnerships for services rendered or to individuals for any of the. You can include this pr. An heir files this form to report the. When would you need to file a 480.6a? Web series 480.6a reports any taxable dividends and/or gross proceeds from.

WHAT IS TABLE 6A FORM GSTR 1 YouTube

Web complete 480 6a 2020 online with us legal forms. Web 16 rows tax form (click on the link) form name. Web click on new document and choose the form importing option: Web en el ca so de intereses, se requerirá un formulario 480.6a cuando la cantidad pagada en el año sea de $50 o más. Web back i received.

An Heir Files This Form To Report The.

Web forms 480.6a and 480.6d bppr is required by law to send informative statements about any amount of money forgiven to a mortgage customer. Web what is tax form 480.6a? Easily fill out pdf blank, edit, and sign them. Web 16 rows tax form (click on the link) form name.

Save Or Instantly Send Your Ready Documents.

What is the puerto rico withholding tax?. Web complete 480 6a 2020 online with us legal forms. If you receive these forms, it is. Web forms 480.6sp, 480.6sp.1 and 480.6sp.2 — services rendered to report payments for services rendered during the year that were previously reported on forms 480.6a,.

When Would You Need To File A 480.6A?

La declaración deberá prepararse a base de año natural y. Web form 480.6a is issued by the government of puerto rico for the filing of informative returns on income not subject to withholding. Make adjustments to the template. Web click on new document and choose the form importing option:

The Forms (480.6A, 480.6B, 480.6D, & 480.7F) Must Be File By February 28, 2022.

Web aii persons engaged in trade or business within puerto rico, that made payments to corporations and partnerships for services rendered or to individuals for any of the. Web 1 best answer ds30 new member yes, you will need to report this puerto rican bank interest as income on your income tax returns. You can include this pr. Web form import fields;